The S&P 500 and Nasdaq Composite Index both hit record highs yesterday, but equities are retreating this morning. Tomorrow brings key inflation and interest rate news, so traders are likely squaring up positions ahead of those developments. Most other markets are flat, including precious metals and Treasuries, while the dollar is up a bit.

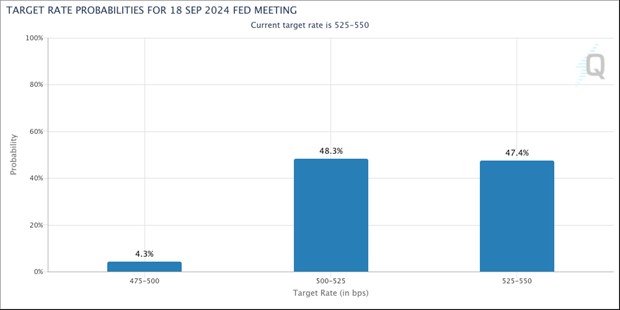

Regarding tomorrow, the Federal Reserve will NOT cut rates from the current range of 5.25%-5.5%. But the Fed won’t raise rates, either. Policymakers are going to sit on their hands, evaluate incoming data, and see what happens. The probabilities change constantly depending on incoming data. But right now, traders are pricing in about a 48% chance the Fed will cut rates by 25 basis points at the September meeting (see chart below).

Source: CME FedWatch Tool

The “Armageddon vs. Not Much to See Here” debate is continuing in commercial real estate. But bears got a pound of red meat yesterday when news broke that an office building in New York City will change hands for less than $50 million. That’s a 67% plunge from its prior purchase price of $153 million in 2018. The transaction was a short sale, one in which the proceeds won’t cover the outstanding debt on the property.

Finally, Apple Inc.’s (AAPL) big conference yesterday included a raft of announcements about how Artificial Intelligence (AI) tech will be integrated into iPhones and the Siri voice assistant. The tech giant also came up with a nifty play on words, calling its “AI” tech “Apple Intelligence.” Investors didn’t seem overly impressed though. The stock slipped 1.9% on the day.