Most people don’t yet understand the balance bar. Simply put, it’s a square out bar that influences the action of many bars into the future. The bar forms a balance line which becomes support/resistance, says Jeff Greenblatt, editor of The Fibonacci Forecaster.

Last week I mentioned all of the conditions in financial markets, I was cutting through the clutter to watch one situation above all others. This is the balance bar in the Dow.

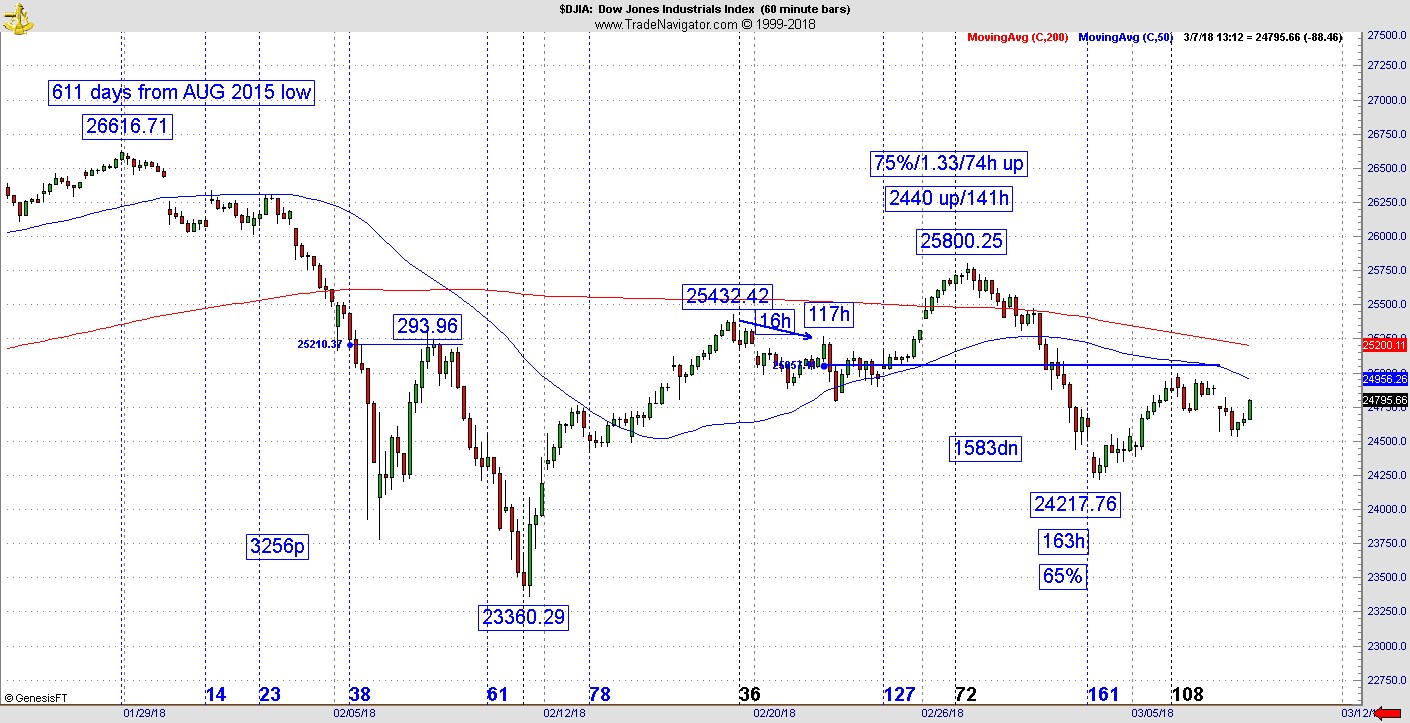

At this time a week ago markets started selling, tried to find a bottom on Thursday but did so on Friday. There were several conditions for the low, one of which is several charts were in the 161 hour window to the top back in January.

Briefly, we now have a busy Dow chart which is in a developing trading range. The recent high on Feb. 27 turned after a range of 2440 at 141 hours from the top. The low on Friday came in at 163 hours on a 65% retracement to the bottom.

But before we get to the balance line, do you realize we are dealing with a market that is setting new highs and lows at the same time? For instance, the PHLX Semiconductor Sector (SOX) hit several new highs this week while at the same time biotech names like Celgene (CELG) and Biogen (BIIB) have trouble lifting off the bottom. At the same time Canadian National Railway (CNI) continues to make fresh lows. Most of the market is somewhere in the middle, which is why we must pay so much attention to the Dow.

The market apparently does not like Trump’s stance on tariffs. Since he mentioned it I’m taking a wait and see approach. Both sides of the discussion have massaged the statistics to fit their view.

Obviously, anyone who has ever taken economics 101 realizes tariffs and trade wars are not the way to go. Last week the new Fed chairman Powell said there will be multiple rate hikes this year. There wasn’t much for the market to like.

But this is March and one of the most important market cycle points of the year. We are two weeks away from the Gann master timing date which comes on the seasonal change point ending winter. Markets tend to calibrate cycles to that date as Gann taught 100 years ago.

This time, Powell’s first big meeting comes right on the seasonal change point/Gann timing window. At the very least, markets don’t go straight up or down, they tend to change direction on or very near any seasonal change point. This is what we have to look forward to.

Right now, the bond market remains elevated off a low as the crowd digests if they’ll get some relief from higher rates going into the next quarter. With the next snowstorm hitting the east, I saw some headlines suggesting this could be a very weak quarter for new home sales. Markets are likely to get over the weather, higher rates not so much.

Getting back to that balance line which represents the big square out on the Dow, the pattern has yet to test it although it is close. The pattern has not strayed far from it over the past two weeks.

Those who follow the William O'Neil methodology of cups and handles should appreciate the following. If we are to get another sustained leg higher, the market likely needs to consolidate near the line and hold it before shooting higher. From my experience balance bars are likely to be tested. The cup may be forming now, we still need that handle.

Near the close the Dow Jones Industrials (DJI) was significantly off the low and it appears we will get that test of the line.