I was invited to speak at a conference of high-wealth money managers last weekend in San Diego. My talk was at a time that gave me maximum exposure, in the morning, but not right before lunch. I knew two of the hundred or so people who attended and had just gotten my Market Directional Investing methodology introduced into their platform. But I couldn’t understand why they wanted me to have such a high profile at their conference. The reason soon became clear.

One of the managing directors, who I just met the day before, came to the podium to introduce me. He asked the group of high-powered brokers one question. “How many of you were afraid to call your clients in the last three months of last year?” Most of the hands went up as they looked around at each other.

And there was my answer. Even the top-of-the-food-chain wealth managers don’t like calling their clients when the markets are falling. He finished his introduction by saying that they’d never have to avoid talking to clients with my investment methodology.

How about your financial advisor? Did you hear from him/her in the last quarter of 2018? Now, for the third time in less than 18 months, the markets are falling hard again. Have you heard from your financial advisor? If you’re like most people, you haven’t heard a thing. If you call him/her, you’re probably getting the same old “Don’t worry, the market always comes back.” And then they go back to hoping the market turns around. But if you’re relying on your portfolio to generate income and capital appreciation for your retirement living, those words ring hollow.

My clients hear from me every week. I send an email to every client telling them the results of my proprietary algorithms for that week and what my investment strategy is going to be. There’s no guessing or hoping. We don’t make money every week, but over the course of the year, we’ve done quite well. For those interested in seeing my portfolio returns, click here. Don’t forget that past performance is not indicative of future returns.

I’d like to introduce you to my process. It’s called Market Directional Investing.

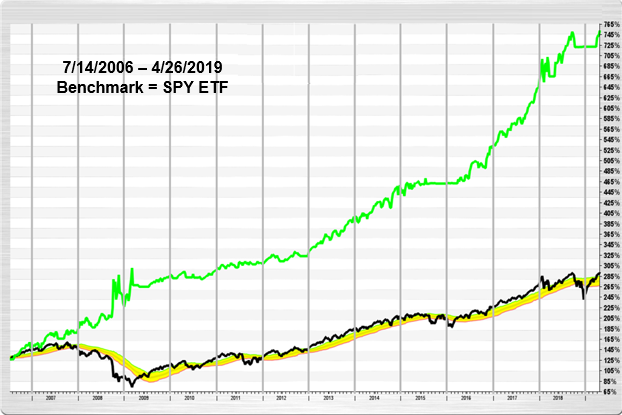

Market Directional Investing allows you to be long when the market is bullish and short when the market is bearish. Rather than returns like the black line that you see in the chart, below, you could potentially have returns similar to the green line.

I’ve developed this process that allows me to take advantage of both bull and bear markets. And move to the sidelines in cash when the risk is too high. As an example, I began moving to cash about 4 weeks ago as the market began moving into (and at this point, well into) my Transition Zone where risk of a reversal or a drop lower is very elevated.

If you are interested, I would like to show you exactly how this is done. I would like to teach you how to follow a process that identifies bullish and bearish trends and the best way to invest in each of them?

On Thursday evening, June 6th, I’ll be conducting an educational presentation that shows how I know exactly when the market is in a bullish trend and when the market is in a bearish trend. And how this process moves me to cash when the risk is too high.

To register for this presentation, click here.

As an added bonus, everyone who registers for this webinar will receive four weeks of my client newsletter. In the newsletter, I show you my updated charts (similar to the chart above) with all of the bullish and bearish signals that my system generated that weekend. You’ll see how I let my clients know exactly what’s going to happen in the upcoming week.

Again, click here to register. This presentation could significantly affect your retirement success.

Visit www.turnercapital.com or contact us at info@turnercapital.com.

TURNER CAPITAL INVESTMENTS, LLC

GROWING AND PROTECTING CLIENT CAPITAL IN BOTH BULL AND BEAR MARKETS