Sponsored Content - Peter Lynch called them “10 baggers”. Some people call them “home runs”. Some authors describe them as “long tails”. They have been called “high-fliers”. What are they? They are stocks that will grow ten-fold or more, explains Mike Adams of Adams Financial Concepts.

The strategy at Adams Financial Concepts, LLC (AFC) and for Mike Adams, even before founding AFC, has been to search for those companies with the potential to be 10-baggers and to do that in portfolios with a limited number of total holdings. When there are 300 stocks in a portfolio the 10-bagger will make little difference on the total portfolio performance. But in a portfolio of eight to ten stocks, one high flier can have a dramatic effect on the performance.

JP Morgan did a study in which they found that since 1980, 320 of the 500 stocks in the Standard and Poor’s 500 were removed from the index: “the S&P 500 deletions that were a consequence of stocks that failed outright [and] were removed due to substantial declines in their market value or were acquired after suffering such a decline”.1 In other words, almost 70% of the stocks in the S&P 500 lose money. The study went further in saying “…of the Russell 3000 companies since 1980 roughly 40% of all stocks suffered a permanent 70%+ decline from their peak value.”

There is a reason that S&P 2 and Eugene Fama 3 have found only three to five percent of all professional money managers to do better than the market over the longer-term (10 years) as measured by their benchmarks.

I know of no one who always picks winning stocks. There are going to be losers. And yes I have had stocks that have lost as much as 70% of their value. So to achieve the level of return my clients have experienced over the years means that I have to pick those long-tail 10 baggers to offset the losses of a few stocks and furnish the superior returns.

MoneyShow’s Top 100 Stocks for 2021

The top performing newsletter advisors and analyst are back, and they just released their best stock ideas for 2021. Get your FREE copy of MoneyShow’s 2021 Top Picks report here and see why the nation's leading investment experts believe these stocks will significantly outperform the market in 2021.

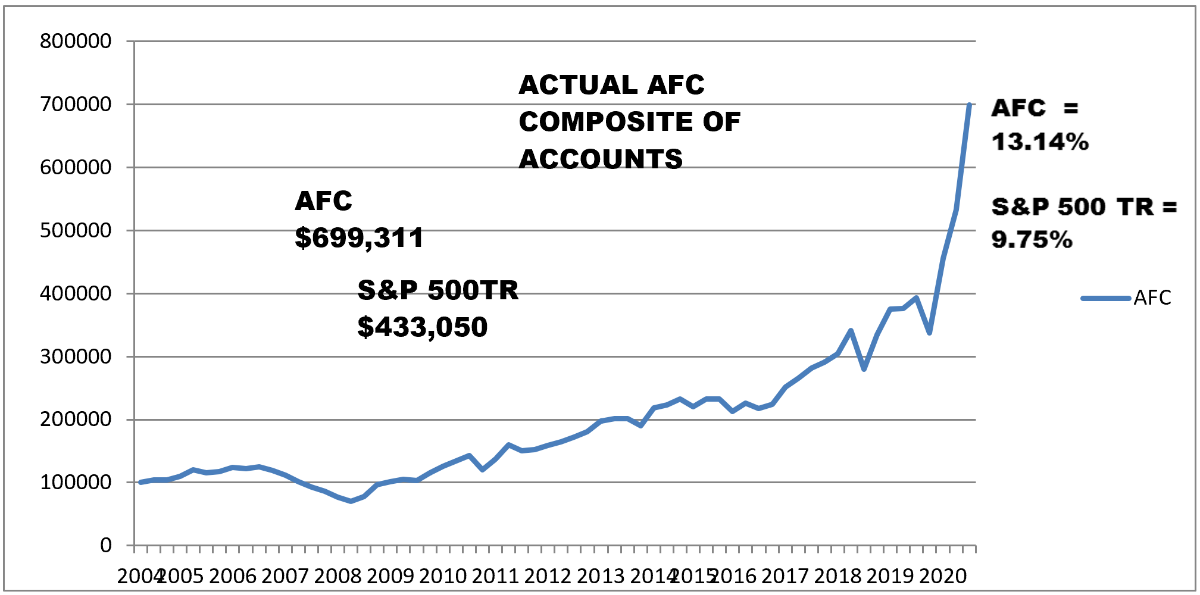

Over the last two years, the composite of my client accounts net of all fees, expenses and costs has been 40% and 77%. There is a reason for those returns. Client portfolios hold eight to ten stocks. Of those stocks, three stocks added in 2019 and three from added in previous years, six in total, seem to be moving like they will be 10-baggers. The pandemic accelerated the upswing in two of the stocks, but the others were doing well even before the pandemic. Incidentally, none of the FAANG stocks are in the portfolios. They have not met my criteria for inclusion.

What this says to me is that the performance of the last two years is not just luck. It also says that there is some not insignificant probability that the performance will continue to be very good. It is not a guarantee and I have to say that. But I am guardedly optimistic.

I do know there will be setbacks and downturns and unexpected occurrences. The returns that have been achieved are with portfolios that were fully invested in all of those times and still achieved the reported results. This covers 16 years through the Great Recession and through the pandemic. The composite is still doing better than the S&P 500 total return by 3 ½% per year on the average.

[1] “The Agony & Ecstasy: The Risks and Rewards of a Concentrated Stock Position”, Michael Cembalest, JP Morgan Asset Management, 2014.

[2] “SPIVA US Scorecard”, aye Soe and Ryan Poirier, S&P Dow Jones, 2018.

[3] Luck versus Skill in the Cross-Section of Mutual fund Returns, Eugene Fama and Kenneth French, The Journal of Finance, October 2010

Learn more about Mike Adams at Adams Financial Concepts.