As we talked a few letters back about the prospect for protectionism and tariffs turning into currency wars, which then have a tendency to turn into hot wars, it is largely apparent this week things have certainly escalated, writes Nell Sloane Monday.

The PBOC has decided to fight Trump and his tariffs with a little bit of devaluation. Now we know the PBOC doesn’t have much leeway in this arena as they will risk two very important things:

- A continued capital flight out of the country.

- Massive reserve loss from a decrease in accumulation due to lack of exports.

We need only go back to late 2015 to see this systemic loss of global growth via these trade wars.

Remember in the zero-sum game of trade, you can’t be both a net exporter and importer and thus, the easiest game to play is devalue one’s currency.

However, this is an absolute race to zero which will drag the global economies on a deflationary spiral. If China continues this path, it will certainly dampen the Federal Reserve’s hopes for its continued rate hiking path as this situation would most certainly cause them to pause or even change course as global growth sinks.

If that isn’t enough of a worry, this headline from RT News might be, “China must speed up development of nukes to deter US aggression.” – state media. Cold War 2.0?

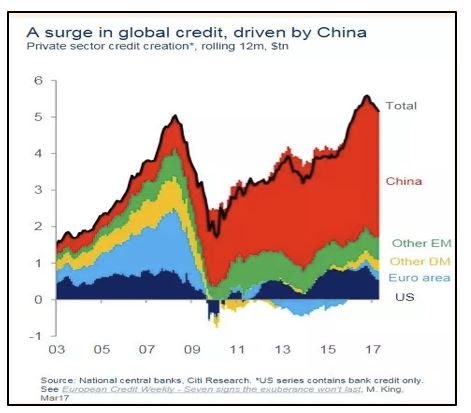

We aren’t sure how much room China has in terms of viable reserve accumulation, but we know one thing, the mountains of credit and debt it has created over the last decade is staggering.

Will China be able to handle a slowdown without destroying their credit markets? We highly doubt it and this chart paints and obvious painful picture should things deed take a turn for the worst:

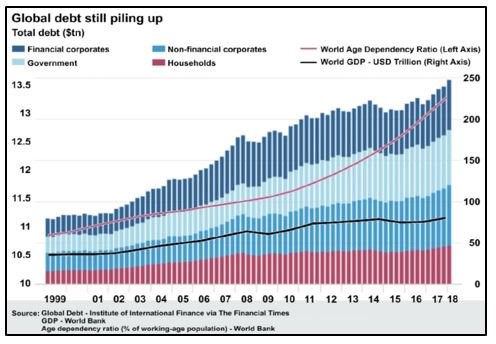

China isn’t alone in this massive debt and credit push as this next chart exhibits nicely:

The prior charts should make it quite obvious that the key to nominal price appreciation is indeed credit growth. Without it, well, we probably will never know!

**

A CEO on tariffs: We also had the pleasure this week to speak with a CEO of a multinational industrial parts supplier and he gave us his opinion on the effects of tariffs.

He said that the uncertainty that is being created upon future growth is strictly conveyed in the apprehension for capex spending and second, he told us that the rise in input costs across all channels isn’t helping margins as the ability for customers to absorb these extra costs is diminutive.

We couldn’t agree more but we feel this is just the beginning, unfortunately.

**

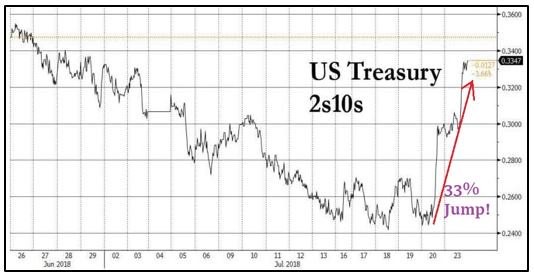

Moving along, we know the Fed has the tools to control the short rate but the long rate is susceptible to variable market forces. We also must note the risk that the Fed may be influenced by another central banks action, in particular the BOJ may decide to allow its 10-year JGB rate a wider trading band. If this does indeed seem to be the case, expect long-dated U.S. yields to rise and the curve to dramatically steepen, just in time to catch a lot of flatter curve players off sides.

In fact, here is a US 2y10y chart from today out of Zhedge:

Certainly not the move one is positioned for in a rate hiking environment, #Pain.

**

Here are a couple more charts which we believe capture the essence of a global protectionist measure, Lumber and Copper:

Copper did rebound a bit on Friday, but you get the picture!

**

Moving over the equity land, Alphabet/Google (GOOGL) was fined $5 billion by the EU under antitrust provisions.(WSJ)

**

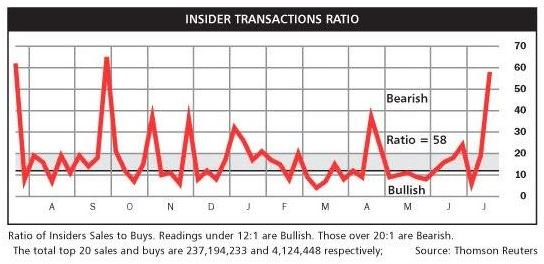

Cashing out after buybacks: We also saw a WSJ report on analysis from Robert J. Jackson Jr. a commissioner at the SEC regarding C-suite insiders capitalizing on their equity buyback plans. “The SEC gives an exemption from market-manipulation rules to companies doing a buyback,” Jackson said in an interview. “The SEC shouldn’t be making it easier for executives to use them to cash out.”

Jackson, a former law professor, examined stock trades at 385 companies that announced buybacks in 2017 through this year’s first quarter. He found the percentage of insiders selling shares more than doubled immediately following their companies’ buyback announcements as many of the stocks popped. (WSJ)

Dare we ask who Jackson thinks the SEC actually works for?

**

WSJ reporting that the U.S. Equity trading volumes have plummeted this month, falling to their lowest levels this year on Friday. The S&P 500 (SPX) hasn’t had a 1% move up or down this entire month, let’s chalk it up to vacationers shall we.

The S&P 500 Volatility Index (VIX) continues to fall as the market rebounds from the tariff and currency wars.

**

Microsoft effect: Also buoying the markets were earnings out of Microsoft (MSFT) which rose to $108 an all-time high on Friday on revenues of $30.1 billion.

Monday, Alphabet (GOOGL) reported $3.2 billion in net income last quarter even after accounting for the mega EU fine. Shares as of this writing were trading as high as $1250 pushing it ever closer to the $900 billion market cap.

However, not to dampen all the good news, this chart from Reuters sends a different connotation of the breadth in equity prices rising:

Not that Tesla (TSLA) needs any more negative coverage, it was reported this week that they hit up a few suppliers to “refund a portion of what the electric car company has spent previously.”

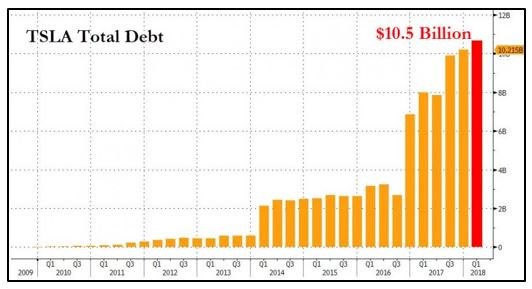

We aren’t even sure how the accounting for that would go, but we are sure that this wreaks of a liquidity crunch. With this chart of Tesla’s total debt, we can see why Unicorn Musk is so worried, although we think it’s the bond holder that should be worried:

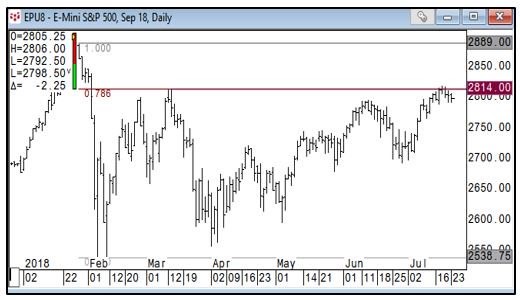

Moving now to the equity technical futures charts courtesy of Keystone Charts Inc, first up the S&P 500 futures which continues to magnet the 2814 level and a level that needs a decisive close above to get bulls back reengaged for that next push higher:

As far as the SPX, it’s trading slightly above its resistance level and has tilted in the bull’s favor, for now, but a close back below negates this move.

**

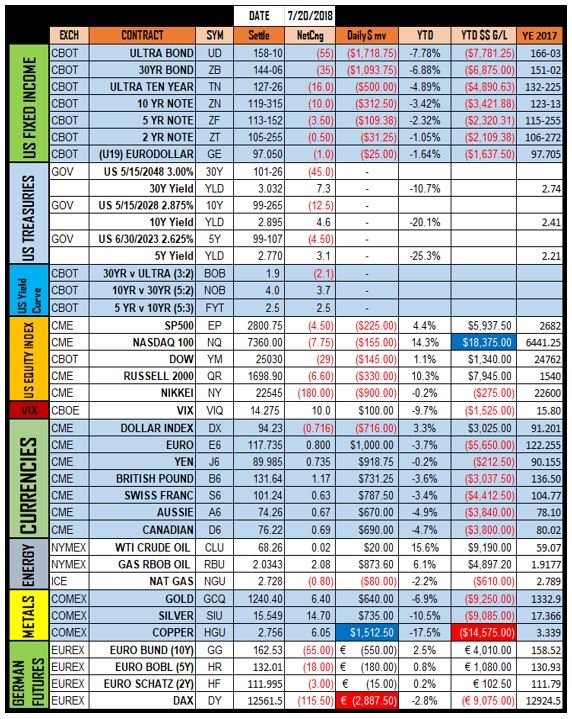

Here are our futures settlement sheet from Friday, July 20.:

Cheers!

Nell

Subscribe to Nell Sloane's free Unique Insights and CryptoCorner newsletters here