Stocks are selling off in the early going, while “safe haven” assets like gold and silver are spiking (along with crude oil). Treasuries and the dollar are down.

Hopes for détente in the US-China trade war are fading after tit-for-tat charges of violations. President Trump said late last week that China was backtracking on pledges related to rare-earth metals exports. Then today, China’s Ministry of Commerce said the US was illegitimately controlling exports of Artificial Intelligence (AI) chips and revoking Chinese student visas. That jeopardizes the preliminary agreements reached in Geneva talks last month.

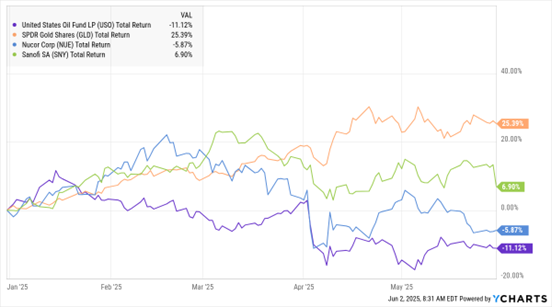

USO, GLD, NUE, SNY (YTD % Change)

Data by YCharts

Ukraine launched an audacious drone attack in Russia over the weekend. Five separate airfields deep within Russia were struck with a force of 117 drones, and dozens of Russian long-range bombers and surveillance airplanes were reportedly damaged. Ukrainian and Russian negotiators are meeting in Istanbul for peace talks and the strike was likely designed to give Ukraine some additional leverage.

The prices of crude oil, gold, and silver all rose in the wake of the attacks as they rekindled geopolitical fears in markets. That said, OPEC+ just agreed to raise output by 411,000 barrels per day in July. Concerns about more barrels returning to the market over time are keeping pressure on crude, which is still down about 11% year-to-date.

Merger Monday might be a hackneyed term, but I’m going with it anyway. Sanofi SA (SNY) announced it’ll purchase Blueprint Medicines Corp. (BPMC) for $9.1 billion. The French-US pharmaceutical deal was Sanofi’s largest since 2018, and it adds existing and potential immunology treatments to Sanofi’s arsenal.

Finally, shares of US steel companies are surging after the president vowed to double steel import tariffs to 50% from 25%. Trump’s plan will allow US producers to hike prices, making more money on their metals output. Cleveland-Cliffs Inc. (CLF) and Nucor Corp. (NUE) were among the beneficiaries.