After ripping yesterday, stocks are muted this morning while gold and silver are giving up ground. Crude oil is modestly higher along with the dollar, while Treasuries are flat.

From escalating tariff costs to slumping Electric Vehicle (EV) subsidies, General Motors Co. (GM) has a lot on its plate – and it showed in the firm’s latest earnings report. Net income plunged to $1.3 billion, or $1.35 per share, from $3.1 billion, or $2.68 per share, in the year-ago period. But the stock actually traded higher initially as revenue and adjusted EPS topped forecasts. GM also lowered its forecast for full-year tariff costs, in part because President Trump just extended a relief program on Friday.

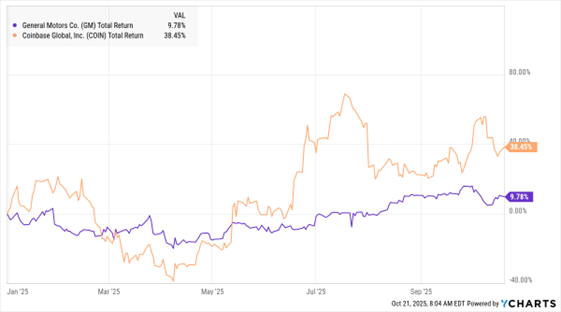

GM, COIN (YTD % Change)

Data by YCharts

Coinbase Global Inc. (COIN) continued its acquisition spree in the cryptocurrency space, buying Echo for $375 million in cash and stock. Echo runs the Sonar platform, which allows investors to buy into private and public tokens. Coinbase and other firms are looking to boost investor access to tokenized securities and assets, and this deal could advance those efforts.

Are “short squeezes” helping propel this market higher? Possibly. A Goldman Sachs Group Inc. (GS) index of the most heavily shorted stocks has soared 16% so far in October – putting it on pace for the best October EVER. Short-sellers borrow shares, then sell them to profit from declines. But when stocks rally instead, they have to buy back those shares to cover their positions – causing “squeezes” that can ironically lead to even-stronger stock market gains.