Stocks enjoyed a broad-based gain yesterday, but they’re more mixed so far today. Gold and silver are taking a breather after a big rally and reversal on Monday, while crude oil is rising. The dollar is taking another header, with the US Dollar Index (DXY) approaching a four-year low.

It’s an earnings bonanza today, with several big, brand-name companies reporting fourth-quarter results. Boeing Co. (BA) continued its turnaround under CEO Kelly Ortberg, reporting a solid $375 million in free cash flow during the period. Revenue jumped 57% to $23.9 billion.

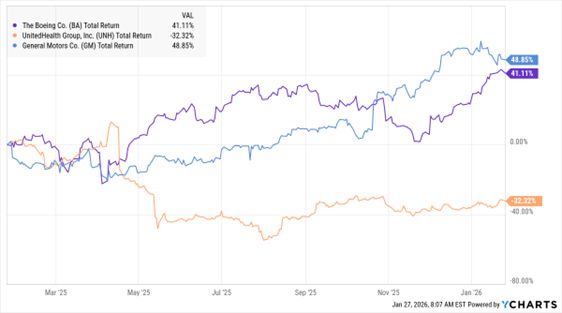

Excluding a big $9.6 billion gain linked to Boeing’s sale of the Jeppesen subsidiary, though, adjusted earnings missed estimates. Some work remains to be done in the company’s defense and space division, too. Boeing stock was down a bit in early trading, but up 41.1% in the last year.

BA, UNH, GM (1-Year % Change)

Data by YCharts

Meanwhile, mega-insurer UnitedHealth Group Inc. (UNH) is reeling after it said 2026 sales would slide for the first time in more than 30 years. The company is deliberately shrinking its membership roles and closing locations at its Optum Health unit.

Plus, the US government said yesterday that it would raise Medicare payment rates just 0.09% next year – far below the 6% rise analysts anticipated. That could squeeze profits further in the government-backed health program. UNH stock tanked 16% in early trading. It was already down 32% in the past 12 months.

Finally, General Motors Co. (GM) reported better-than-expected adjusted earnings in Q4, while also forecasting a range for 2026 EPS with a midpoint that topped current estimates. While it lost $3.3 billion overall due to a previously disclosed charge tied to its Electric Vehicle (EV) unit, the company boosted its dividend 20%. Plus, it announced a $6 billion share buyback program, cheering investors. GM stock rose 4% -- adding to its 48.8% rally since January 2025.