Precious metals are rocking and rolling again, as are most cryptocurrencies. Stocks are modestly higher along with the US dollar, while Treasuries are slumping.

The “Debasement Trade” keeps enriching investors who hold gold and Bitcoin. Gold surged again overnight, trading within $40 of the $4,000-an-ounce level, while Bitcoin hit a new record above $125,000 before pulling back a bit.

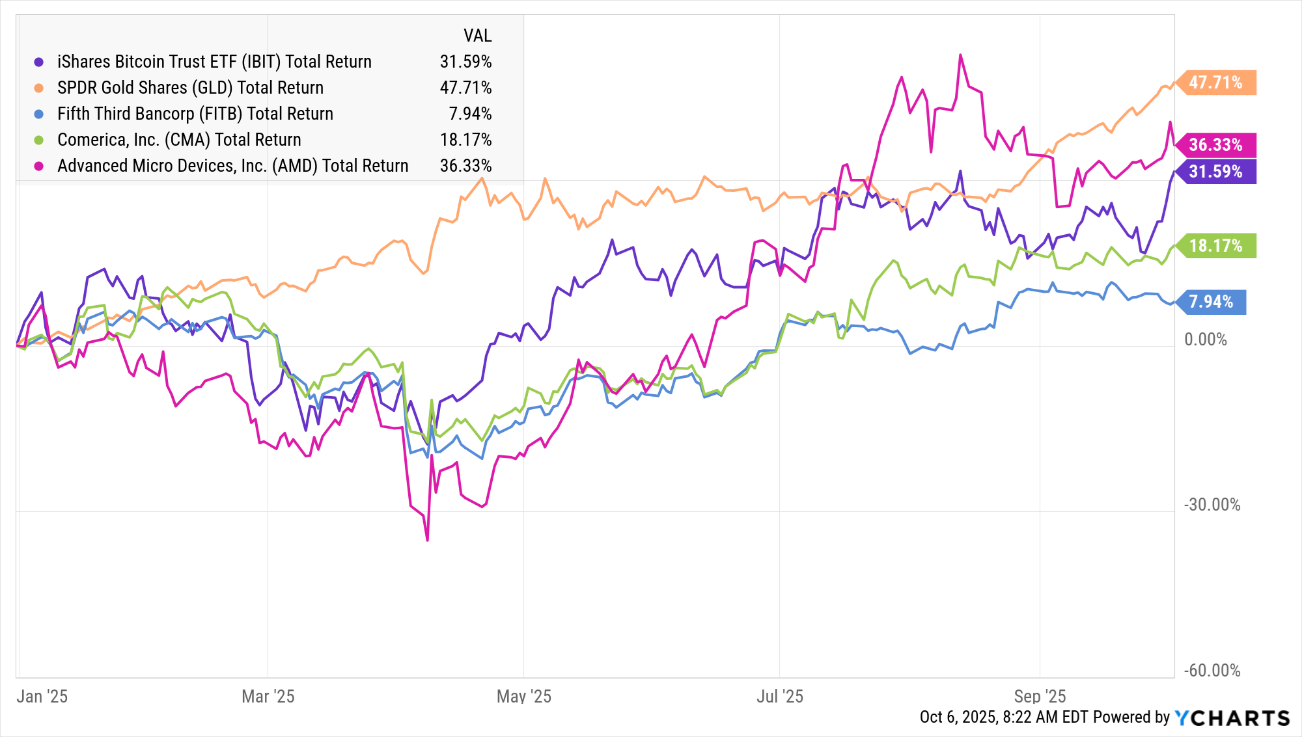

IBIT, GLD, FITB, CMA, AMD (YTD % Change)

Data by YCharts

Investors have been piling into these alternative forms of money and wealth-protection due to rising political dysfunction and government debt. Here in the US, the government shutdown is entering week two, with no sign of compromise emerging over the weekend. Election results in Japan and Europe suggest other countries will run policy loose to cope with suffocating debt loads, too – fueling even more debasement buying overseas.

Meanwhile, regional banks are bulking up now that they face a much friendlier regulatory environment under the Trump Administration. Fifth Third Bancorp (FITB) said it would buy Comerica Inc. (CMA) for $10.9 billion, combining two modest-sized institutions into the ninth-largest US bank. Fifth Third is a Midwest institution that was looking for more Southeast US exposure, while Comerica wanted more access to retail deposits to fund growth. FITB’s $82.88-per-share offer price represents a 17% premium to where CMA closed on Friday.

Stop me if you’ve heard this before: An Artificial Intelligence (AI) mega-deal has been signed! Open AI agreed to purchase up to six gigawatts worth of semiconductors from Advanced Micro Devices Inc. (AMD) over the next half-decade, while receiving warrants to buy up to 10% of AMD’s outstanding shares if certain milestones get hit. AMD shares surged on the news, which signals the next step in its plan to disrupt Nvidia Corp.’s (NVDA) dominance in AI chips.