Stocks are flattish today after a big rally in tech yesterday. Crude oil and Treasuries are also subdued, but gold is testing $4K. The dollar is also up.

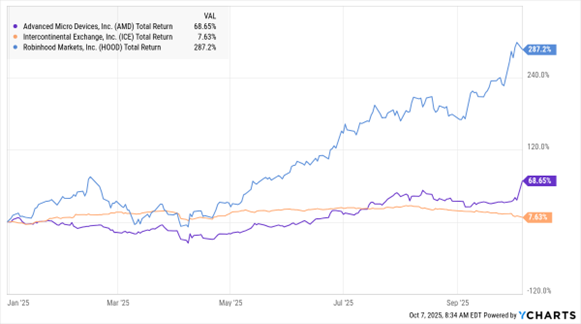

OpenAI is out there signing deals with virtually everyone in Big Tech, leading to eye-popping share-price moves for partners like Advanced Micro Devices Inc. (AMD). It surged more than 23% yesterday. But more outside analysts are questioning the circular nature of those transactions, and whether the Sam Altman-led firm might be biting off more than it can chew. Still, that didn’t stop the private company from achieving a $500 BILLION valuation in a recent funding round.

AMD, ICE, HOOD (YTD % Change)

Data by YCharts

The blending of traditional financial markets and “prediction” markets continues, with NYSE parent Intercontinental Exchange Inc. (ICE) investing $2 billion in Polymarket. The transaction values Polymarket around $8 billion. Prediction market platforms like Polymarket and competitor Kalshi allow customers to make yes-or-no bets on a wide range of events in financial markets, sports, politics, and more.

While Polymarket was banned from accepting trades from US-based customers in 2022, it’s getting re-established here now, helped along by the Trump Administration’s friendlier approach to the financial industry. As a side note, Robinhood Markets Inc. (HOOD) customers can now trade Kalshi contracts directly in the Robinhood app as part of a recent tie-up between those two firms.

Lastly, yet another minor mining stock is soaring thanks to federal government involvement. Shares of Canada’s Trilogy Metals Inc. (TMQ.CA) more than tripled after President Trump authorized the permitting and construction of an Alaskan mining road. In exchange, the government would get a 10% stake in Trilogy and warrants to purchase another 7.5%. The road would open up access to the Ambler Mining District, where proposed projects could produce copper, cobalt, and other minerals.