Happy Veterans Day! Stocks are mostly flat after a big relief rally on Monday. Gold, silver, and crude oil are rallying, though, while the dollar is slipping.

The Senate secured another vote needed to end the government shutdown late yesterday. The funding bill now moves to the House, which should vote Wednesday, then President Trump’s desk for a signature. For investors, the key takeaway is that the shutdown will end this week.

The focus will now shift to tallying up the economic damage done by the 41-day process. The Congressional Budget Office (CBO) estimated a six-week government closure – roughly akin to what has played out – would reduce Q4 GDP by about 1.5 percentage points.

Wall Street will also closely analyze the backlog of economic reports that will be released in coming days. That’s because the Federal Reserve meets again Dec. 9-10, and the numbers could influence the interest rate debates that policymakers have there.

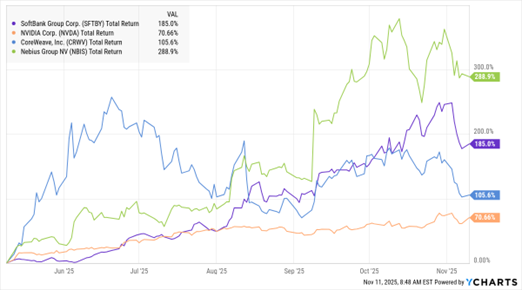

SFTBY, NVDA, CRWV, NBIS (6-Mo. % Change)

Data by YCharts

Meanwhile, at least one big Nvidia Corp. (NVDA) shareholder is cashing in – SoftBank Group Corp. (SFTBY). The Japanese investment firm sold its entire $5.8 billion position in NVDA to fund other projects in the Artificial Intelligence (AI) and data center space. SoftBank shares have surged because its portfolio includes investments in red-hot private tech companies like OpenAI, Perplexity AI, and ByteDance.

Speaking of AI stocks, CoreWeave Inc. (CRWV) did NOT manage to knock the ball out of the park withs its Q3 earnings. Plus, the data center darling forecast revenue of $5.05 billion to $5.15 billion for 2025 overall. That missed analyst forecasts of $5.29 billion, sending its shares lower in early trading.

On the flip side, Nebius Group NV (NBIS) inked a $3 billion deal with Meta Platforms Inc. (META) to provide data services and cloud capacity over the next five years. Its shares spiked. All told, the “AI Boom/AI Bubble” debate shows no sign of letting up – and the technical outlook for sector stocks is cloudier now than it was several months ago.