Markets are cheering talk of progress in the long-running US-China trade dispute. Stocks and crypto are higher, gold and silver are lower, while Treasuries and the dollar are flattish.

President Trump is on an Asian trip this week, one that has so far included a series of smaller “framework” deals with Southeast Asian nations like Thailand, Cambodia, Vietnam, and Malaysia. Later, he’ll be meeting with Chinese leader Xi Jinping in South Korea. Negotiators on both sides are trying to pile up as many “wins” that their leaders can announce, even as many bigger trade and geopolitical issues won’t be resolved.

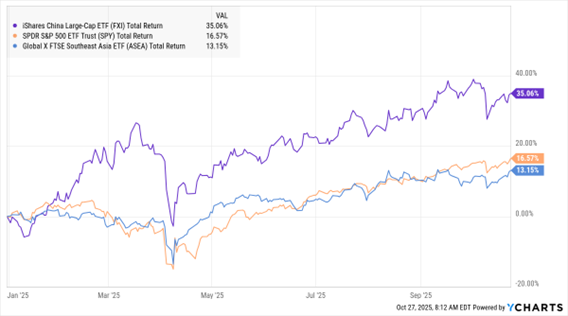

The US will likely back off Trump’s recent 100% tariff threat, while China will probably announce purchases of US soybeans and dial back some of its rare earth export restrictions. Progress toward détente helped markets rally around the world on Sunday and Monday. But it’s worth noting that the iShares China Large-Cap ETF (FXI) has been outperforming the SPDR S&P 500 ETF (SPY) all year, with gains of 35% versus 16.5% through last week. The Global X FTSE Southeast Asia ETF (ASEA) has lagged a bit, up 13.1%.

FXI, SPY, ASEA (YTD % Change)

Data by YCharts

There’s another bank deal to talk about today. Super-regional bank Huntington Bancshares Inc. (HBAN) is buying Cadence Bank (CADE) for $7.4 billion in stock. The move will add 400 Cadence locations in Texas, Mississippi, Alabama, Florida, and other Southern states to Huntington’s branch network. Bank mergers are heating up because the Trump Administration takes more of a laissez-faire approach to consolidation.

Meanwhile, Swiss drug giant Novartis AG (NVS) is buying US biotech company Avidity Biosciences Inc. (RNA) for $12 billion in cash. The $72 offer represented a 46% premium to where RNA traded on Friday. Novartis wants access to Avidity’s treatments for rare muscle disorders, including a development-stage drug for Duchenne muscular dystrophy called Delzota.