Obviously, if you’ve been paying attention, you know the stock market is down dramatically in just the past few days. To begin with, the Fed basically said they were ‘one-and-done’ on lowering rates… right… we all believed that one. Then Trump does a double-whammy on China by threatening to increase tariffs and then declares China a currency manipulator. The market is tanking as I write this article. How much further will the market go down? Is this the beginning of the next bear market correction or the best buying opportunity of 2019? Do you have a strong opinion about this?

And how much are you willing to lose if your opinion is wrong?

I was reading the headlines on the financial websites this morning. The first one was, “Strong Buys for a Rising Market” and the second one shouted, “The Market Will be Down 15% by Year-End”. See, there’s a headline or opinion for whatever you want to believe.

But what if these opinions are wrong (they can’t both be right at the same time)? How much will it cost you to follow the wrong opinion? And think about it… how much have your opinions cost you in the market in the past? How many times were you wrong and didn’t want to admit it, instead saying “the market’s wrong”?

That’s why I don’t invest based on opinions. I refuse to guess what’s going to happen next and then subject my clients to my guessing with their money. And right now, with the market tanking, my clients are sitting in safe high-yielding money markets while the market tries to decide which way it wants to go for the long-term because that’s when I want back in the market… AFTER it has decided whether its back into a bull trend or into the much-anticipated bear trend. It matters not which trend it chooses; my clients make money in either bull or bear markets.

You see.. I invest a different way. I use math. No guessing, no costly wrong opinions, no wondering what to do next.

In fact, I can explain my investment strategy to you in just 23 words:

When the market is bullish, I’m long. When the market is bearish, I’m short. And when the market is indecisive, I’m in cash.

Can you explain your investment strategy to me in just 23 words? Most people have a strategy, but they haven’t written it down or (in most cases) even be able to describe it. I can describe their strategy and do it in just three words…

“Guess and Hope”

That’s the strategy that most investors employ. After they’ve made their guesses, er, investment decisions, all they have is hope. Sorry, that’s just not my kind of strategy. I refuse to manage my money and my clients’ money by guessing and hoping.

Think about it. The markets don’t trade in a flat line. They’re either trending higher, trending lower, or transitioning from one trend to another. My investment philosophy, which I call Market-Directional Investing, uses math to measure these market trends. When a trend is established, like a surfer getting on a wave, I hop on the trend and ride it as long as it lasts. After the trend dissipates, I move to cash and wait for the next trend to develop.

No guessing… No hoping… Just measuring the market wherever it is and investing accordingly.

But here’s what I haven’t told you. Unlike the “guess and hope” crowd, I’m looking forward to the next bear market, whenever it takes place. I can make money in bear markets just as easily, and generally more quickly, as I do in bull markets. In bear markets I use inverse ETFs that move up when the market moves down.

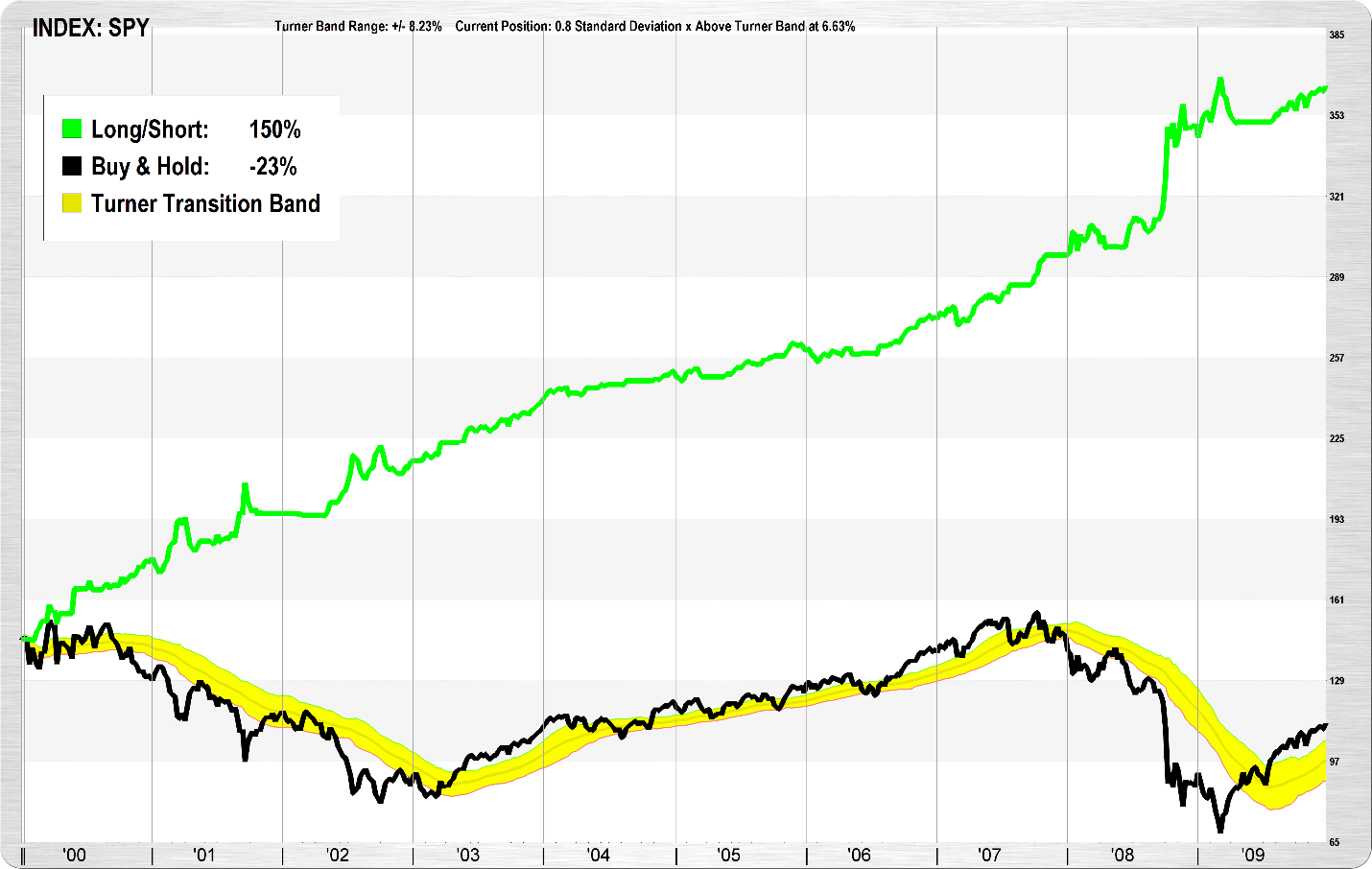

Here’s a chart of the previous decade using my Market-Directional methodology. You can see that as the markets moved lower in 2000-2002 and 2007-2009, my methodology moved higher.

It’s not a secret, we’re just using math to measure the market. We don’t move until the market has moved and when the market is in a bullish trend, we’re bullish. When it’s in a bearish trend, we’re bearish. That’s right… We make our move AFTER the market has made its move. That way, we never have to guess what trend the market is in because we know (mathematically) what trend the market is in. Measuring where the market is removes all guessing about where the market might be in the future. You see, we know (mathematically know) that any bullish or bearish trend in the market will last exactly as long as it lasts. We don’t guess when a trend will end; we simply measure where the market is and that always tells us when a trend has ended and when a new trend has begun. I know this sounds simple… maybe too simple… but sometimes simple is better. And in my market-directional strategy, simple measuring of trends is the key to being on the right side of the market.

In my next webinar, I will be walking a select group of investors through in-depth look at how my investment methodology works in all market conditions. This deep-dive presentation will take place on Wednesday evening, August 7th, at 7:30 pm ET. Click here to register. If you can’t make it, be sure to register anyway and I’ll email you the link to watch the recording.

Stop hoping and guessing. Stop losing money on opinions (guesses) about what the market is going to do next. Attend this totally free webinar and learn how to measure your way into a successful investment strategy. See you online, Wednesday evening!

Visit www.turnercapital.com or contact us at info@turnercapital.com.

TURNER CAPITAL INVESTMENTS, LLC

GROWING AND PROTECTING CLIENT CAPITAL IN BOTH BULL AND BEAR MARKETS

IMPORTANT:

Please note the chart referenced above is hypothetical in nature and does NOT represent actual trading. Past performance is not indicative of future returns and all performance numbers noted herein are purely theoretical and do not represent actual trades, the cost of trades, tax consequences or management fees. No recommendation is being made to buy or sell any security. Investing in the stock market involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. Nothing contained herein should be construed as a warranty of investment results. All securities trading, whether in stocks, options, or other investment vehicles, is speculative in nature and involves substantial risk of loss. Turner Capital encourages you to read the investor information available at the websites of the Securities and Exchange Commission at www.sec.gov, the Financial Industry Regulatory Authority at www.finra.org, and the Options Clearing Corporation at www.optionsclearing.com. A critically important aspect of this strategy is how it performs against the S&P 500 index in a bear market. If no bear market is encountered, the performance is much lower than shown in the chart, above.