After a modest fade yesterday, equity markets are mostly adrift in the wake of “meh” data on the economy. The dollar is lower along with crude oil, while Treasuries and precious metals are flattish.

Investors finally got fresh employment data – and it wasn’t great. The economy added 64,000 jobs in November, slightly above the 50,000 forecast by economists. But October’s delayed figure came in at negative-105,000 – roughly 4X the expected loss.

Unemployment also rose to 4.6% last month, well ahead of the 4.4% that was forecast. Average hourly earnings inched up 0.1%, less than the expected 0.3%. Meanwhile, headline retail sales flat-lined in October (though sales rose 0.4% once you strip out autos). Economists expected gains of 0.1% and 0.3%, respectively.

All in all, the figures confirm softness in the labor market and economy – a key reason why the Federal Reserve cut interest rates by 25 basis points last week. But Fed Chair Jay Powell and his fellow policymakers also signaled a reluctance to move much further unless the data deteriorates notably in early 2026.

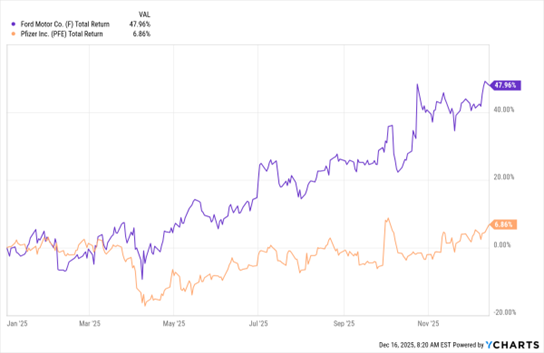

F, PFE (YTD % Change)

Data by YCharts

In other news, Ford Motor Co. (F) is pivoting massively away from Electric Vehicles (EVs) – and paying through the nose to make the switch. The automaker said it would take a $19.5 billion charge as part of its new strategy. It will cancel its Lightning EV pickup line and shift to hybrids and “Extended-Range EV” vehicles, which use a mix of gasoline and batteries for power. The company is also going to produce battery energy storage systems in plants that previously made EV batteries. Ford stock is up 47.9% year-to-date.

Drugmaker Pfizer Inc. (PFE) is trying to rebuild its pipeline of products following a sharp post-Covid slump in its share price – but it’s going to take time. The company just forecast sales of $59.5 billion to $62.5 billion in 2026, roughly in line with the $62 billion expected for 2025.

Meanwhile, CEO Albert Bourla is leading an effort to cut $7 billion in costs through 2027…and announcing deals like the recent $10 billion acquisition of Metsera to add drugs to its lineup. PFE stock is up 6.8% YTD.