Gold continues to shine, blowing past $4,000-an-ounce yesterday and running even higher today. Silver is getting closer to an all-time high, too, while crude oil and equites are rallying modestly. Ditto for Treasuries and the US dollar.

The “Debasement Trade” shows no sign of letting up. Investors the world over are flocking to precious metals and cryptocurrencies amid a surge in global government debt, deficits, and currency debasement. Central banks are accumulating gold willy nilly, too. Plus, gold ETF buyers plowed more money into bullion funds in September than in any month in the last three years.

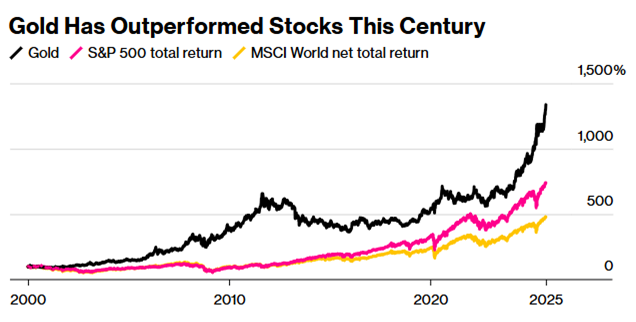

Source: Bloomberg

Result: Gold is now up more than 50% in 2025! In fact, it is easily outpacing the S&P 500 Index (^SPX) in this new century. As for related STOCKS? The VanEck Gold Miners ETF (GDX) has surged 127% this year…more than 4X the gain of the Global X Artificial Intelligence & Technology ETF (AIQ) – and closing in the 140.9% return of AI darling Palantir Technologies Inc. (PLTR).

Speaking of AI, Nvidia Corp. (NVDA) reportedly inked another quasi-“circular” deal with Elon Musk’s xAI startup. The AI venture is raising $20 billion in equity and debt to finance its Colossus 2 data center project in Tennessee.

Nvidia will invest up to $2 billion to fund the xAI facility’s development. Then a special purpose vehicle will turn around and buy Nvidia processors…and rent them to xAI. Outside analysts are increasingly questioning deal structures like these, saying they echo some of the troublesome transactions seen during the dot-com-bubble.