Markets continue to bleed in the early going, with stocks, cryptocurrencies, gold and silver all sliding further. Bonds are up a bit, while the dollar is flattish.

What stands out about the recent selloff? It’s taking down “everything,” from stocks to Bitcoin to traditional safe havens like precious metals. The benchmark cryptocurrency briefly pierced $90,000 to the downside overnight, for instance, triggering additional liquidations in Asian markets.

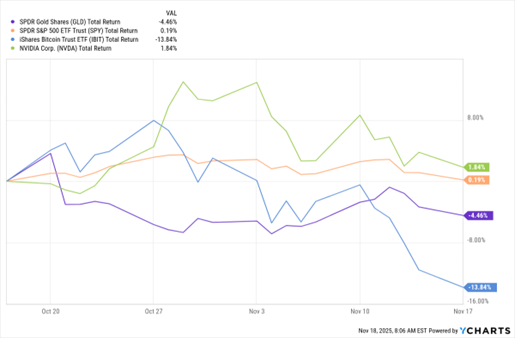

SPY, IBIT, GLD, NVDA (1-Mo.% Change)

Data by YCharts

Cryptos have lost a cumulative $1.2 trillion recently, while the SPDR S&P 500 ETF (SPY) is in the midst of its longest selloff since August. The SPDR Gold Shares (GLD) is down 4.4% in the last month, though still up more than 53% year-to-date.

All eyes will turn to Nvidia Corp. (NVDA) on Wednesday to see if the Artificial Intelligence (AI) juggernaut can turn sentiment – and market pricing – around. The $4.6 trillion chipmaker is reporting earnings tomorrow after the bell, and investors will be watching closely for any sign of a worrisome slowdown in revenue or profit growth. They’ll also want to hear what CEO Jensen Huang says about orders and capex spending in the AI industry. He previously said NVDA has more than $500 billion in chip orders for 2025 and 2026.

Lastly, Home Depot Inc. (HD) whiffed on third-quarter earnings AND pared its full-year forecast amid reduced spending on big ticket items and large home improvement projects. The retailer delivered $3.74 in adjusted earnings per share, missing the average estimate by a dime. Plus, it said EPS would drop 5% year-over-year, more than double the previous forecast of minus-2%.