You can get your financial retirement goals back on track! Here’s how to do it, writes Mike Turner of Turner Capital Investments.

The headlines are all over the internet. And they’re almost all scary. Baby boomers are grossly unprepared for their retirements.

According to Bankrate.com, 20% of US workers are saving nothing for retirement. Another 20% is saving only 5% of their annual income. And only 16% are saving more than 15% of their income.

Want some more bad news? According to an article by CNBC, one-third of baby boomers have nothing saved for retirement.

For those who have saved next to nothing, there’s even more bad news. Those retiring today could have 30 years or more in retirement. That means 30 years or more without a paycheck coming in.

Actually, “retirement” is a relatively new idea. 150 years ago, people worked until they died. Our modern retirement is a combination of increasing life spans and substantially improved economic conditions. The standard retirement age has been thought of as 65, but that too is changing.

Today, the average life span is more than 78 years. And that number can be misleading. According to the Social Security Administration, a man reaching 65 today can expect to live on average until 84 years old. Women reaching 65 today can expect to live past 86 years.

And, according to an article by Pew Research, the number of centenarians (those over 100 years old) is expected to increase by eightfold over the next 30 years.

I talk to thousands of investors each year. The biggest concern that most have is that they haven’t saved enough for retirement and that they’ll outlive their money.

These are legitimate concerns. Nobody wants to have to live a lower standard of living in retirement or get outside help from their family or, gulp, from the government.

But there’s good news hidden in the above numbers. An increasing lifespan and a robust economy can give a second chance to those who haven’t saved enough yet. The average retirement age is sure to increase over the coming decades and that gives a longer runway to those who don’t have enough money for retirement today.

Having more years to invest is an advantage, but only if you use it properly. If you subscribe to the old way of investing, aka “buy and hold”, the potential advantage of having more years to invest could easily be wiped away by a 50% bear market. We’ve seen two of those this century and we’re sure to see more in the future.

There’s a more intelligent way to invest that can help you make best use of your longevity advantage.

It’s called Market Directional Investing.

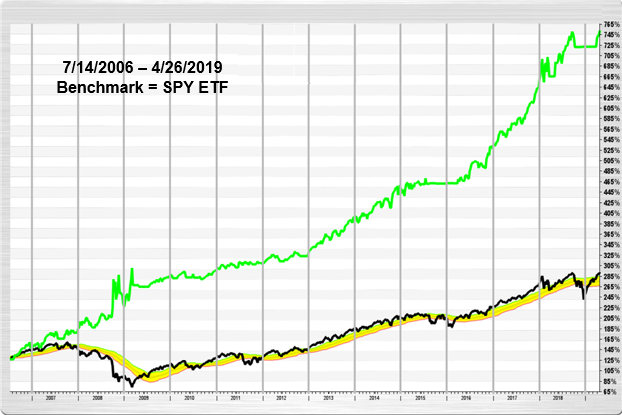

What if you could be long when the market is bullish and short when the market is bearish? Rather than the buy-and-hold returns like the black line you see in the chart, below, you could potentially have returns similar to the green line.

Want to know how to do this? How could a system like this jump start your retirement savings and get you back on track?

On Thursday evening, June 6th, I’ll be conducting an educational presentation that shows how to know, exactly when the market is in a bullish trend and exactly when the market is in a bearish trend. And the real beauty of this methodology is how it signals when risk is too high; and it is time to take profits and move to the sidelines and wait for the next signal (bull or bear).

To register for this presentation, click here.

As an added bonus, everyone who registers for this webinar will receive four weeks of my client newsletter. In the newsletter, I show you my updated charts (similar to the chart above) with all of the bullish and bearish signals that my system generates.

Again, click here to register. This presentation could significantly affect your retirement success.

Visit www.turnercapital.com or contact us at info@turnercapital.com.

TURNER CAPITAL INVESTMENTS, LLC

GROWING AND PROTECTING CLIENT CAPITAL IN BOTH BULL AND BEAR MARKETS

IMPORTANT:

Please note the chart referenced above is hypothetical in nature and does NOT represent actual trading. Past performance is not indicative of future returns and all performance numbers noted herein are purely theoretical and do not represent actual trades, the cost of trades, tax consequences or management fees. No recommendation is being made to buy or sell any security. Investing in the stock market involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. Nothing contained herein should be construed as a warranty of investment results. All securities trading, whether in stocks, options, or other investment vehicles, is speculative in nature and involves substantial risk of loss. Turner Capital encourages you to read the investor information available at the websites of the Securities and Exchange Commission at www.sec.gov, the Financial Industry Regulatory Authority at www.finra.org, and the Options Clearing Corporation at www.optionsclearing.com. A critically important aspect of this strategy is how it performs against the S&P 500 index in a bear market. If no bear market is encountered, the performance is much lower than shown in the chart, above.