After falling on their face Friday, equity markets are starting the week off in a more positive fashion. Gold and silver are rallying again, while Treasuries and the dollar are mostly flat.

It’s that time of year again – the time when major brokerages and strategists publish look-ahead reports and S&P 500 Index (^SPX) targets for the next 12 months. Citigroup Inc. (C) became the latest to lay down a marker, saying the S&P will hit 7,700 by year-end 2026. So far, Oppenheimer has the highest target on Wall Street among big firms – 8,100. Those would represent gains of around 13% to 19% from Friday’s closing level of 6,827.

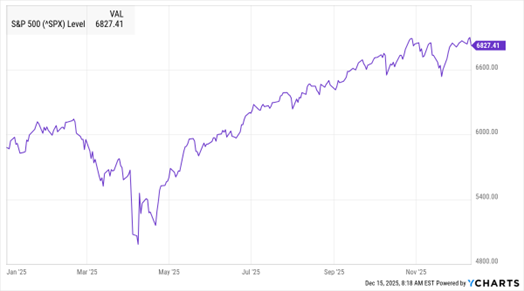

S&P 500 Index (^SPX)

Data by YCharts

Get ready for a double dose of jobs data tomorrow. In a bit of “catch up” from the government shutdown, the Labor Department will release a complete report on employment for November and some delayed data for October as well. Economists are forecasting a gain of 40,000 jobs for November, and an unemployment rate of 4.4%.

Private data has shown a lackluster job market – but not an imploding one. That said, Federal Reserve Chairman Jay Powell said last week that official data may be overstating job growth by as much as 60,000 positions per month. If that’s true, it means the US economy has been LOSING about 20,000 jobs per month since the spring.

The US government took another step to ensure access to critical materials, linking up with Korea Zinc Co. to build an advanced smelting plant in Tennessee. It will have the capability to process zinc, lead, copper, gold, and other standard metals, as well as strategic materials like antimony and germanium. Uncle Sam will be part of a group providing $1.94 billion in funding for the $7.4 billion project.

Finally, it’s time to say goodbye to iRobot Corp. (IRBT), the company that made the plucky and revolutionary Roomba vacuum in the early 2000s. The firm filed for Chapter 11 bankruptcy protection over the weekend following years of supply chain problems and stiff competition from cheaper rivals. The Chinese firm Shenzhen PICEA Robotics co. will take it over, however, ensuring some products will still be available in the marketplace.