You’re either waiting for setups or waiting for positions to do something. Waiting is tough, but patience is key. If you are getting ready to take unnecessary action, just breathe or “wind the clock,” writes Dave Landry. More Trading Lessons Fridays on MoneyShow.com.

A while back, former multi-billion-dollar money manager Greg Morris met the gang at The TradersEXPO in New York for food and drinks to celebrate his birthday. After the obligatory jokes-which are best described as 8th grade humor, at best, are out the way, the conversation often turns toward the markets or aviation and in this case, both.

To those of you who don’t know Greg, in addition to running billions, here are a few highlights: he was previously the “Morris” part of MurphyMorris.com (John Murphy was the “Murphy” part, the site is now StockCharts.com), a fighter pilot (Top Gun btw) and a commercial airline pilot. Sounds like someone who can’t hold a job! (his joke).

Anyway, I asked Greg if the items that made the flight checklist were put there by someone forgetting that item. And yes, he confirmed, for instance, that the reason putting the landing gear down is on the list when landing is because someone forgot to do that. This got me thinking about a checklist for traders. Let’s explore this further.

Pre-trade checklist

You’re much more likely to make an emotionally charged decision during the heat of battle. That’s because stress is at its highest when information is changing or uncertain. Now, the only time that information is static is after the close. Therefore, you must plan while you’re in this relaxed state. I like to grab a big cup of coffee and go on my treasure hunt of sifting through thousands of charts looking for my next big winner.

Planning the trade checklist

Ask yourself....

- Does the stock tend to trade cleanly and not like an electrocardiogram?

- Is the stock in an obvious trend or an obvious emerging trend?

- Are there any big picture patterns—say a major double bottom or recent huge base that might suggest a bigger move could be in the works?

- Is there “clear air” above? (i.e., no overhead supply) Remember, if there a significant amount of trading above where you enter, those who bought in that area will likely be looking to bail out at breakeven. It’s human nature.

- Does the setup meet all criteria for the setup? For instance, for a Trend Knockout (TKO) the knockout move must be a meaningful wide range bar down—enough to have likely shaken out some nervous nellies and attracted some egotistical shorts. Persistent Pullbacks must pullback after a persistent trend (I know, “duh” implied, but you’d be surprised how many people send me charts that have no trend whatsoever.)

If the stock does pass muster....

- Is the representative sector also trending?

- Are stocks within the sector also trending? Sometimes a few big cap issues can cause an aberration in the overall sector. Therefore, the more supporting evidence, the better.

- Have you gone through all the tradable stocks within the sector to see if there are any sexy sisters? Sometimes, a good setup might lead you to a great setup.

- Is the overall market headed in the intended direction and if not, do you think you have either a) the mother-of-all setups or b) a stock that can trade contra to the market (e.g. occasionally a commodity stock or a speculative IPO)?

- Have you weighed all of the above with the potential choice of not taking any new action?

Ready, set, action?

The only reason to ever trade is to make money—and never for action. Not putting capital into harm’s way should always be considered. Many times, I’ll spend hours doing research that produces absolutely nothing actionable. That’s okay. As an ex-sailboat racer, I’ve been caught in many nasty storms including a low-pressure system for 36 hours--and we were the smallest boat in the fleet! And, once around 400 miles off the coast of Bermuda, we nearly sank as the biggest boat in the fleet. Size didn’t matter in this case, especially since there wasn’t room for all of us in the life raft.

So, I can attest to the fact that “it’s better to be on the dock drinking beer wishing that you were out to sea than to be out to sea wishing you were on the dock.” As a pilot who has lost engines, I’m sure Greg can attest the same thing towards flying.

Now, it took me 14 hours to cover everything you need to know about stock selection, but if you just check off the above I can assure you that you’re well on your way. Come to a few chart shows and ask about your candidates.

So, you have decided that you have a worthy candidate...

Plan your trade checklist

- Do you know where exactly you will get in (your entry price)? And, is that entry far enough away from the closing price so that you're not triggered by a false move (e.g., market manipulation-yes, it happens)?

- Do you know exactly where you will place your initial protective stop? And, is that stop outside of the normal volatility so you won’t get stopped out on noise alone. Is it also at a level where you will obviously be wrong as a trend follower?

- Do you know how you will trail your protective stop before the initial profit target is hit (usually roughly 1-for-1).

- Have you mapped out a general plan for after the initial profit target is hit? (e.g., allow it to gradually widen to make the transition to longer-term trader).

During the trade checklist

At dinner, Greg asked me about my plans for the following day. I told him that I was speaking for four-hours. He then made the uptrend and downtrend motions with his arms and said, “How are you going to speak about that for four hours?” My reply was--motioning my arm horizontally--“Well, there’s also sideways!” I went on to say that in addition to trends I was going to cover setups and money management. Further, I was going to cover trading psychology—for instance, things like how sometimes, all it takes is a few seconds pause from a physiological standpoint to bypass the emotional part of your brain (the amygdala). He replied: “Wind the clock,” a reference from his excellent book (which doubles as a doorstop-his joke) “Investing With The Trend.”

Due to the potential to make emotionally-charged decisions, we have to keep calm and follow the plan. In the aforementioned book, Greg said, “The absolute worst time to create or change a rule is when you are emotionally concerned about something that just seems to not be working correctly.”

He gave the example of F-4 Phantom jet simulations back in the 1970s. When faced with an emergency situation such as loss of oil pressure or an engine failure, many pilots, including himself, would flip the wrong switch or pull the wrong lever “during the emotional surge that comes with bright flashing lights and loud horns.”

His solution for not repeating these mistakes became simple: Wind the clock (back then there were analog instruments). The few seconds it took to wind the clock helped to “rid yourself of the adrenaline rush” and led to clearer thinking.

Like all seasoned pilots, Greg has had a few “wind the clock” moments. He gave the example of once losing an engine. The co-pilot immediately wanted to shut the engine down. Greg, said no!, and after metaphorically winding the (now digital) clock, said to leave it on for now because you risk the chance of shutting down the good engine. He landed the plane, and no one was the wiser. Fortunately, for Greg, and those flying along with him, “he’s never put a scratch in an airplane.”

Don’t wake the panic monster

You have a little “panic monster” (aka the amygdala) inside your head. As I often say, the best way to avoid making emotionally charged decisions is to “tiptoe past the panic monster” to avoid waking him. Here’s a little exercise for you. The next time you want to make an instant quip back at your spouse or significant other, just breathe! (Or wind your watch.) You’d be surprised at how often that will keep you out of trouble. You’re welcome! Now, applied to trading, just breathe.

The only five things that you should be doing

If you’re following my swing-to-intermediate-term (and hopefully much longer!) approach, there are only five things that you should ever be doing:

Do nothing unless the market is doing one of the above 4 things

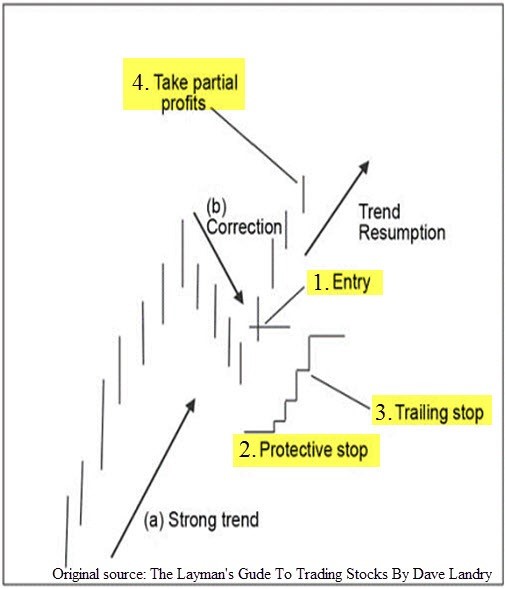

- Did the stock trigger an entry and if so, did you enter? (1)

- Did you place a protective stop once triggered? (2)

- Did the stock move in your favor (on a closing basis) and if so, did you trail your stop higher? (3)

- Did the stock hit your initial profit target and if so, did you take partial profits (half)? (4)

- If there's not one of the 4 things above to do, are you doing nothing?

Now, if your more disciplined, there might be occasions—not every day—where exercising a little discretion (e.g., surviving a stop nick by giving the position a small amount of wiggle room, taking partial profits on a close enough near miss, etc..), in the above can greatly improve performance.

The waiting is the hardest part

Tom Petty got it right. The waiting is the hardest part. You’re a person of action—and seriously, if you weren’t you wouldn’t be working to improve yourself by reading this prose. And, as a person of action, waiting can be tough. You’re either waiting for setups or waiting for positions to do something. Waiting is tough, but patience is key. Again, if you are getting ready to take unnecessary action just breathe or “wind the clock.”

I’m a big fan of symbolism. I have a “Sardine” Drive street sign proudly displayed over the door of my office. It serves as a constant reminder that I must believe in what I see and not in what I believe. And, it reminds me that I’m here to trade, not to interject logic, reasoning, or emotions into my trades. See this Random Thoughts for more on “trading sardines.”

Anyway, inspired by Greg, I now keep a vintage aircraft clock on my desk (scored on eBay). I literally wind the clock before clicking “confirm order.” As silly as this sounds, this has helped my trading. Case and point: While writing this original column-before the clock arrived-I “fat fingered” an order. I’m sure that if I would have taken a few seconds to confirm I would have realized my mistake.

Checklist after the trade

After the dust settles is a good time for reflection. Do an honest post-mortem and ask yourself:

- Did you really pick the best and leave the rest? Circle back to the pre-trade checklist. Yes, it’s in perfect hindsight, but at least you’ll be thinking clearer.

You’ll find that sometimes you’ll think “what the hell was I thinking?” That’s okay. That’s part of the positive feedback cycle. With time, you’ll find yourself asking that question less and less-one of the few things that I can guarantee.

Remember, “outcomes are noisy.” Bad trades can make money and great trades can lose money. Think like world-class professional bridge player Richard Zeckhauser who scores himself based not so much on whether he won the hand, but rather how well he played it.

Good traders are no different. They recognize proper procedure regardless of the outcome. You might want to write that down.

- Did you truly plan your trade ahead of time?

- Did you follow the plan?

Again, as a person of action it’s hard not to do something when there’s nothing to do.

Micromanagement is one of the biggest sins I see. And trust me, I’m not immune to the Siren call. We’re wired to avoid pain at all costs. It’s tough to see a position head toward the stop and just watch it.

On the flip side, it’s tough not to be tempted to mentally monetize gains and lock them in before they evaporate, especially if you’re coming off a string of losses. I think Mr. Lambert got it half right—doing nothing is much harder than it looks.

In summary, we’re human and prone to make emotionally charged mistakes. Therefore, take a breath, wind the clock, and check your checklist. That might be all you need to keep you from winging it.

May the trend be with you!

Dave Landry’s Trading Full Circle course videos and newsletter here