I am mostly long this market purely because stocks continue to climb. I don’t trust it but it doesn’t keep me up at night--yet. Because I don’t understand it, I’m still trading in small lots, still hedged. Still eyeing that exit door, writes Dr. Joe Duarte Sunday.

The late Tom Petty in his album rock hit “The Great Wide Open” once crooned; “into the great wide open, under them skies of blue, out in the great wide open, a rebel without a clue.”

The song was about a guy named Eddie with a high school diploma that went to Hollywood, met a girl with a tattoo, got himself a tattoo and a roadie named Bart, made an album and struck it big. He went to parties and hobnobbed with movie stars.

“The sky was the limit,” until the record company rep in charge of his career let Eddie know “I don’t hear a single.”

In the music business that means no song from the album will get on the radio. BOOM!

Last week, in this space, I noted the robot fueled stock market was at a crucial decision point and that Turkey was the focus. More specifically, I asked a simple question: “what if Turkey doesn’t matter?”

Joe Duarte: Get ready for the Meatloaf Market. What's it gonna be boy?

Well, given the volatile trading week which ended on an up note, I’d say that the bots don’t really care that much about Turkey or anything else at least for now. “The sky was the limit.”

Of course, since the robots move the market based on every single headline, what we think we know now, may be meaningless in the next five minutes as someone with some sort of influence does something that trips the algos – “into the great wide open.”

Still, for traders, there is only one truth, price action – “under them skies of blue.” Thus, anyone who thinks beyond price in the current market has likely been hitting the Tums quite a bit in the last 19 months – “I don’t hear a single.”

Consequently, the only profitable course at the moment is to trade prudently but to stay long because what used to work is not what’s working at the moment – “into the great wide open.”

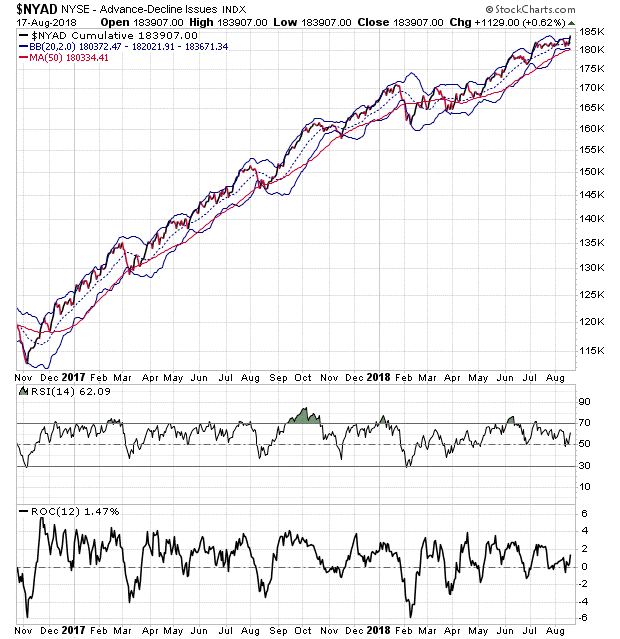

Another new high for the market’s breadth confirms uptrend

Turkey’s currency crisis was supposed to be the death knell for the bull market in U.S. stocks, but instead we got yet another new high in the New York Stock Exchange Advance Decline line (NYAD).

Given the fact that the NYAD has been ridiculously accurate as a predictor of the market’s general trend, it seems foolish to go against it for now. Thus, until proven otherwise, we seem to be headed for yet another up leg in the markets.

Mixed picture for indexes

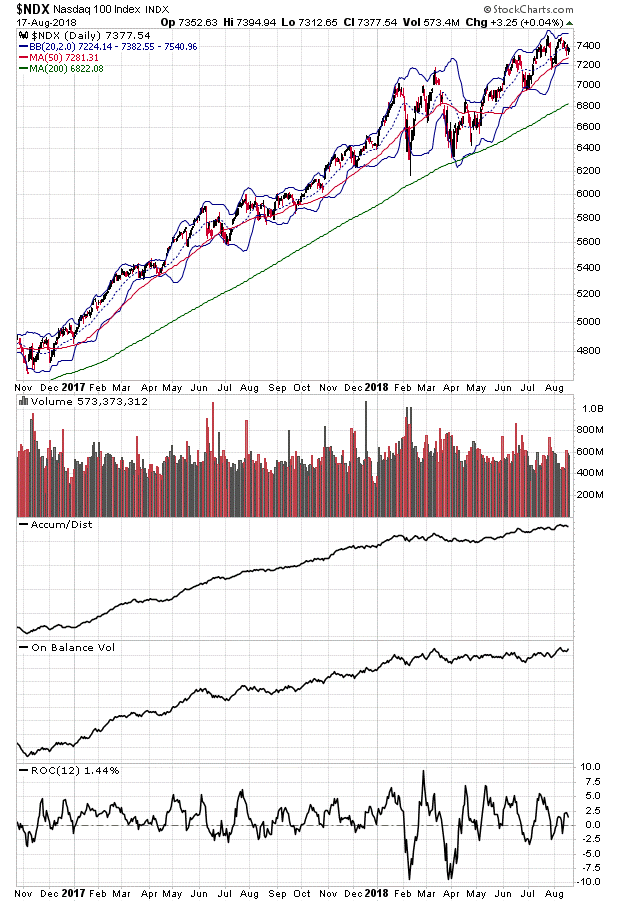

The NYAD is pointing to higher prices for stocks in the intermediate term. But under the hood, this market is starting to be a selective affair. Perhaps the Achilles heel for this market is technology. I would watch two things.

First, Tesla (TSLA) and the general trend of the Nasdaq 100 Index (NDX), since it is heavily influenced by the action in Tesla, Alphabet (GOOGL), Netflix (NFLX), Apple (AAPL) and Amazon.com (AMZN).

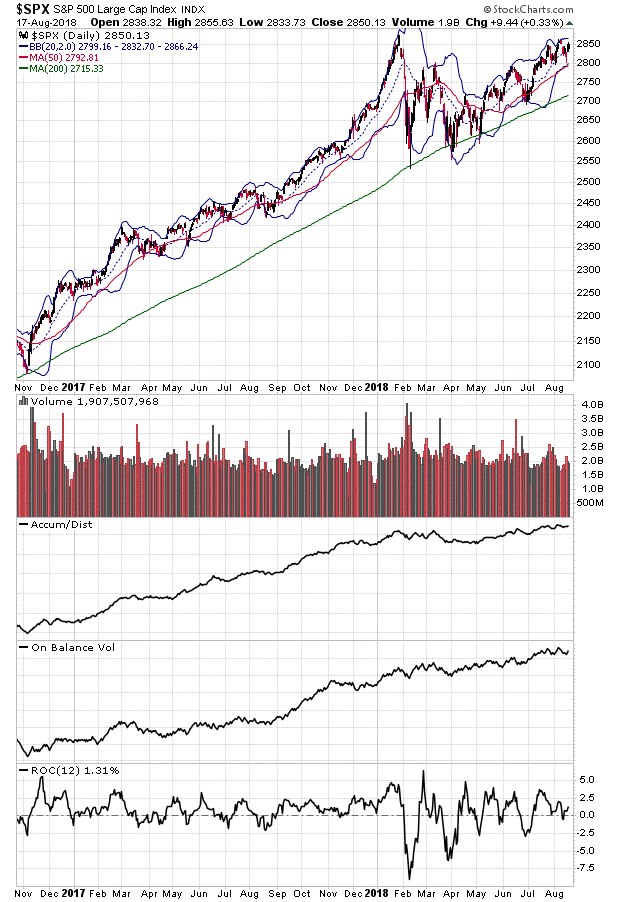

Consider the Nasdaq 100 chart which failed to end the trading week on a convincing up note, especially compared to the S&P 500 (SPX) which moved steadily higher on strength from the health care stocks.

The key remains volume, which remains in what seems to be a set pattern where down days have higher volume than that which we see on up days. The net result is generally flat Accumulation Distribution (ADI) and On Balance Volume (OBV).

What is this history you speak of?

Bull markets climb walls of worry. And this wall of worry is fueled by the crisis du jour where every dip gets bought. So it seems that history continues to be rewritten as what was once considered a potential global financial crisis, whether it is Turkey, Venezuela, Italy, China, or wherever else there is a potential situation, it’s currently just another blip in the digital stream of consciousness of the increasingly influential algo fueled market.

So nothing’s changed over the last 19 months. I am mostly long this market – such as it is – purely because stocks continue to climb. I don’t trust it but it doesn’t keep me up at night – yet. But because I don’t understand it, I’m still trading in small lots. I’m still hedged. And I’m still eyeing that exit door. And if that’s the way it’s got to be for the next five years, that’s the way I’ll do it, all the way to the bank.

“Into the great wide open – a market without a clue.”

Joe Duarte is an active trader and author of Trading Options for Dummies, now in its third edition and The Everything Investing in your 20s and 30s. To receive Joe’s exclusive stock, option, and ETF recommendations, including trade results, visit www.joeduarteinthemoneyoptions.com.