Stocks are bouncing after a modestly weak session on Thursday. Gold, silver, and crude oil are higher, too, while crude oil, Treasuries, and the dollar are flattish.

President Trump rolled out a slew of new tariffs set to take effect Oct. 1 in a series of social media posts. Branded drugs from companies that aren’t building plants in the US? 100%. Heavy trucks imported into the US? 25%. Kitchen cabinets and bathroom vanities? 50%. Upholstered furniture? 30%.

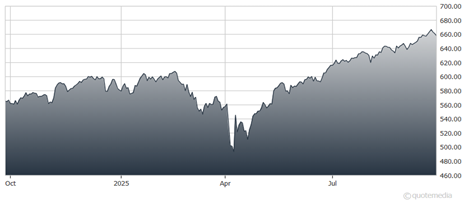

SPDR S&P 500 ETF (SPY)

Trump cited “National Security and other reasons” for the latest round of levies. But after some initial post-announcement volatility, markets settled down. That’s in part because most drugmakers already have or are building US-based plants. The housing-related tariffs were actually lower than some advocates had been pushing for, too.

How much is TikTok worth? The federal government is pushing a $14 billion valuation for the social media platform’s US operations. The administration wants its Chinese-based parent company ByteDance Ltd. to sell a majority stake to US investors.

But TikTok’s US operations generate more than $10 billion in annual sales, which means that’s only a 1.4X revenue multiple. That valuation looks incredibly low relative to peers like Meta Platforms Inc. (META) and Alphabet Inc. (GOOGL) – which trade at 10X and 8X sales, respectively. China and the US are still haggling over the proposed deal, which has a 120-day completion deadline.

Finally, the Wall Street Journal published a front pager on its website titled “Spending on AI Is at Epic Levels. Will It Ever Pay Off?” As the headline suggests, it covers the massive Artificial Intelligence spending plans companies are announcing and the enormous size and prodigious power demands of data centers going up around the US. The piece also raises questions about whether they’ll generate enough revenue over time to make the upfront investments worthwhile. It’s worth a read no matter where you come down on the AI debate.