Markets were mixed yesterday, though they’re rallying more broadly this morning. Silver is powering ahead, while crude oil and gold are up, too. Treasuries are slipping a bit.

The plot is thickening in the latest Hollywood takeover fight, with Warner Bros. Discovery Inc. (WBD) urging shareholders to reject a hostile bid from Paramount Skydance Corp. (PSKY). Paramount had topped a previous $72 billion ($27.75 per share) proposal from Netflix Inc. (NFLX), offering $77.9 billion ($30 per share) instead. Paramount also said its deal would earn regulatory approval more easily, but Warner’s response suggested funding for its offer is less secure than Netflix’s.

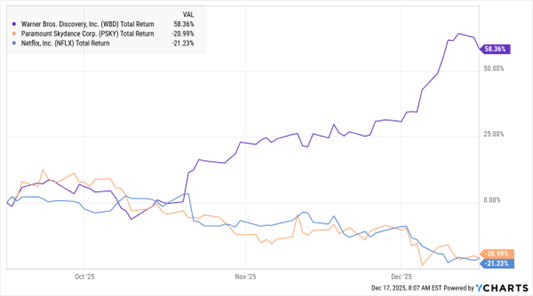

WBD, PSKY, NFLX (3-Mo. % Change)

Data by YCharts

The higher bid is backed by David and Larry Ellison, the father-and-son power team who are CEO of Paramount and founder and executive chairman of Oracle Corp. (ORCL) respectively. Yet shareholders don’t seem enamored with either bidder’s strategy. PSKY stock has slid 20.9% in the last month, while NFLX stock has lost 21.2%. WBD shares are up 58.3%.

After falling to its lowest level in almost five years, crude oil is rising this morning amid new US threats to Venezuela. President Trump said the US would blockade sanctioned oil tankers, preventing them from loading crude in the South American country for transport around the world. While output from Venezuela has slid for years to just 1 million barrels per day, the move still increases geopolitical risk – and therefore petroleum market pricing. It follows the US seizure of a tanker called The Skipper several days ago.

How much is Alphabet Inc.’s (GOOGL) Waymo business worth? We’ll soon find out, as the robotaxi company is looking to raise as much as $15 billion in a funding round. That round could value Waymo at more than $100 billion. The company has more than 2,500 cars offering driverless ride services, a business that Tesla Inc. (TSLA) is also trying to crack and running tests for in select locations.