Sponsored Content-"There's no such thing as a free lunch" is a frequently heard commercial saying. When looking at income generating strategies for equity options, perhaps a better guideline is the relationship between risk and return-what risk am I taking for what return? Am I happy with that level of risk?

The covered call

In the recent low interest rate environment, many holders of stock have been keen to enhance their returns from that stock by writing (selling) calls backed by those stocks.

For detailed information on the construction of the covered call, go to OIC's website

Figure 1 shows the profit and loss on the combined stock and option position at expiration.

The strategy involves writing a call that is covered by an equivalent long stock position. The income received from the call option sold provides a small hedge on the stock and allows an investor to earn premium income, in return for temporarily surrendering some of the stock's upside potential.

The covered call can be a good way to enhance the return on a stock already held during sideways or range bound market conditions. It is not suitable for markets experiencing dramatic up or down moves. One way to look at the covered call is to see the premium received not only as extra income, but also as a buffer should the position not turn out as expected. For this strategy, the risk is in the stock. If the stock declines sharply, the investor will be holding a stock that has fallen in value, with the premium received reducing the loss.

If the stock moves sharply higher, then the investor will be unable to participate in any upward move beyond the strike price of the call option sold, although he will also have received the premium income from writing the call. It is worth noting that U.S. exchange-traded equity options can be traded out of. For example, if the market rises sharply, then the investor can buy back the call sold (probably at a loss), thus allowing his stock to participate fully in any upward move. The investor is also free to then be able to write a call option at a higher strike price if he wanted to.

The OIC website offers a free covered call calculator here

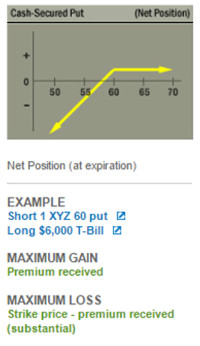

The cash secured put

In the case of the covered call, a call is written against stock already held. In the case of the cash secured put, an investor writes a put option and holds cash with which to buy the underlying stock if the put is exercised. So the two possible outcomes are either buying the stock more cheaply (at the strike price less the premium received) or just receiving the premium (the option is not exercised, so the investor keeps the premium.

For detailed information on this strategy go here

Figure 2 shows the profit and loss on the combined stock and option position at expiration. It is the same as that of the covered call.

Again, the risk is in the stock. If the stock rises and the put is not exercised, then the investor keeps the premium. The investor will have been disappointed, however, if she had been hoping that the put would be exercised on a down move in the underlying stock (thus enabling her to buy the stock at the effective lower price of the strike price less the premium received), and then hoping to participate in a rally in the stock price.

If the stock falls, then the put she has sold is likely to be exercised and the investor buys the stock at the exercise price, further enhanced by the premium that she has received. If the price keeps falling, however, she will take a loss once the cushion of the premium income received has been exceeded.

The covered combination

A covered combination strategy is where one call and one put with the same expiration, but different strike prices, are written against each 100 shares of the underlying stock. For example: an investor writes 1 XYZ May 60 call and writes 1 XYZ May 55 put, and buys 100 shares of XYZ stock. Two options are sold, so two amounts of premium are collected.

This is a combination of the covered call, plus a cash secured short put. It is also known as a covered strangle as both a put and a call are sold with different strikes, and the underlying stock to be sold if the call is exercised is already held. The investor also needs to be able to pay for the extra stock that he will purchase if the put is exercised. It is a strategy that anticipates limited movement between the strike prices of the options sold.

Depending on the price movement of the underlying, several outcomes are possible: both options sold are exercised; neither option sold is exercised; the short call is exercised; or the short put is exercised.

If the underlying price stays between the strike price of the put sold and the call sold, neither option is likely to be exercised and the investor keeps any premium that he has received. He may also make a small gain (or loss) on the underlying stock that he is holding. If it is a loss, then the premium received will act as buffer.

If the underlying price moves below the strike price of the put sold and then above the strike price of the call sold, then both options could be exercised. If the short call is exercised, then the long stock will be delivered to fulfil that obligation. If the put is exercised, then the investor will have to pay for the underlying stock and will buy the stock at a lower effective price as he will also have received the premium when he sold the put. He will be hoping that the stock price then rises.

If just the call or just the put are exercised, then the outcomes will be as described for the covered call and the cash secured put.

Conclusion

We have focused on covered or partly covered strategies as these offer lower risk. Other premium generating strategies that offer higher risk include short straddles and strangles. It is not possible in a short overview to cover all possible income generating strategies, but this post is intended to help investors develop their own risk and return framework. This involves straightforward questions such as how is the trade structured, what do I receive if the expected outcome happens, and what happens if it doesn't.

As with any option strategy, research and preparation are fundamental.

About OIC:

The Options Industry Council (OIC) is an educational resource funded by OCC, the world's largest equity derivatives clearing organization, and the U.S. options exchanges. The mission of OIC is to increase awareness, understanding and responsible use of exchange-listed options among a global audience of investors, including individuals, financial advisors and institutional managers, by providing independent and unbiased education combined with practical expertise.

Learn more about OIC at www.OptionsEducation.org

Disclaimers:

Options involve risk and are not suitable for all investors. Individuals should not enter into Options transactions until they have read and understood the risk disclosure document, Characteristics and Risks of Standardized Options, which may be obtained from your broker, from any exchange on which options are traded or by visiting www.OptionsEducation.org. None of the information in this post should be construed as a recommendation to buy or sell a security or to provide investment advice. C2016 The Options Industry Council. All rights reserved. The opinions expressed are the author's own.