Stocks ripped higher on Friday, and they’re adding to those gains in the early going today. Gold and silver are also up a bit, while crude oil is trading slightly lower. Treasuries and the dollar are climbing.

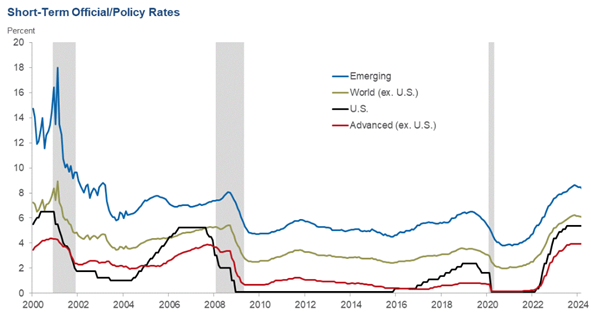

It’s central bank “season” this week, with the US Federal Reserve joining foreign counterparts in discussing and/or adjusting interest rate policies. While the Fed is unlikely to actually cut rates when its policy meeting concludes Wednesday, officials will likely make it clear they plan to at the next meeting in September.

Meanwhile, it’s possible the Bank of Japan will raise rates earlier that day – and that the Bank of England will cut them on Thursday. Traders will also get data on home prices, consumer confidence, and manufacturing activity in the first few days of this week, plus the July nonfarm payrolls report on Friday. Buckle up!

Source: Dallas Fed

Higher inflation and reduced discretionary income continue to take bites out of customer purses and wallets at McDonald’s Corp. (MCD), according to CEO Chris Kempczinski. The fast-food giant missed sales and earnings estimates in the second quarter, with same-store sales falling 1% globally from a year earlier. MCD hopes recent value-oriented promotions like its $5 meal deal will bring customers back in the door.

Finally, Bitcoin is flirting with $70,000 again after Republican presidential candidate Donald Trump spoke at a Nashville cryptocurrency conference this weekend. He suggested the US could establish a “strategic” Bitcoin stockpile, funded in part by any crypto seized in federal criminal cases. The US has a Strategic Petroleum Reserve (SPR) where it stores hundreds of millions of barrels of crude oil that it can release if war or weather-related problems curtail energy supply here.