Stocks and Treasuries are trading around the flatline in the early going today. Gold and crude oil are modestly lower along with the dollar, while Bitcoin is holding recent gains around $104,000.

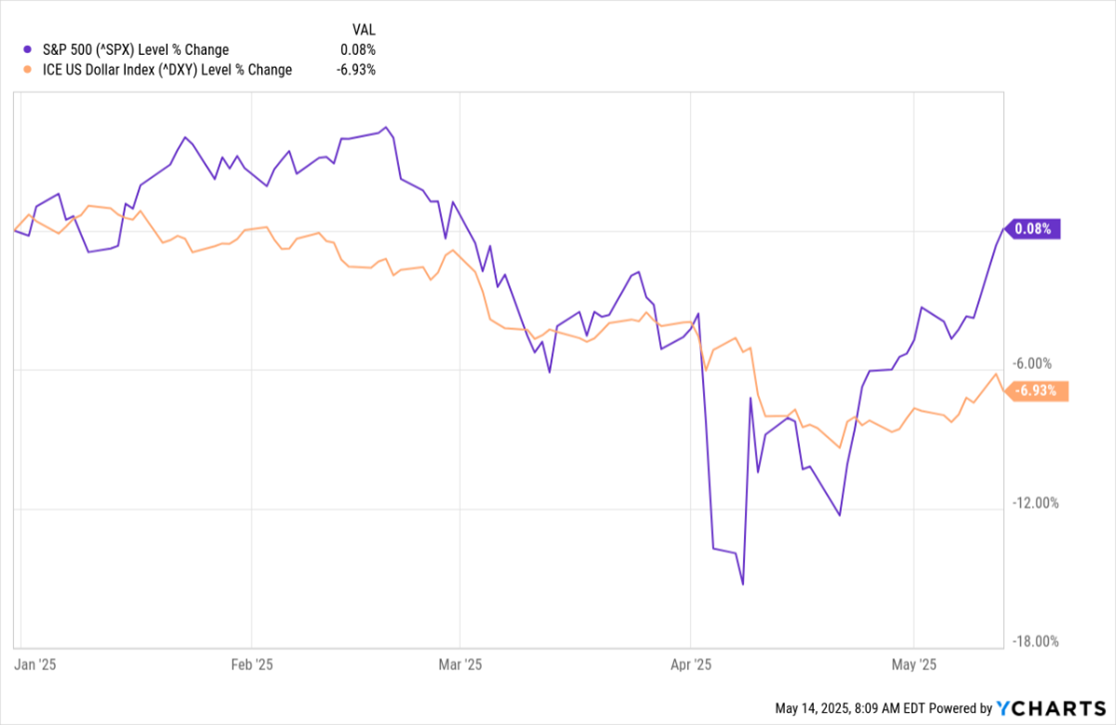

Thanks to yesterday’s rally in the S&P 500, the benchmark index is now in POSITIVE territory year-to-date. That’s quite a change from where things stood in early April. Still, even after the S&P’s 18% surge from the low, it remains about 260 points below its February high. The Nasdaq Composite Index hasn’t yet reached the “flat YTD” milestone, either.

SPX, DXY (YTD % Change)

Data by YCharts

Meanwhile, the dollar fell in Asian trading, leaving the broad US Dollar Index down about 7% in 2025. Weakness against the South Korean won was particularly noteworthy. The Trump Administration is reportedly discussing the greenback’s value vis-à-vis the won as part of trade and tariff negotiations, saying the weakness of Asian currencies against the dollar gives them an economic advantage.

Several days ago, the Taiwan dollar recorded its largest two-day surge against the US dollar ever. Many analysts speculate moves like this are part of a "wink-nod" move by the administration to drive the dollar lower. That, in turn, has been a factor supporting the price of gold – a traditional, contra-dollar asset.

Finally, Wegovy-maker Novo Nordisk (NVO) is teaming up with the biotech firm Septerna Inc. (SEPN) on anti-obesity treatments. Novo will pay Septerna $200 million up front – and as much as $2.2 billion over time – as the firms work toward developing and commercializing oral small molecule medicines. They could ultimately treat obesity, type 2 diabetes, and other health problems.