The Nasdaq Composite and S&P 500 Index (^SPX) hit fresh highs yesterday, and stocks are adding to their gains this morning. Gold and silver are bouncing along with Treasuries, while the dollar is weakening. Bitcoin is trading back above $120,000.

Sure, we know the Federal Reserve is increasingly likely to cut interest rates at the September meeting. But could it lower them by…50 basis points? More traders are placing bets on that outcome, according to Bloomberg, amid a full-court press on the Fed from the Trump Administration.

Treasury Secretary Scott Bessent suggested in a Fox Business interview yesterday that a move of that magnitude might be justified. Then this morning on Bloomberg, he argued that most economic models suggested rates should be 150-175 bps lower than they are now (a range of 4.25% - 4.5%). For more on the Fed outlook, see my Chart of the Day article.

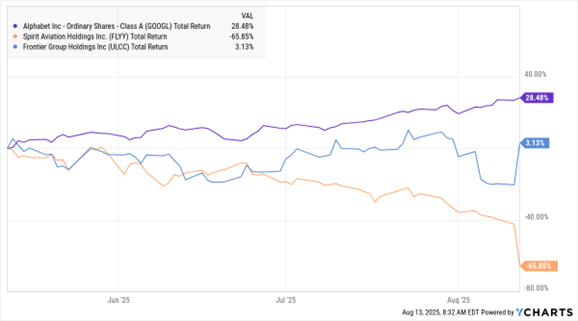

GOOGL, FLYY, ULCC (3-Mo. % Change)

Data by YCharts

In other news, a US District Judge ruled last year that Alphabet Inc. (GOOGL) illegally monopolized the search market. Now, with that judge poised to rule on remedies soon, at least one company is openly bidding for the Google Chrome browser business.

The Artificial Intelligence (AI) firm Perplexity offered to pay $34.5 billion for Chrome, well above its estimated $18 billion value. Google would prefer to modify certain business arrangements instead of cut bait with Chrome. Plus, if it appeals the judge’s ultimate ruling, that could delay any changes from taking effect for even longer. The Justice Department originally sued Alphabet in 2020.

Could Spirit Aviation Holdings Inc. (FLYY) be running out of financial…runway? The firm filed for bankruptcy, restructured, then emerged in its current form back in March. But despite making changes to its frequent flier program, signing new partnerships, and taking other steps, revenue has disappointed.

As a result, Spirit warned yesterday that there was “substantial doubt as to the Company’s ability to continue as a going concern” over the next year. That caused its shares to plummet more than 40%. Other airline stocks rallied, however, on the expectation that Spirit’s demise (if it happened) would boost pricing power for the rest of the industry. One example: Frontier Group Holdings Inc. (ULCC) surged more than 29%.