Equities are slipping in late-week trading, while precious metals are threatening to break above key levels. Crude oil is higher as well, while natural gas is holding most of this week’s big gains. Treasuries and the dollar are flat.

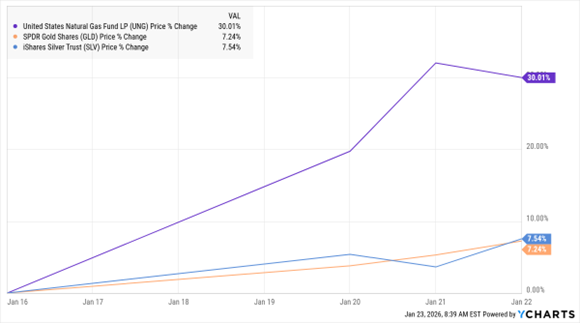

Stocks swung to and fro all week as the Greenland crisis ramped up then ramped down. But the real action has been in resources! First, natural gas prices surged this week due to expectations of widespread frigid weather, snow, sleet, and ice across much of the Midwest and eastern US. The United States Natural Gas Fund LP (UNG) has jumped 30% in the last week.

Meanwhile, we’re thisclose to seeing $5,000 gold and $100 silver! The yellow metal was recently trading just $60 shy of that big round number, while silver was only a couple dimes away from trading in the triple digits. Investors are flocking to metals amid rising geopolitical concerns, fears of purchasing power debasement, and a surge in borrow-and-spend stimulus by governments around the world. The SPDR Gold Shares (GLD) is up 7.2% in the last week, while the iShares Silver Trust (SLV) is up 7.5%.

UNG, GLD, SLV (1-Week % Change)

Data by YCharts

Could Nvidia Corp. (NVDA) soon ramp up shipments of its H200 chips to China? The Trump Administration has allowed the tech giant to ship the older-generation products to China, but the Chinese government has been slow-walking the process. National security and a desire to promote domestic chip producers were the reasons. But now, Beijing appears poised to allow shipments to move forward – and that could boost NVDA’s bottom line. Nvidia stock rose in early trading.

Elsewhere in the semiconductor space, Intel Corp. (INTC) is sliding after the company released a weaker-than-expected forecast for first-quarter sales and earnings. Intel stock has been rallying sharply amid hopes for its new 18A products. But higher manufacturing costs and supply shortages are coming into play, hurting results in the shorter term.