Equity markets are still twiddling their proverbial thumbs ahead of the Federal Reserve’s latest interest rate decision, due out later today. Silver is extending its breakout above $60, crude oil is rising a bit, but gold is easing back. The dollar and Treasuries are flattish.

Two developments are in Wall Street’s crosshairs today. One is the Fed meeting, where policymakers are expected to cut interest rates – but in a split vote that underscores dissension in the ranks. Chair Jay Powell will likely announce a 25-basis point cut, but signal the Fed could be on hold for a while to see what happens with inflation and economic growth.

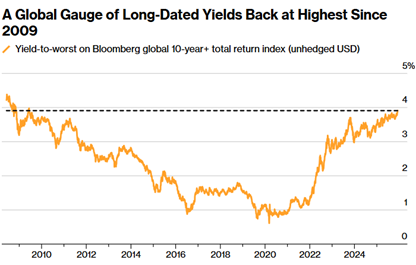

Source: Bloomberg

The frontrunner to replace Powell in 2026, President Trump’s National Economic Council director Kevin Hassett, said yesterday that there is “plenty of room” to cut rates further down the road. But ironically, long-term bond yields are climbing pretty much around the world. One Bloomberg gauge of global bond yields just hit its highest since 2009, driven by worries about lingering inflation, massive debt issuance in the US and abroad, and expected rate HIKES in some countries like Japan and Australia.

Meanwhile, Elon Musk’s SpaceX could launch the biggest Initial Public Offering (IPO) in world history next year, according to reports. The private space launch and satellite company will look to raise more than $30 billion, valuing it at around $1.5 trillion overall.

SpaceX is targeting a mid-to-late-2026 timeframe for the share sale, which would likely eclipse the previous record deal. That occurred in 2019, when Saudi Arabia’s national oil company Saudi Aramco sold a minority stake for $29 billion. Starlink is SpaceX’s big revenue-generator, accounting for most of the up to $24 billion in sales the firm expects to have in 2026.