There’s money moving into other areas of the market, such as the agricultural sector where I’ve recently recommended Tyson Foods (TSN), Archer Daniels Midland (ADM) and Hormel Inc. (HRL), three stocks that held nicely during last week’s tech wreck, says Dr. Joe Duarte.

Weeks such as the one which ended on Sept. 7 can make any investor jittery. But in this day and age, weird is the new normal. So, until proven otherwise, we are still in a bull market and the long-term trend for stocks remains up.

With so many bears pounding the table, it’s difficult to conceive that we’ve seen the final high in this bull market. Sure, this is the longest bull-run in history and has been in place since 2009. And yes, there is plenty to worry about.

We’re all familiar with the litany of negatives: the Fed, trade wars, imploding emerging markets, rising tensions in the Middle East and the outrageous Washington politics of the moment just in time for what may be the most important mid-term election of the last 100 years.

As a result, if there was ever a time for a bear market, this would be it. But, even despite last week’s tech wreck, the market is still closer to a new high than to its 200-day moving average, the line that divides bull and bear markets.

Yes, all good things come to an end. And yes, we may be in the early stages of what could be a very meaningful market correction – even a bear market if things get bad enough. But here’s a thought. Everyone knows that the world is upside down, a situation which as a contrarian makes me wonder if this isn’t just another pause that refreshes.

Mind you, I’m just thinking out loud, and as everyone who’s been keeping up with this space for the past 12 months, I remain cautious and hedged although I still have plenty of longs which by and large are acting fairly well at the moment.

Still, it seems as if a bear market is just too easy a conclusion at the moment, especially given the past endings of historic bull markets. Just compare the current market to the past two periods that preceded a bear market, the end of the dot.com bubble (1999) and the subprime mortgage crash (2008).

During those times everyone was bullish, and all the talk was about stocks rising forever. Moreover, the few bears that were growling at the time were hardly making any dent in the market zeitgeist. Today however, everyone seems to be at least talking bear language.

Of course, the FAANG stocks (FNGU) may have seen their best days for now.

What’s my point? I may be wrong, and yes, every bull market reaches the point where the bears are finally right. So certainly, this may be that point. But as bad as this market feels, this period of time does not act as if it is the end of the bull market. That’s because bull markets climb walls of worry and this remains the mother of all such walls.

Short-term trend shaken but not stirred

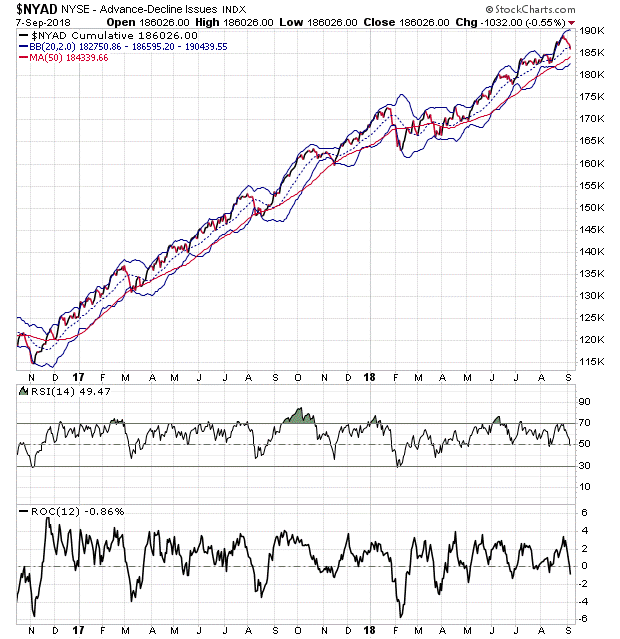

The New York Stock Exchange Advance Decline line (NYAD) has been the most accurate indicator of the stock market’s trend since the 2016 election, which is why I analyze and describe it every week in this space. And although the way things ended last week and the NYAD seems to be predicting a further short-term decline in stock prices, we’ve been here many times before and we are still climbing.

Note the following. Even though last week was a difficult week for anyone on the long side, the NYAD remains in a long-term uptrend. Moreover, the general trading pattern remains unchanged as the line has remained above the support of the 20-day moving average and looks as if it may find support, as it has multiple times since the 2016 market bottom, at the lower Bollinger Band.

Certainly, it’s too early to make a call one way or another just yet. Still, it’s good trading to wait until that particular chart pattern is fully broken before turning full out bearish.

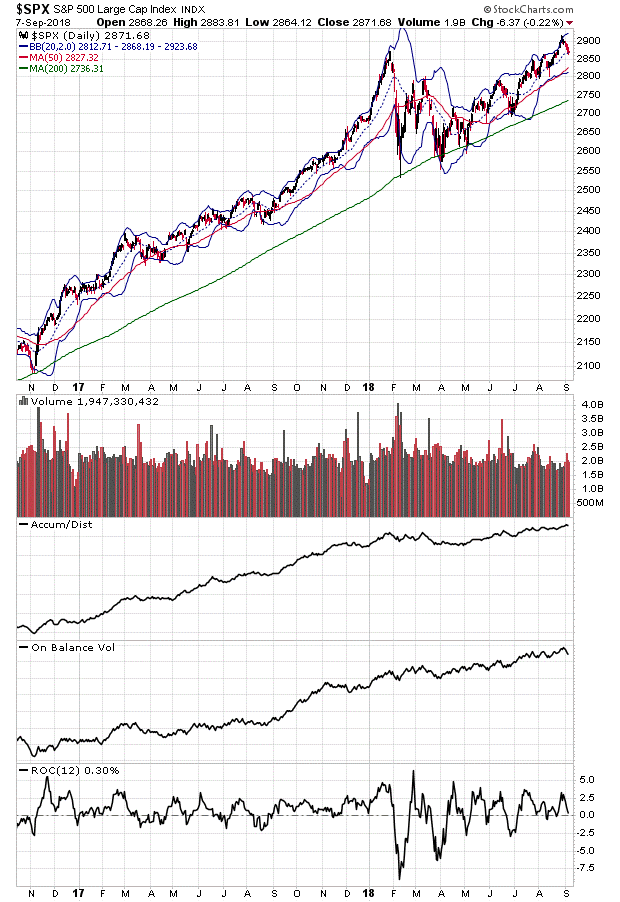

Elsewhere, the Standard & Poor’s 500 Index (SPX) got pushed around quite a bit. And while NYAD remains in a more convincing uptrend, SPX took a bit more of a bruising. More specifically, the Accumulation Distribution (ADI) indicator stalled slightly.

The more telling sign that perhaps there is going to be a bit more damage here is the rolling over of the On Balance Volume (OBV) indicator which is a direct indication of more aggressive selling than buying. Even more concerning is the action in the raw volume bars which also rose during the selling spree.

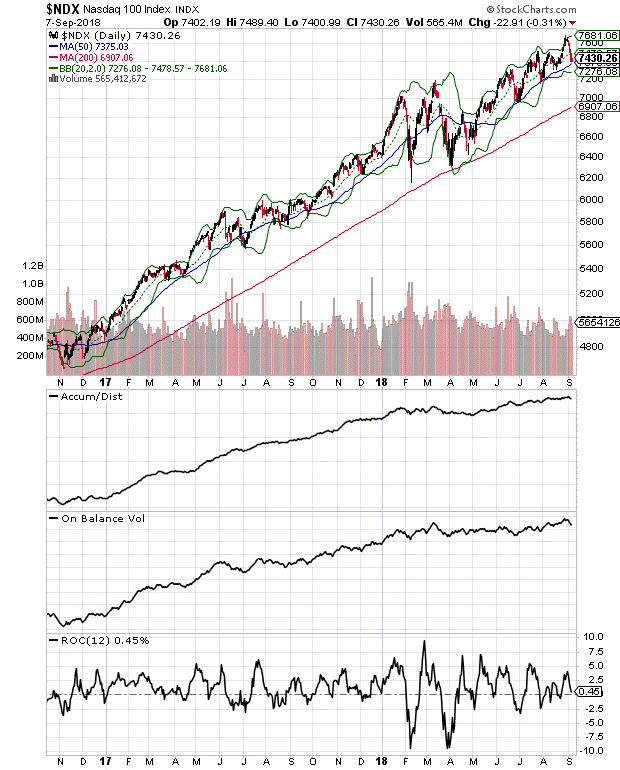

Finally, the Nasdaq 100 Index (NDX) took a fairly good-sized drubbing closing the week at its 50 day moving average. Along with SPX volume rose on the selling spree, which is a short-term negative and could point to more trouble down the road if it is not corrected. For now, both SPX and NDX have neutral momentum as ROC rolled over but managed to close above zero for the week.

Markets beat to their own drums and no one really knows anything for sure

It is plausible to consider the notion that the bears are right, and the bull market is over. At the same time, maybe they’re wrong again, at least for the next few weeks to months. Yet, only one thing is certain; no one really knows what lies ahead except maybe the black box trading algos that do most of the trading on Wall Street.

Moreover, playing the prediction game at this point in history is highly risky, as there are probably events lurking out there that no one, perhaps even those with the highest level of insider knowledge can even imagine waiting to unfold.

So, because the game is so obtuse this cycle, this time is different even if the outcome is eventually going to be the same as every other time. What it all boils down to is this: trade in small lots, use options, keep cash levels higher than normal, hedge and see what happens next.

Joe Duarte is an active trader and author of Trading Options for Dummies, now in its third edition and The Everything Investing in your 20s and 30s. To receive Joe’s exclusive stock, option, and ETF recommendations, including trade results, visit www.joeduarteinthemoneyoptions.com.