Stocks are modestly weaker in early trading today following a Tuesday slump. Gold, silver, and other metals keep ripping higher, while oil is up as well. Treasuries and the dollar are flat, while Bitcoin has regained $95,000.

The corporate earnings trickle is starting to become a flood. JPMorgan Chase & Co. (JPM) left a bad taste in bank investors’ mouths yesterday after releasing somewhat disappointing Q4 numbers. Today, we’ll see if reports from Bank of America Corp. (BAC) and Wells Fargo & Co. (WFC) will get “Big Finance” back on track.

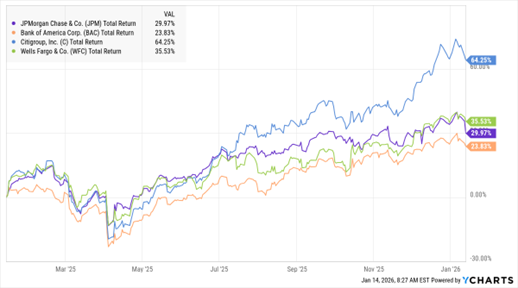

JPM, BAC, C, WFC (1-Yr. % Change)

Data by YCharts

Bank of America said Q4 profit rose 12% year-over-year, while noting that consumer spending was solid and card delinquency rates eased. Wells Fargo topped analyst estimates, reporting adjusted earnings per share of $1.76 versus a forecast of $1.66. Revenue came in a bit light, however. Citigroup Inc. (C), for its part, topped adjusted earnings and sales estimates. The firm is also reportedly cutting costs by laying off 1,000 workers this week. Despite recent weakness, shares of all four banks are up nicely in the last 12 months.

Meanwhile, the rampaging rally in precious and base metals is continuing this week. Gold and silver hit record highs overnight amid rising geopolitical instability in Iran and continued questions about Federal Reserve independence.

Base metals like copper and tin hit their own new highs amid aggressive buying in China. Investors are also questioning whether mines and smelters can keep up with demand fueled by the AI boom and enhanced infrastructure spending. Worth noting: crude oil prices are joining the commodities rally today thanks to concerns the Trump Administration could take military action against Iran for cracking down on antigovernment protestors.

Finally, the luxury department store owner Saks Global filed for Chapter 11 bankruptcy protection amid stiff competition and dwindling cash levels. The firm’s $2.7 billion acquisition of competitor Neiman Marcus only exacerbated its financial woes. It’s unclear whether the 159-year-old firm will be able to successfully restructure or ultimately liquidate.