Tech stocks rallied yesterday on more dealmaking, while gold surged to a fresh record overnight. This morning, crude oil is bouncing while Treasuries and the dollar are mostly flat.

The Artificial Intelligence (AI) revolution continues to spawn big-money tie-ups, with the latest being Nvidia Corp.’s (NVDA) plan to invest up to $100 billion in OpenAI. OpenAI would, in turn, use Nvidia’s money to buy…Nvidia chips. Specifically, OpenAI will use the funds to build more AI data centers -- with each gigawatt of NVDA systems deployed resulting in the release of more financing.

The interesting arrangement follows a $300 billion OpenAI-Oracle Corp. (ORCL) deal that helped send ORCL shares up by the most in any single day since 1992. Some skeptics are asking if this enormous raise-money-and-spend-money cycle is sustainable, though.

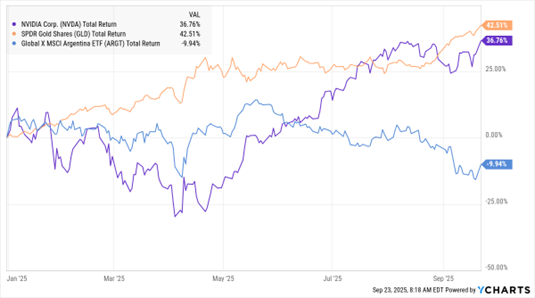

NVDA, GLD, ARGT (YTD % Change)

Data by YCharts

Meanwhile, $3,800 an ounce fell by the wayside in the gold market. Futures topped that level in overnight trading, while silver closed in on $45, amid an ongoing surge in central bank and ETF buying. The SPDR Gold Shares (GLD) is up 42.5% year-to-date, while the People’s Bank of China has added gold to its reserves for 10 months in a row.

The Chinese central bank is even reportedly trying to get friendly foreign central banks to store their reserves within the country’s borders. The plan would have the Shanghai Gold Exchange acting as a custodian for other countries, similar to what the UK, US, and Switzerland have done for decades.

Finally, Argentina could be in line for a US-funded bailout after voters and investors soured on President Javier Milei’s reformist plans. Milei slashed spending, removed tariffs, and otherwise enacted free-market-oriented reforms to bring down inflation.

But rising unemployment and dollar flight caused Argentine stocks, bonds, and the peso currency to fall. That prompted US Treasury Secretary Scott Bessent to suggest yesterday that the US could help out by using “swap lines, direct currency purchase, and purchases of US-dollar denominated government debt.” Argentine markets rallied in response, though the Global X MSCI Argentina ETF (ARGT) is still down about 10% year-to-date.