Stocks are adding to yesterday’s gains in the early going, while gold and silver are rebounding after a selloff on Thursday. Crude oil is getting closer to trading with a “5”-handle, and the dollar and Treasuries are mostly flat.

Today is “Jobs Friday.” Or it would be if the government weren’t shut down. The usual report on unemployment, job creation, wage growth, and other labor market indicators wasn’t released at 8:30 am Eastern – and it’s unclear when the official data will come out.

That said, the ADP private sector jobs report earlier this week missed expectations by a big margin. It showed the economy shed 32,000 jobs last month when economists expected a gain of 50,000. Other less-well-known reports from firms like Indeed and Revelio Labs also suggest that the job market is losing steam, though not imploding.

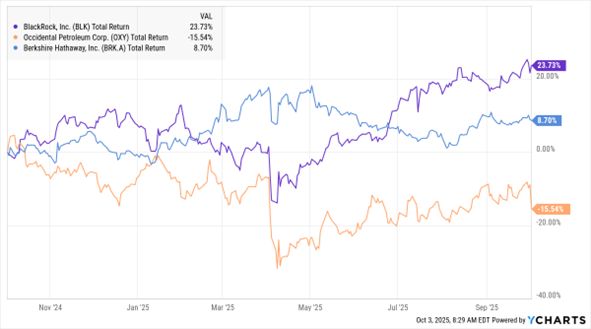

BLK, OXY, BRK.A (YTD % Change)

Data by YCharts

The flood of Artificial Intelligence (AI) deals keeps gaining momentum. The Global Infrastructure Partners arm of BlackRock Inc. (BLK) is planning to buy Aligned Data Centers for around $40 billion, according to Bloomberg. Aligned operates 128 campuses and data centers in the US and South America. It recently obtained commitments for $12 billion in equity and debt financing to expand its footprint.

In other news, Berkshire Hathaway (BRK.A) said this week that it would buy Occidental Petroleum Corp.’s (OXY) petrochemical business for $9.7 billion. Warren Buffett’s conglomerate already owns about 27% of OXY, and the all-cash deal will help the parent company shore up its finances. With oil prices languishing in the $60s, investors had been growing more concerned about Occidental’s history of debt-fueled deals.