After rallying yesterday, equities are subdued in early trading today. Crude oil is higher, precious metals are pulling back along with Treasuries, and the dollar is flat.

The explosion in data center construction and Artificial Intelligence (AI) model activity is having a major side effect – higher electric bills. Electricity prices rose more than 7% in September to 18.07 cents per kilowatt-hour. That was the biggest increase in almost three years, and it left prices at an all-time high. Just one AI-focused data center consumes as much power as 1,000 big box stores, according to the Wall Street Journal.

Now, the Trump Administration is teaming up with several governors to pressure the power grid operator PJM Interconnection LLC. They want PJM to hold a special wholesale auction that would apply to a longer-than-usual term, a step that would help push tech firms to self-fund more power plant construction and energy supply for their facilities.

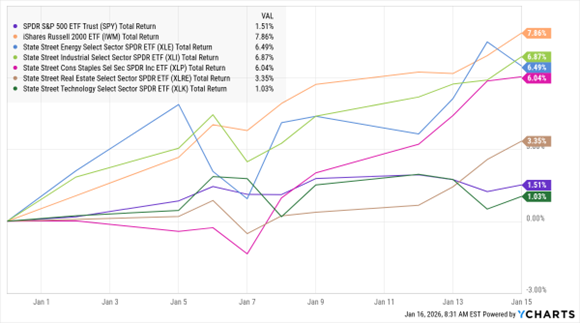

SPY, IWM, XLE, XLI, XLP, XLRE, XLK (YTD % Change)

Data by YCharts

Speaking of Big Tech, the sector is underperforming the broader market in this young new year amid a rotation into left-behind groups and small caps. The iShares Russell 2000 ETF (IWM) has rallied 7.8% in 2026, more than 7X the State Street Technology Select Sector SPDR ETF (XLK). Sector ETFs tracking energy, industrial, consumer staples, and even real estate stocks are handily outperforming the tech ETF.

Still, a new US-Taiwan trade deal and solid earnings in the semiconductor group are helping narrow the gap today. Investors poured $14 billion into US large cap stock funds in the most recent week, too. That far outpaced the $579 million in small cap flows, according to LSEG Lipper. Total stock fund inflows hit $28.1 billion, the highest since early October.

Lastly, one of the stocks recommended in our brand-new MoneyShow 2026 Top Picks Report is rocketing higher. AST Space Mobile Inc. (ASTS) is surging for a second day amid optimism the satellite communications company could benefit from greater defense spending. The Texas firm announced a contract tied to the US government’s “SHIELD” project, which aims to use Low-Earth Orbit satellites for various military applications. You can download a FREE copy of the report to read more about ASTS stock here.