The S&P 500 is on a run, and so far, it looks like it might keep going. Gold and silver are bouncing, while crude oil is not. Treasuries are under a bit of downside pressure, as is the US dollar.

A big stock market WINNING streak? You wouldn’t have expected that a month ago. But here we are. The S&P 500 rose for the eighth day in a row on Thursday, its longest string of “up” days since August 2024. It gained 8.7% during that stretch.

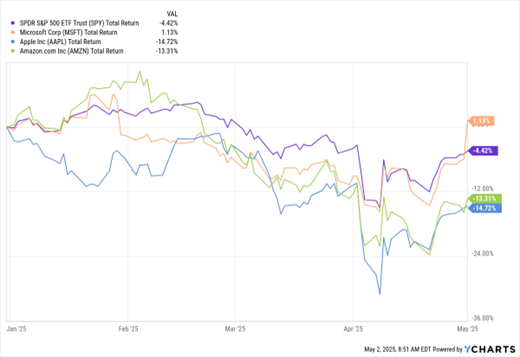

If the S&P 500 closes higher today, that would mark the best streak since November 2004. That said, we remain about 10% off recent highs in the Nasdaq and 19% in the Russell 2000. While that’s an improvement from -23% and -28% during the depths of the decline, it shows we still have wood to chop.

SPY, MSFT, AAPL, AMZN (YTD % Change)

Data by YCharts

Driving the gains yesterday were stocks like Microsoft Corp. (MSFT), which delivered great earnings and revenue news. But more broadly, investors are getting increasingly optimistic about potential trade and tariff deals. Even China signaled it might be ready to talk, with a Chinese Commerce Ministry spokesperson saying, “If you want to fight, we will fight to the end; if you want to talk, our door is wide open.”

As solid as MSFT’s numbers were, results from two other “Mag 7” names left something to be desired. Apple Inc. (AAPL) missed services revenue estimates during the fiscal second quarter, and warned that tariffs could boost costs by $900 million in Q3. For its part, Amazon.com Inc. (AMZN) offered up a lighter-than-expected operating income forecast of $13 billion to $17.5 billion in Q2..

On the economic front, nonfarm payrolls rose by 177,000 in April. Those job gains beat the average estimate of 130,000, but were a step down from 185,000 in March. Unemployment held steady at 4.2%, while average hourly earnings growth dipped to 0.2%.

Net-net, the data wasn’t great...but neither was it terrible. Let’s call it “A-OK.” Arguably, that could be what the market needs to hold recent gains – because numbers like these open the door to a couple of Federal Reserve rate cuts in 2025.