To confirm or not to confirm: That is the question. OK, maybe that’s not exactly what Shakespeare wrote in "Hamlet." But when it comes to this environment, it’s the most important point investors should ponder about the markets, writes Mike Larson Wednesday.

That’s because, from where I sit, it sure looks like the S&P 500’s recent move to marginal new highs is NOT being confirmed by all kinds of other assets.

Let’s start with this chart of the SPDR S&P 500 ETF (SPY). Not much up for debate there. It recently took out its January peak just below $287 in late August.

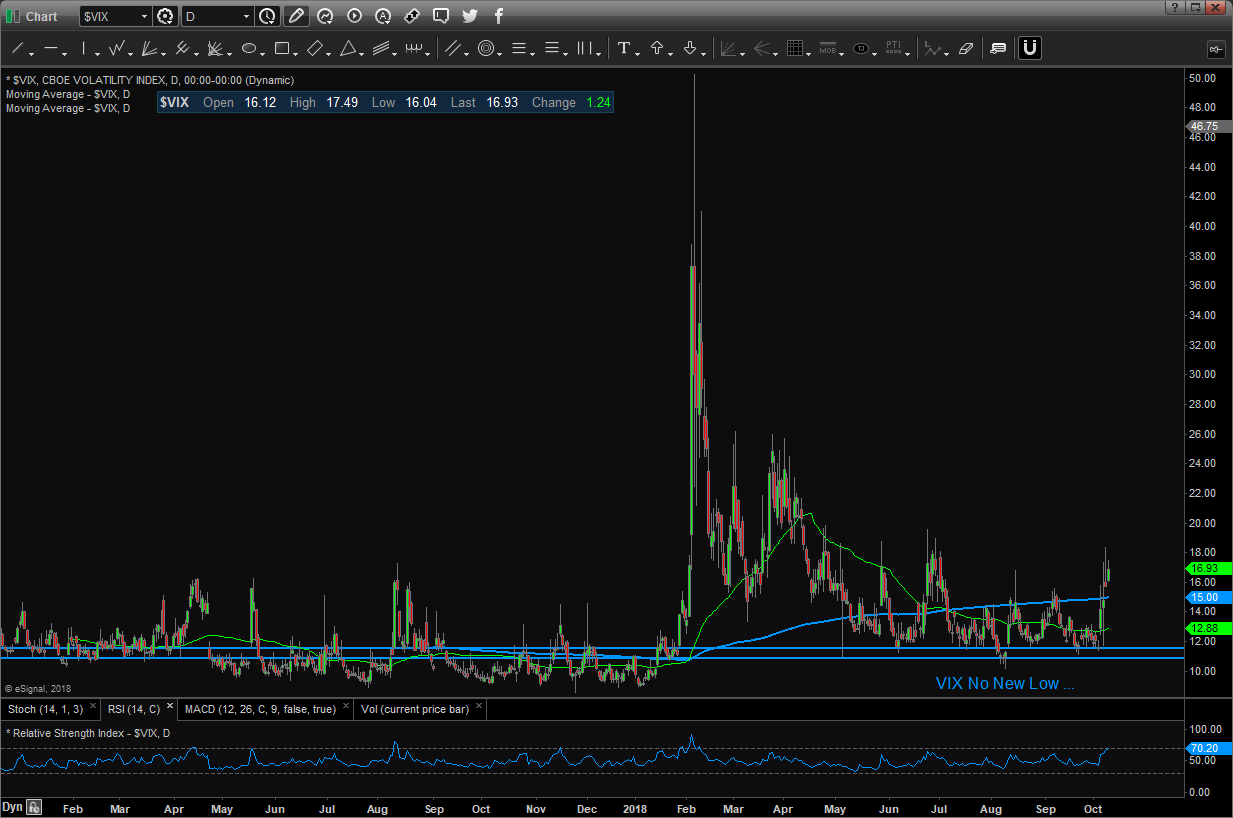

Now look at a chart of the CBOE Volatility Index (VIX). You can see the extreme complacency evident in the VIX throughout 2017, with scores of dips into the single-digits.

Then we had the huge spike in January and February, which accompanied twin 1,000-point down days in the Dow Industrials.

What do you notice since then?

That we have not dropped back into the “Complacency Zone,” even with the S&P making a modest new high.

Every time this key gauge of market volatility pulled back and tested the original January/February breakout level, it held. That’s a sign that investor concern is rising behind the scenes.

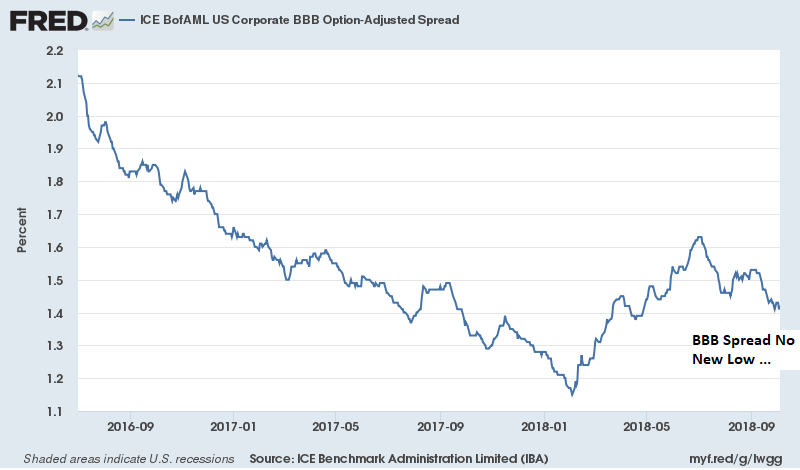

Now take a look at this chart. It shows the ICE BofAML U.S. Corporate BBB Option-Adjusted Spread.

I know, that’s a mouthful. But in a nutshell, it shows the difference in yield between lower-investment-grade corporate bonds and U.S. Treasuries.

The wider the spread, the more yield investors want for owning bonds that are riskier than those issued by Uncle Sam.

You can see that, throughout the post-election bull market run in 2016 and 2017, spreads got narrower and narrower as stocks climbed higher and higher. Then when volatility surged and stocks tanked, spreads jumped.

All normal.

What is not normal? The fact that this risk spread isn’t moving in tandem with stocks anymore.

It isn’t even close to its January low, despite the S&P 500 hitting a new high.

Now I don’t know whether the stock market is going to meet the same unfortunate fate as Hamlet. But I do know these non-confirmations are worth watching, especially in light of all the other divergences that I’ve been discussing.

So, my advice remains the same as it’s been since early 2018: Play things safe! This means …

- Avoid or reduce your exposure to vulnerable investments like overhyped, “garbage” IPOs and most financials.

- Focus on “Safe Money” stocks in more-conservative sectors.

- Lower your overall allocation to equities and keep higher amounts of cash in reserve.

Then be sure to stay tuned to my updates here, my latest Weiss Ratings’ Safe Money Reportissues and, if your travel schedule permits, the presentations I’m delivering at various conferences and events.

The next event I’m participating in is the New Orleans Investment Conference. It runs from Nov. 1 to Nov. 4 in the Crescent City, and you can register to attend by clicking this link. Or if you prefer, you can call 1-800-648-8411 for more details.

Until next time,

Mike Larson

Check out Mike’s presentation, How to Invest in Today’s High-Anxiety Markets at MoneyShow Dallas here.

Duration: 47:04.

Recorded: Oct. 5, 2018.

Check out Mike’s short video, Mike Larson’s Dividend Stock Picks at MoneyShow San Francisco here.

Duration: 3:48.

Recorded: August 24, 2018.

Check out Mike’s short video, 2 Safe Yield Stock Picks at MoneyShow San Francisco here.

Duration: 4:42.

Recorded: August 24, 2018.

Check out Mike’s short video interview, Conservative Stock Picks for 2018 at MoneyShow Las Vegas here.

Duration: 3:33

Recorded: May 14, 2018

Check out Mike’s short video interview What Investors Are Doing Wrong and How to Fix It at MoneyShow Las Vegas here:

Duration: 2:22

Recorded: May 14, 2018.