It has been a WILD first half of the year for markets. Now, in the final trading day for Q2, stocks are rallying while the dollar is dipping. Gold and silver are mixed, while Treasuries and crude oil are flat.

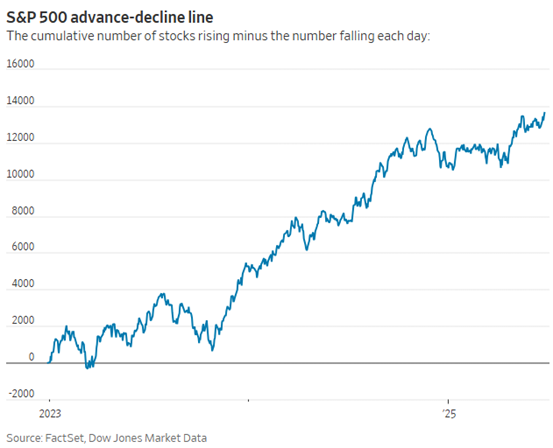

Overall, the S&P 500 has surged 24% from its early April low, pushing its year-to-date gain to 5%. Big Tech has been leading the charge, but many other stocks are now participating in the rally, too. Not only are we seeing the highest number of S&P 500 stocks trading above their 50-day moving averages since the fall, but the index’s advance-decline line just hit a fresh high.

Source: Wall Street Journal

At the same time, the US dollar is closing out its worst first-half of trading since 1973. The US Dollar Index has dropped more than 10% this year due to trade and tariff policy concerns, expectations for Federal Reserve interest rate cuts, and growing worries over US debts and deficits. On the flip side, gold has surged more than 24% and Bitcoin has gained 15%.

Meanwhile, North American trade policy is squarely in focus again – with markets getting an extra boost today after Canada took steps to unwind its “digital services tax” to placate President Trump. The 3% levy would have largely impacted US “Big Tech” companies like Meta Platforms Inc. (META) and Alphabet Inc. (GOOGL) – and raised billions of dollars in revenue for Canada’s government. But Trump suspended trade talks on Friday over the tax. Canadian officials are hoping the move will allow for the two countries to lock in a broader trade deal by July 21.