Stocks are mixed after an intraday bounce on Monday. Crude oil is rising, gold and silver are waffling, and Treasuries are mostly flat.

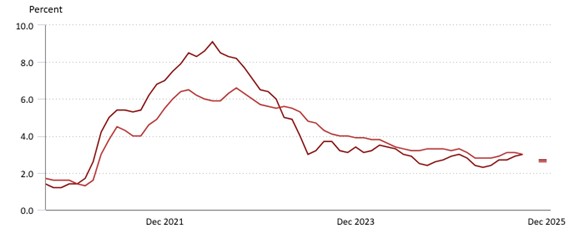

Let’s call the inflation numbers tame…ish. The Consumer Price Index rose 0.3% on the headline and 0.2% on the core in December. Economists expected both numbers to come in at +0.3%. On a year-over-year basis, consumer prices are up 2.7% overall and 2.6% if you exclude food and energy. The data keeps 2026 Federal Reserve interest rate cuts on the table, though maybe not until later in Q1 or Q2.

Headline, Core CPI (YOY % Change)

Source: Bureau of Labor Statistics

Speaking of the Fed, blowback from the White House-Fed fracas increased yesterday. Global central banks weighed in publicly to support Chair Jay Powell and Treasury Secretary Scott Bessent reportedly warned of economic and political ramifications from the charges. Still, stocks bounced back yesterday and gold cooled off today. That suggests investors are anticipating some kind of resolution or offramp to develop.

Elsewhere in Corporate America, the Q4 earnings season is starting to ramp up. Mega-bank JPMorgan Chase & Co. (JPM) reported earnings excluding certain costs of $14.7 billion, or $5.23 per share. That slightly beat forecasts. On the plus side, trading revenue blew away estimates at $8.24 billion. On the minus side, investment banking fee income missed targets and the bank confirmed that spending in 2025 would remain elevated. JPMorgan stock is up 38.1% in the past year.

Delta Air Lines Inc. (DAL), for its part, was another big name reporting Q4 results. Adjusted earnings per share came in at $1.55 per share, slightly beating the $1.53 forecast. Revenue missed targets, though, and Delta stock dipped despite commentary from CEO Ed Bastian about a “strong start” to 2026. Heading into the report, Delta stock was up 7.3%.