After hitting fresh records yesterday, equities are mixed this morning. Gold is ramping after a multi-day surge in silver, while crude oil is flattish. The dollar is up a bit along with longer-term Treasury yields.

Yesterday, the Dow Jones Industrial Average, S&P 500 Index (^SPX), AND the Russell 2000 Index all hit new highs. But the Dow outperformed the S&P by the widest margin in more than nine months...while the Nasdaq Composite actually dipped on the day. More investors are diversifying out of mega-cap US tech stocks amid easier monetary policy and questions about the sustainability of the Artificial Intelligence (AI) boom.

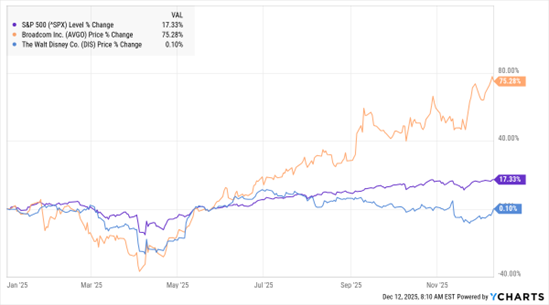

SPX, AVGO, DIS (YTD % Change)

Data by YCharts

Speaking of which, Broadcom Inc. (AVGO) stock is down despite beating sales and earnings forecasts in the fiscal fourth quarter. Investors seemed moderately disappointed in remarks from CEO Hock Tan about order volume for its AI chips. Then again, the stock WAS up 75% year-to-date heading into the report, not to mention trading at more than 40X earnings. So, it’s not shocking to see some profit-taking.

Content providers have been battling it out with AI companies for the last few years, threatening them over products like Sora from OpenAI and Gemini from Alphabet Inc. (GOOGL). Those tools allow users to produce AI-generated videos featuring intellectual property like movie characters from firms such as Walt Disney Co. (DIS).

But this week, Disney said it would buy an equity stake in OpenAI for $1 billion – and allow the company to license 200-plus Disney characters for use in Sora-generated videos. That won’t solve the fight over whether AI models can freely “scrape” content without compensation. But it could presage other deals from entertainment firms, actors’ unions, and other interested parties.