Stocks got shellacked yesterday, and they’re starting Friday off on a sour note, too. Crude oil, gold, and silver are up a bit, while Treasuries and the dollar are flattish. Bitcoin breached $100K to the downside again in early trading.

Talks continue on ways to end the record-long government shutdown, now in its 38th day. In the meantime, check your email if you have travel plans! The shutdown is prompting schedule reductions at 40 major US airports, with 4% of US flights getting cancelled today. That number will rise to 10% by Nov. 14, per the Federal Aviation Administration (FAA).

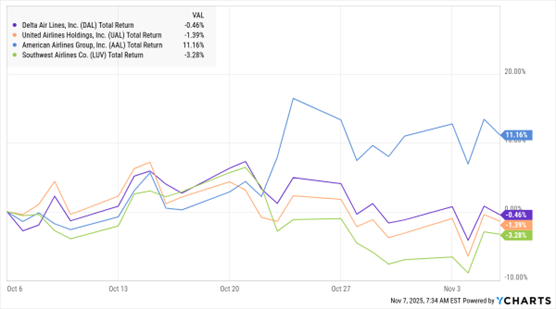

Officials say the move is necessary to ensure airline safety, given increasing absenteeism and scheduling conflicts among air traffic controllers who are working without pay. As for the impact on sector investors, airline stocks are mixed in the last month – with Southwest Airlines Co. (LUV) down 3.2%, but American Airlines Group Inc. (AAL) up 11.1%. Shares of Delta Air Lines Inc. (DAL) and United Airlines Holdings Inc. (UAL) are essentially unchanged.

LUV, AAL, DAL, UAL (1-Mo. % Change)

Data by YCharts

Meanwhile, things haven’t gone so well for cryptocurrency investors lately. The market cap of all cryptos tracked by CoinGecko hit $4.4 trillion on Oct. 6. It has since plunged 20%, leaving the asset class up just a couple of percentage points year-to-date. Bitcoin alone is having its worst week since March. The move comes amid a broader selloff in some of the year’s biggest winners, including AI stocks.

Lastly, the debate and the vote is over. Tesla Inc. (TSLA) CEO Elon Musk WILL receive the first $1 trillion compensation package offered by an American corporation. The Board of Directors strongly supported the award, though some large investors and institutional proxy advisors recommended shareholders vote against it.

Still, Musk will need to hit ambitious growth targets for the market value of TSLA, plus operational milestones for the company's underlying business, over a span of years to earn the full payout. That makes the number more of a theoretical, cumulative, future payout than “money in the bank” today. Musk is worth approximately $460 billion currently, per Bloomberg.