A question I get asked a lot as a professional money manager is how do I go about choosing stocks to buy. I always answer with a three-word response: “what and when,” writes Mike Turner Wednesday. He's presenting at MoneyShow Dallas Oct. 4-5.

I like seeing peoples’ reactions to these three words because I know they’re curious. You can see them thinking “what and when? What does he mean?”

And then I explain the meaning behind what and when. It’s about fundamentals and technicals.

Fundamentals tell me what stocks I want to consider buying.

Technicals tell me when I want to buy them.

Why do I care about fundamentals? Because you, the investor, care about fundamentals. Even though fundamentals are a lagging indicator, they’re important to millions of investors and can have an effect on the price of stocks.

It all comes down to the demand for shares; the higher the demand, the higher the price. Fundamentals have only to do with how they impact the minds of investors with regard to the desire (or demand) for shares. After all, no one actually buys a company when they buy a stock; they are only buying shares that they believe will go higher and the seller believes those shares will go lower. I want to own shares of a company that has an investor demand that will tend to push the price of a stock’s share price higher.

Stocks with good fundamentals have stronger staying power. This means stocks with strong fundamentals tend to stay on trend with less volatility than stocks with weaker company fundamentals.

This next statement is important.

I only compare the fundamentals of stocks that are in the same sector and industry.

I hear the media gurus talk about the P/E of the S&P 500 (SPX) and just shake my head. What a meaningless statistic. How does that help you make money? It doesn’t.

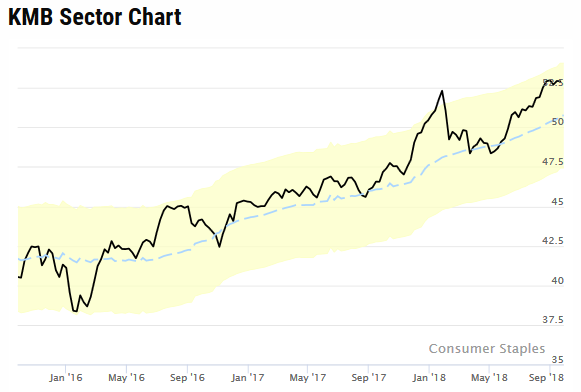

Here’s an example. Kimberly-Clark Corporation (KMB) is part of the Consumer Staples sector. Here’s my proprietary chart of the entire sector. The consumer staples sector tends to be slow growth and this chart shows exactly that. Over the past three years, the sector has moved higher with a few periods of downward moves.

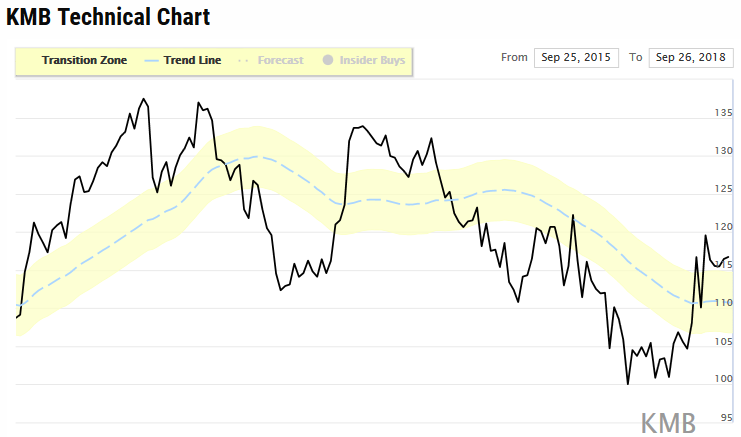

I score stocks using 100 maximum points for fundamentals and 100 maximum points for technicals. KMB has a terrible fundamental score. It’s only a 30 out of 100 due to terrible quarterly and yearly revenue growth. According to my system, KMB has bearish fundamentals. This means this stock probably has far less investor support of shares of KMB than a competing company that has a fundamental score of 70 or 80 or higher.

Its technical score of 79 is ok, and I consider that to be a bullish indicator, but it’s not enough to make up for the poor fundamental score. Because of the combination of bearish fundamentals, but bullish technicals, I currently rank KMB as Neutral.

The poor fundamentals are most likely the reason the price of the stock has been awful for the past 2-1/2 years. It’s grossly underperforming its sector peer group. Of the 178 consumer staples stocks I follow in my database, KMB is #100.

Of course, a company like KMB is probably working to turn things around. But until their fundamentals begin to outperform those of their peer group, KMB will never show up on my radar of what I want to even consider buying.

I discuss how to measure a stock’s fundamentals in my new book, Rule 1 of Investing: How to Always Be on the Right Side of the Market, which recently just released on Amazon. In the book, I talk about my Market-Directional approach and the rules necessary for successful investing.

The MoneyShow Dallas is almost here, it’s coming up next week. I hope to see old friends and meet many new friends as well. Maybe we can talk about what and when together.

The MoneyShow Dallas – October 3-5

Stop guessing and start measuring,

If you’re interested in learning more about how I manage money using the Market-Directional Investing methodology, you can read more here.

Mike Turner: how to measure a market, in a short video.

Recorded: MoneyShow San Francisco, August 24, 2018.

Duration: 4:22.

Mike Turner: Rule 1 of Investing, his new book in a short video.

Recorded: MoneyShow San Francisco, August 24, 2018.

Duration: 3:42.