Trade idea: I’m getting more cautious – and I think you should, too. You don’t have to sell everything. Consider paring equity exposure somewhat or hedging against downside risk using put options or inverse ETFs, writes Mike Larson, senior analyst at Weiss Ratings.

You know what worries me more than anything? When I see market action that doesn’t “make sense” on the surface. Consider the following ...

* An esoteric, obscure interest rate market “risk” indicator, called the LIBOR-OIS spread, has been going nuts to the upside lately. In fact, it just soared to the highest level since the tail end of the last financial crisis in 2009.

Some of the smartest minds on Wall Street have been trying to explain why it’s happening. But none of the explanations have proven satisfying. Meanwhile, the rise has continued virtually nonstop.

* On Tuesday, the Dow Industrials (DJI) soared more than 500 points on an intraday basis. But Treasury bond prices barely dipped, gold rallied a few bucks, and the CBOE S&P Volatility Index (VIX) measure of market volatility has essentially unchanged. Huh? You’d expect bonds, gold, and volatility to plunge on that kind of stock rally – but it didn’t happen.

* Then on Wednesday, gold prices exploded by as much as $21 an ounce. That put gold within a whisker of breaking out from a five-year trading range. Treasury bond prices rallied again, driving the 30-year yield ever closer to an extremely important downside level of 2.65%. Yet measures of stock volatility failed to surge as high as they should have, given these other “Risk Off” market indicators.

Look, we all have plenty of “real world” things to worry about. That includes the renewed threat of hostilities in Syria, ongoing political dysfunction in Washington, the potential for a trade war with China, and more.

But as an investor, you shouldn’t just pay attention to the news and the headlines. What’s more important is how markets react to them. And right now, I’m seeing downright weird (for lack of a better word) market action all over the place.

When that happens, you know what I do? I get more cautious – and I think you should, too.

You don’t have to sell everything. But consider paring your equity exposure somewhat or hedging against downside risk using put options or inverse ETFs.

Don’t know where to get started? Well, here’s a list of inverse ETFs from the provider ProShares that I pulled together using the information in our vast Weiss Ratings database. It’s sorted in descending order by three-month total return and doesn’t include any ETFs with less than $100 million in assets.

Data Date: April 11, 2018

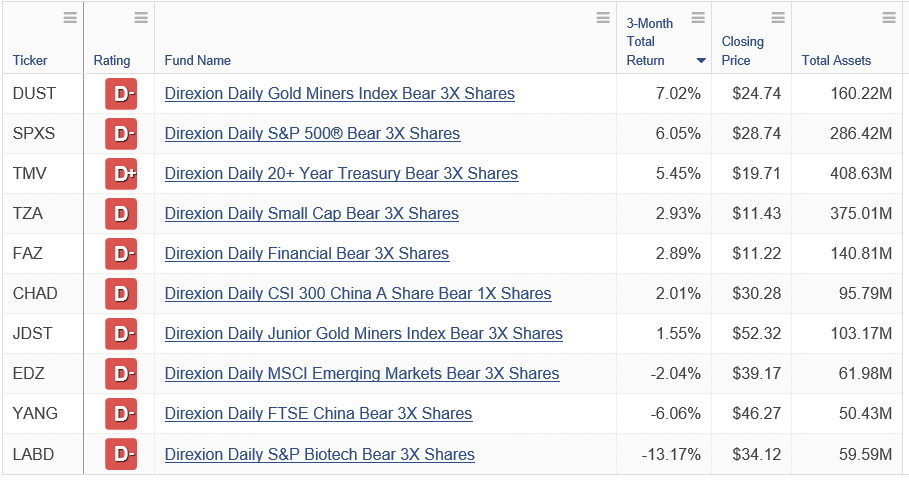

Meanwhile, here’s a list of the best-performing inverse ETFs from the provider Direxion. I used a lower cutoff of $50 million in assets here since some of that company’s funds are smaller.

Data Date: April 11, 2018

I’m not saying you should run out and buy all of these funds today. But you should familiarize yourself with them, especially if the broad trend is shifting from a nine-year bull market to the start of a bear one, as I’m increasingly inclined to believe. Consider adding them on market rallies when prices are better in order to get positioned for the next leg down.

Some other things to keep in mind: The ProShares ETFs are a mix of leveraged and unleveraged ETFs, while the Direxion ETFs are almost all leveraged – by as much as 3X. That means the tracking error, or difference between what the underlying index or sector is doing and how the ETF is performing, will get worse the longer you hold them.

You, therefore, need to keep a tight leash on 2X and 3X ETFs, trading them with shorter time periods rather than holding them for months or years.

You’ll also notice that these ETFs feature low grades from our Weiss Ratings system. That’s no surprise. We’ve been in a nine-year bull market, and that action has been devastating to the performance of inverse ETFs. BUT if the trend is changing, you can bet the performance will too, and our Ratings will pick up on that over time.

Bottom line: Don’t ignore “weird” trading action. Recognize it and adapt to it – before it threatens the value of your portfolio!

Until next time,

Mike Larson

Check out Mike’s short video interview at MoneyShow Orlando: How to Find Dividend Stocks here.

Duration: 2:26

Recorded: Feb. 9, 2018.

Follow Mike Larson and subscribe to Weiss Ratings products here.

Follow Mike on Twitter at @RealMikeLarson