Markets are off to a relatively quiet start this week, with stocks, gold, silver, and the dollar largely unchanged. Crude oil is down a bit along with bonds.

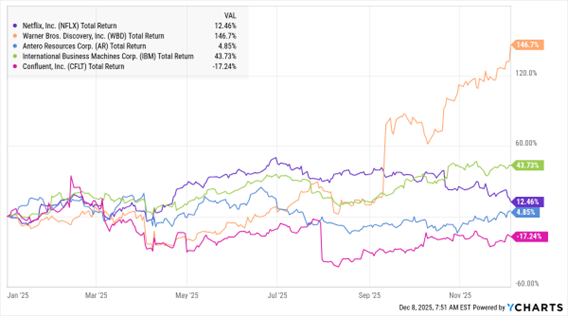

Could Netflix Inc.’s (NFLX) $72 billion deal for Warner Bros. Discovery Inc. (WBD) face more antitrust concerns than anticipated? President Trump weighed in on the transaction Sunday, saying “it could be a problem” given the combined firm’s market share in the entertainment production and streaming industry. Regulators will ultimately have to decide if uniting HBO Max, Netflix, the Warner Bros. production studio, and other assets under one roof gives the firm too much power.

NFLX, WBD, AR, IBM, CFLT (YTD % Change)

Data by YCharts

Amid a surged in natural gas prices, Antero Resources Corp. (AR) said it would buy gas production assets from HG Energy II for $2.8 billion in cash. The move will give the Denver-based producer access to more wells in Ohio, Pennsylvania, and West Virginia. AR shares are up 4.8% year-to-date, while natural gas futures are up 61%.

Meanwhile, International Business Machines Corp. (IBM) is buying Confluent Inc. (CFLT) for $11 billion. Confluent sells technology services for managing real-time data to customers in businesses like retail and financial services. IBM wants to beef up its services and Artificial Intelligence (AI) offerings, and the deal would accelerate that process.

Finally, China’s trade surplus with the rest of the world crossed a critical threshold in November, topping $1 trillion amid a 5.9% year-over-year rise in exports. Shipments to the US plunged 29%, but China boosted exports to other parts of the globe – including Africa, Europe, and Southeast Asia. The $1.08 trillion surplus for the first 11 months of the year topped the previous full-year record of $992 billion in 2024.