As this bitcoin rally is so far holding, we’ve seen quite a few more coins begin to setup bullishly, including some of our favorites binance, steemit, and bitshares, writes Ryan Wilday of Ellliott Wave Trader.

In last week’s article,The Crypto Market Condundrum, I noted that the larger wave patterns of many cryptos indicate a fork in the road — either to lower lows, or the beginning of a new rally.

Bitcoin (BTCUSD), which has continued to hold over the February 6 lows, has traced out a corrective structure, as have some of our other large caps. Thus, they predict lower lows, to bull market support levels. Yet many of our favorite small-cap coins have crashed directly through those February lows, to areas of support that threaten a continued bull market. I proposed a few patterns that can resolve the dichotomy.

Indeed, this is a critical point in the crypto market.

However, while we have seen a continued grind up from recent lows, we haven’t seen enough action in the last week to answer the questions about the long-term pattern. However, as I’ve stated many times over the last few months, I’ll be looking higher this year as long as $3000–$3500 holds in bitcoin.

Given the long-term questions, we’ve been trading short-term in bitcoin over the last week, in our Elliott Wave Trader trading room. We’ll keep the trading short-term for as long as intermediate timeframes leave questions. And we’ll hold our long-term positions as long as bull market support holds.

Since I cannot add more clarity on last week’s charts, I thought I’d turn to a few other cryptos we’re watching, that have started to set up bullishly over the last week.

Binance coin

Binance is a favorite in our trading room. Binance (BNB) sold the coin to raise development funds and in return provided holders with a discount on trading commission.

While it has pushed through the February 6 low, it has held wave (iv) support on my long-term count. It then traced out a potentially bullish pattern off our recent lows on March 18.

While the pattern can defined as an ABC, as opposed to the bullish 1–2–3 as defined by its wave proportions, it has started to take out key resistance. This resistance is like a wall challenging further price gains.

When I see a three-wave pattern that takes out resistance, I start to look for a diagonal, defined by five waves with each an ABC sub-structure. Diagonals are very choppy structures. Yet, after this diagonal completes, we expect a return to an impulsive structure.

Provided there is a follow through on our pattern, our expected target when complete lies above $100 later in the year. This provides a nice price gain from the current $13 region.

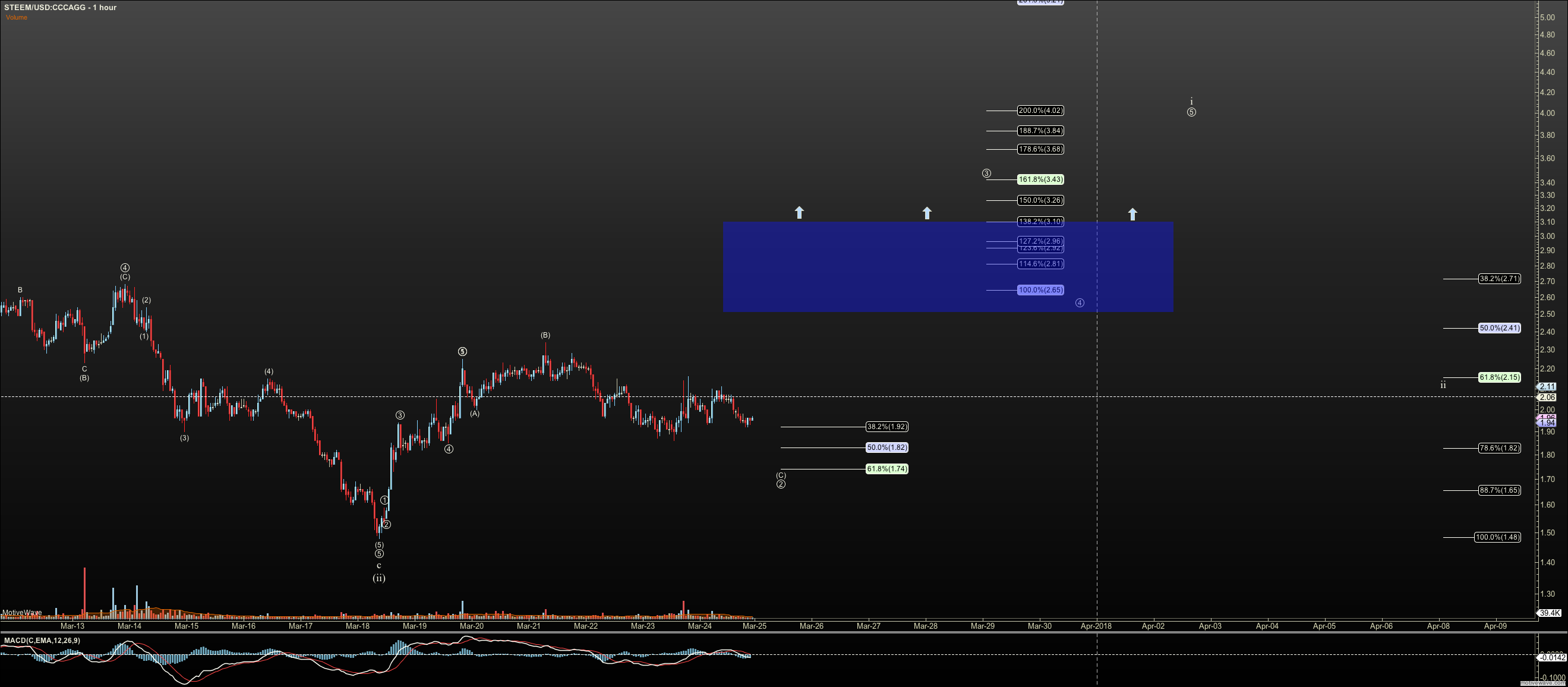

STEEM

We closely watch the coin of the social media site Steemit (STEEM) and have traded it since mid-2017. The symbol is STEEM.

We see the larger five-wave pattern either in a primary wave 2, potentially in only A of that 2, or in a more progressed 1–2, i-ii. Both patterns have targets that exceed $150 but differ slightly over the next few months.

Clarity on which pattern is correct will depend on whether it moves impulsively off the recent lows. So far it has made little progress, leading to little clarity.

What we do have is a smaller degree 1–2 setting up off recent lows on March 18.

Yet, due to the potential of our March 18 low being an A wave of a larger decline, we need to see if this pattern stops at three waves. We need to see STEEM rally over the $3.20 level to lower the probability of lower lows, and to make it likely that we see a rally over $4 and beyond. See attached chart.

Bitshares

Whereas 2017 was the year of strong moves in platform coins like ethereum (ETHUSD), my analysis of the market suggests that 2018 (and 2019) will be the year of decentralized exchanges. Bitshares is one of those exchanges and its coin, bitshares (BTS), is the main currency on the exchange. I have a long-term target exceeding $80.

The recent lows on March 18 have reversed and formed a bullish 1–2 setup, as shown. Provided the higher low at 14 cents holds and we see a follow through to 18 cents, we’ll have a signal that a larger rally has begun. Ideally, any retrace from 18 cents remains corrective and holds 13 cents.

Conclusion

The current action off the March 18 lows has not given us clarity on the larger degree path in this bull market, nor whether bitcoin is signaling that small-cap coins will break long-term bullish support. However, as this rally is so far holding, we’ve seen quite a few more coins begin to setup bullishly, including some of our favorites highlighted above.

Subscribe to Elliott Wave Trader here

More recent cryptocurrency commentary on MoneyShow.com

The CFTC and virtual currencies

The risks and rewards of trading cryptocurrencies

Trading Lesson: Decrypting the cryptic cryptos

Trading Lesson: Decrypting the cryptic cryptos: Many questions, few answers

As regulators come for crypto criminals, invest in what is real