Markets are rejoicing thanks to tamer inflation figures, with equities and Treasuries solidly higher and crude oil modestly so. Gold and silver are down a bit along with the dollar.

Markets FINALLY got Consumer Price Index data for September – and it was better than expected. The headline CPI rose 0.3%, while the core rate that excludes food and energy climbed 0.2%. Both readings were one-tenth of a percentage point lower than what economists estimated. The government shutdown – now the second-longest on record – had delayed the report’s release.

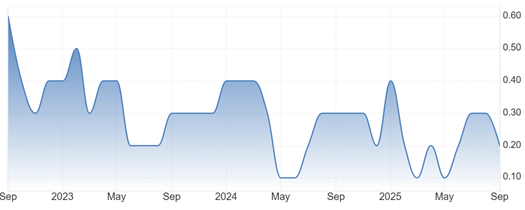

Core CPI (MOM % Change)

Source: Trading Economics

The cooler inflation data all but locks in a quarter-point cut at next week’s Federal Reserve meeting. But analysts remain divided on what the Fed will do about Quantitative Tightening, or QT. The Fed has been shrinking its $6.6 trillion portfolio of securities for more than three years now, a process markets largely ignored.

But money markets have started to get skittish over the last several weeks, and some short-term interest rates have actually ticked higher. That could force the Fed to stop draining liquidity at next week’s meeting – or at its December gathering at the latest.

Meanwhile, President Trump will be meeting with Chinese leader Xi Jinping soon. The White House announced that the two leaders would sit down next Thursday while Trump is traveling in Asia. He will also meet with heads of state from Malaysia, Japan, and South Korea. The US and China have been fighting over tariff rates, access to high-tech gear, the ownership of TikTok’s US operations, and fentanyl trafficking, among other things.

Separately, the president announced last night that he was cutting off trade talks with Canada because the Ontario government ran television ads criticizing his tariffs. The ads used audio from a 1987 radio address delivered by former president Ronald Reagan.