For the United States, July 4th is the iconic symbol of national independence as it commemorates the signing of the Declaration of Independence in 1776, writes Nell Sloane Tuesday.

Despite being voted and signed on two days prior, we celebrate it on the 4th, maybe because that’s when the documents’ actual wording was approved.

Anyway, speaking of wording, it seems as if the Preamble has been thrust to the forefront with the election of one Donald John Trump. We highlight this part of the Preamble as being most relevant in describing the new administration from those prior,

“That to secure these rights, Governments are instituted among Men, deriving their just powers from the consent of the governed, That whenever any Form of Government becomes destructive of these ends, it is the Right of the People to alter or to abolish it, and to institute new Government, laying its foundation on such principles and organizing its powers in such form, as to them shall seem most likely to effect their Safety and Happiness.”

Happy 4th of July everyone and what we have seemingly been accustomed to by now, is the fact that holidays that come mid- week seem to wipe out the whole week in terms of productivity.

**

For those who haven’t heard of “Q” or Qanon, we highly suggest you research it.

This movement that has been ongoing behind the scenes is formidable and has gained a huge following not just here, but globally. Many mainstream publications have come out denouncing, discrediting and mounting a clear disdain for any such conspiracies, but we know better.

We know that there is always truth to something, especially something this large. We only mention this because it does affect business, it does affect markets and in life, knowledge is the true freedom. So, let’s just say, we want you to know so you aren’t surprised.

If you want to know more about it, @Prayingmedic on Twitter is a good place to start. We will leave it at that.

**

More than Facebook admitted: In other news, we thought it interesting that Facebook’s submittal to congressional hearings follow up questions, some 2000 or so, exposed the fact that it continued to share data even after they admitted to such.

Facebook (FB) continued to share data with 61 hardware and software makers as well as app developers even after the 2015 admission of sharing data and after they had said it cut off third party access. (thehackernews.com)

Coverage: Facebook discloses it has shared data with other companies.

**

The financial markets continue to exhibit worry about Fed rate hikes, yield curve flattening and of course impending trade wars via tariffs.

**

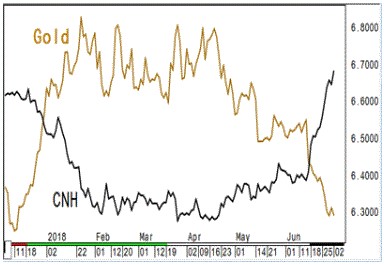

Week yuan: Speaking of trade wars, let’s take a look at the Chinese yuan (CNH) shall we, as you can see, its been weakening ever since things began to heat up: (chart courtesy of CQGXX)

We know the Chinese are in a mad scramble to try and de-dollarize but we tend to think those efforts are fleeting and we don’t think this is what they had in mind when converting into gold, as you can see both the yuan and gold losing ground, aka double whammy.

**

Who says you can’t win a trade war. Most don’t realize but the U.S. is in a very formidable position right now globally. Many disagree with this notion, but we tend to think that Trump will never negotiate from a position of weakness, Many don’t know but his uncle John, in which he is named for by middle name, was president of MIT.

Word is his uncle also possessed all of the great Nikolai Tesla’s files, God only knows how much data was extracted from that vast and profound knowledge base.

**

Crude performance: Has anyone thought why the hell has crude oil performed so well? How much is America now producing? How much do we sell? The U.S. sells nearly 10.6 million barrels per day, second only to Saudi Arabia, so where is the petro dollar and weak dollar correlation again?

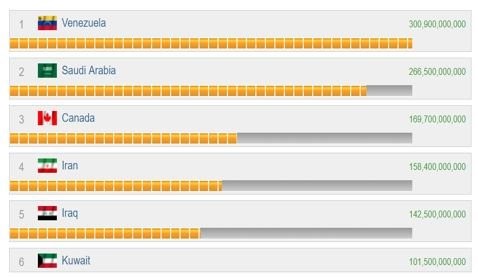

Anyway, through our research and what we thought was strange is that Venezuela has by far the largest oil reserves in the world, nearly 14% more than Saudi Arabia.

Maybe this is why the country is so destabilized. How the hell can a country like this with all this wealth, be so maligned, so malfunctioned and mismanaged?

Considering it is a federalist set up on the forefront, but dictator presidential rule on the backside, maybe this has something to do with it. Maybe they should just link their currency to oil through the blockchain and then will the realize their power…just saying.

**

Speaking of oil, here is a chart from Keystone charts once again, pointing out the strength of oil even versus that mighty S&P 500 (SPX). You can see the target resistance line, we are getting close, so perhaps some profit taking will hit the sector given such a locale.

**

Moving back onto the China-U.S. theme, when we look at the Shanghai Composite, we can’t help but think the S&P 500 will play catch down here as this entire year, the Shanghai Composite has underpaced the SPX and the divergence has grown quite wide over the last month:

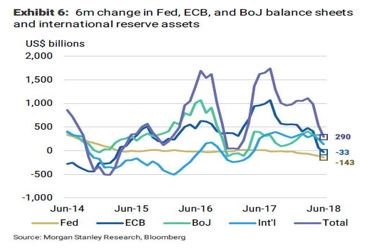

Then again, we all know there is a willing and able PBOC, BOJ or ECB to back stop any formidable attempt to dump their wealth generating mechanism. In fact, all this talk of the U.S. tightening is just not valid in the larger central bank global scope of things. Here is a good chart showing how much tightening is not going on, perhaps on a relative basis but overall, we are still net QE $290 billion.

**

So where is all this QE going again? Well to a shrinking pie and of course PE and M&A. The WSJ ran a good article highlighting the fact that 2018 is on pace for record global deal volume.

OK, that’s it for this week,

We hope you enjoy some parades, some outdoor fun and some intriguing local conversation, we know we will. Cheers!

Cheers!

Nell

Subscribe to Nell Sloane's free Unique Insights and Crypto Corner newsletters here