If you invest, then tread lightly. The cryptos have proven to be wonderful trading vehicles. Beware that exchanges aren’t regulated and there have been a few horror stories here so far, asserts Dave Landry. He’s founder and president of DaveLandry.com.

With bitcoin (BTC) hitting all-time highs there’s been a lot of talk about its legitimacy. Is it a real currency? Is it a bubble? Should you invest or trade it? If so, how? Let’s explore this further along with something that has the potential to be much bigger than bitcoin.

A bitcoin is just some zeros and ones. How can that be real money?

Before we get into bitcoin’s legitimacy, let’s talk about money.

I have millions, no wait, hundreds of trillions of dollars. You may have seen me standing proudly standing in front of this display in webinars. I also have millions of pounds, francs, lira, rupees, real, dongs and dinars, etc...

This money is so-called fiat money. Fiat, which is Latin for “let it be done,” means that the money has no intrinsic value. It’s not backed by anything other than the approval of the government that printed it. It physically cannot be directly converted to an equal weight of a hard asset such as gold or silver. In recent years it’s been joked that the difference between countries in crisis and the U.S. is the size of our printing press.

Fiat money works as long as people believe in it. Or, more accurately, as long as people believe in their government. If you don’t have enough to worry about, just remember that history has shown that all fiat currencies eventually fail. What’s even scarier is that the average lifespan is around 27 years!

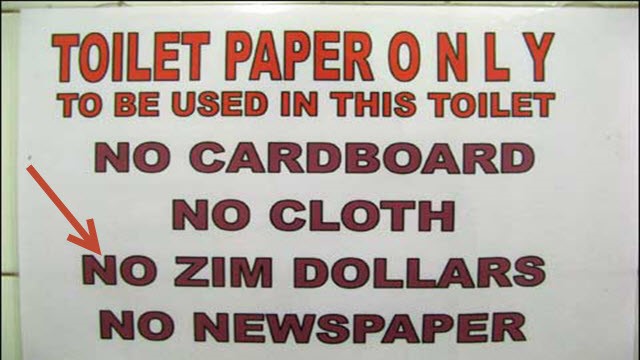

As fiat currencies begin to fail, they become more and more worthless. In more recent years, signs can be found in South African public toilets asking you to not use Zim notes. The currency has become so worthless that you can’t even wipe your butt with it!

Back to bitcoin. Where’s the trust?

Bitcoin has no official government or central intermediary. The trust is based on an open system of cryptology. Numerous accountants known as miners look at the open ledger to verify that the transaction is legitimate.

The first one to verify the legitimacy of a transaction collects a small fee after confirmation and agreement by a certain number of other miners. It truly becomes a circle of trust. Without digressing too far, I looked into mining with one of my old PCs. I quickly learned that it’s not that easy. It would take approximately one million years to mine one bitcoin. And, I’m assuming that they are talking about a newer PC!

Capitalism has really taken off here. A quick Google image search of “bitcoin mining farms” shows the massive warehouses filled with thousands of computers.

Answer the question: How can zeros and ones be a currency?

Bitcoin and other cryptocurrencies are based upon a cryptography technique called blockchain. Let’s say you email your boss a spreadsheet that you’ve been working on. You have not sent him the actual spreadsheet but rather a copy. After you hit send, both you and your boss have the spreadsheet.

Now, imagine that only one copy of this spreadsheet can exist. Once you hit send it disappears from your computer. This is made possible by having a record of the transaction attached. Through a transparent network, others can see and verify the transaction. The transaction gets “chained” into the record.

The blockchain is bigger than the bitcoin

The Economist says this: “The blockchain is an even more potent technology. In essence it is a shared, trusted, public ledger that everyone can inspect, but which no single user controls. The participants in a blockchain system collectively keep the ledger up to date: it can be amended only according to strict rules and by general agreement. bitcoin’s blockchain ledger prevents double-spending and keeps track of transactions continuously. It is what makes possible a currency without a central bank.”

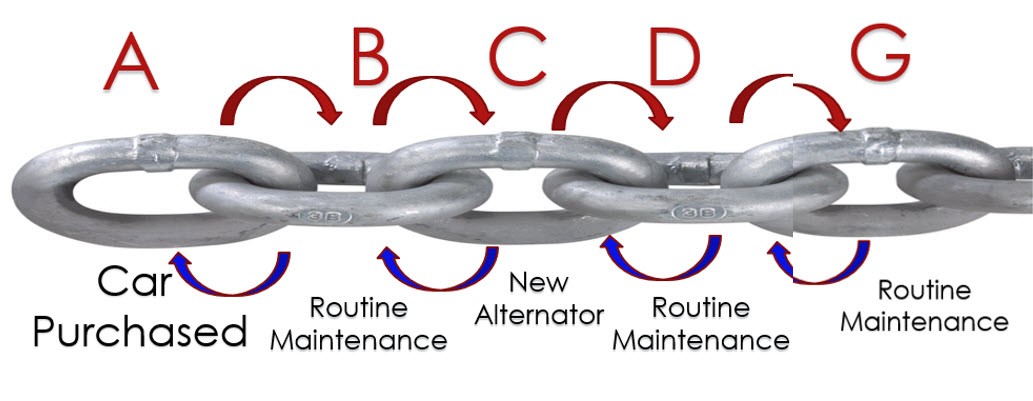

Rather than re-invent the wheel, I did a massively simplified example of a blockchain back in October in The Week In Charts. Below is a quick summary.

In a nutshell, records must match the records that they are “chained” to. Trying to replace or eliminate a link in the chain would cause the transaction to be tossed out.

Let’s say that your car’s maintenance records are block chained. Each record points to the prior and subsequent record. Now, let’s suppose that at some point your car gets flooded and then subsequently repaired (see picture). If you tried to eliminate these transactions from the chain, it simply will no longer add up. The aforementioned accountants would verify this and toss out the record.

Without having this turn into a lengthy blockchain discussion (and showing you what little I know about this complex and vast subject), just know these two things:

One, it’s what makes bitcoin and other cryptocurriences possible.

And two, it's going to be much bigger than bitcoin. We’ll likely see blockchain technology applied to many businesses. We’ll have to pay attention to see what companies benefit here. The good news that the charts will lead the way. That’s the beauty of technical analysis!

“Every single type of business can be turned on its head with this technology.”

—Alex Tapscott

So, what’s a bitcoin worth?

The value of anything is what someone will pay you for it. A few of my notes have some collector value--e.g. my 100 trillion dollar notes have gone up 5,000% since I bought them--but most aren’t worth the paper they’re printed on.

So, what is a bitcoin worth? Well, again, like anything, it’s worth with someone will pay you for it.

Is the supply of bitcoin limited?

According to blockchain.info, there are approximately 16.7 million bitcoins in circulation today. In theory, there can only be around 21 million total. Put into perspective, that’s just enough for almost everyone in Florida (or every other person in California) to have just one.

Since some coins will be and have been lost, one could argue that the supply is not only limited but will eventually shrink.

Obviously, supply if irrelevant without demand. The point is that the supply is limited. And for now, with bitcoin closing in on 10k, there is demand.

So, is bitcoin “legit”?

I think so. Technically, I guess we’ll have to wait 27 years total (until 2036, since bitcoin was created in 2009) to see if it beats the average fiat failure rate. Speaking of fiats, some (like John McAfee) argue that since there is a high cost to mine the bitcoins vs. running a printing press that they should not be lumped in with the fiat currencies.

Also, the fact that a real regulated exchange such as the Chicago Merc are creating contracts on them is a big validation. The skinny on bitcoin futures, by Carley Garner.

Should you invest in bitcoin?

First of all, (as often mentioned) I don’t believe that there are any good longer-term “investments.” The prices of everything goes up and goes down. All asset classes will lose at least half of their value at some point in your lifetime. You might want to write that down. Look no further than the stock market over the past 20 years.

Now, when I first started writing this piece I was going to propose that buying one bitcoin wouldn’t hurt--with a few caveats. Back then, the price of bitcoin was around $4000.

Here was my argument: Suppose you spend $100 a weekend playing golf, eating out, on boat gas, or some other frivolous (but possibly necessary for your sanity) activity. That comes to over $5000 per year. That’s $5000 that you’ll never see again.

True, all work and no play makes Jack a dull boy so you could argue that the money was well spent. And, it might encourage you to work harder so that you have even more money to spend. The point is, if you’re already spending--insert the current price of bitcoin (BTC)--per year on something that will not have any chance of a monetary return, then what’s the harm in buying one bitcoin?

Well, now that bitcoin is closing in on $11,000 and then dropped, it’s a little tougher to make the argument, but you get the idea.

Disclaimer and reminder: I am not a registered investment advisor. Caveat emptor. All information here is for educational and (hopefully sometimes) entertainment purpose only.

Should you trade bitcoin and other cryptos like litecoin and ethereum?

The quick answer is yes! With most cryptos trending nicely, they can make for wonderful trading vehicles.

Simple trend following techniques found right here at DaveLandry.com can work quite well. They always do in trending markets. Just don’t forget a heavy dose of money management. For instance, I'm a huge fan of creating free positions--taking partial profits and trailing a stop higher (see below).

Also, a little trading psychology wouldn’t hurt either--don’t get too caught up in the euphoria--if only there was a micro course just released here, hmmm. As I preach, trading done properly, is often boring. Therefore, these markets should be just as boring as any other markets that you trade.

Let’s take a look at my most recent trades:

1. Bitcoin is in a solid uptrend as evidenced by the big blue arrow.

2. The crypto pulls back in a trend knockout (TKO) type of fashion.

3. An entry is placed above the market and subsequently triggers.

4. A stop is placed taking into consideration the volatility of the instrument and the depth of the pullback.

5. Half of the position is sold for a swing trade, just in case, the longer-term trend does not ensue.

6. Via a trailing stop, I now have a free position, barring disaster. The game now is to see how long I can hold on. Take the Trading Full Circle Course (below) to learn more about all this.

The point is that technical analysis, especially simplified trend following, is alive and well here. There is one big problem. The “exchanges,” and I use that term loosely, aren’t regulated.

Ethereum went from over $300 to 10 cents in a flash on one exchange due to lack of controls to handle large orders (see the Week in Charts above).

And, technically, your cryptocurrencies are at risk as long as someone (e.g. the exchange) holds them for you online. Google Mt. Gox for a horror story here.

So, trade them but tread lightly until some sort of regulation/protection is instituted. Also, keep in mind that same thing that makes the cryptos work is the same thing that makes it impossible to “unwind” trades. Case and point: In the ethereum crash, the exchange paid off those who got screwed. It was hush money, not the unwinding of trades.

Is security a concern with bitcoin?

I believe that the blockchain is a solid thing with bitcoin and other cryptocurrencies. However, with anything in technology, hacking is always a concern. True, major exchanges and mining farms are being targeted but the far more easier target is you. It’s a heck of a lot harder to steal from an institution than it is to steal from you personally. Many hackers are working 24/7 to figure out ways to do just that.

So, again, as long as your money is on an exchange or online, it’s prone to attacks. I also wouldn’t keep more than a token amount on your smartphone. According to security expert (and colorful character!) John McAfee, that’s currently where the biggest vulnerability lies. McAffee’s a little paranoid and you should be too!

Is bitcoin a bubble?

The quick answer is probably. That’s okay though. Bubbles are very tradable. They usually go a lot further and last a lot longer than most believe. I love ‘em! Ride them as long as possible. Just make sure that you have a chair ready for when the music stops. Savvy traders can then also ride the fall lower.

I did come across an interesting infographic thanks to a link from David Keller, my friend and colleague from the American Association of Professional Technical Analysts. With Bill Gates being worth twice the value of bitcoin, it does help to put things into perspective.

In summary

Bitcoin is a legitimate currency--at least as legitimate as any other un-backed fiat currency like the ones in your pocket right now. Time will tell if it will fail, just like all fiat currencies have historically.

Like any other asset, it’s worth exactly what someone will pay you for it. Nothing more, nothing less.

If you invest then tread lightly, possibly no more than what you would normally fritter away on a frivolous activity.

Based on their current trending characteristics, the cryptos have proven to be wonderful trading vehicles. Treat and trade them like you would trade any other asset class. Beware that exchanges aren’t regulated and there have been a few horror stories here so far.

The blockchain is what makes bitcoin possible. It will revolutionize many businesses. We need to pay attention to opportunities here. The good news is that the charts will lead the way with both the cryptos and blockchain opportunities.

May the trend be with you!

Dave Landry’s Trading Full Circle course videos and newsletter here

Related series on trading bitcoin and cryptocurrencies on MoneyShow.com:

Getting your feet wet in cryptocurrency

How to trade cryptos safely

Do fundamentals drive bitcoin?

How to keep your cryptos safe

See the CFTC Primer on Virtual Currencies.