Many years ago, I was a caller to Financial News Radio and I told the hosts I knew when the internet bear was going to end. Since nobody knew when the bottom was coming, they laughed. I got their attention, writes Jeff Greenblatt Wednesday.

One could tell they were thinking, what would this guy say before they buried me.

Let’s call one of the hosts Joe (not his real name). I said, “The market will bottom when Joe turns bearish.”

The other host laughed. He said, “You know what, he’s right, you’ve been bullish the whole way down!” Through the phone I could feel the smoke coming out of the top of Joe’s head. But to his credit, he invited me on his show the following Monday to debate him. That’s really how you are reading this column.

On Tuesday morning several contributors to business media basically repeated the same thing. They said in order for good stocks to go on sale, a correction is part of the discounting process. Several recommended buying right there. Maybe some did because after the market was down 500 it recovered all the losses before finishing down only 100+.

It’s simply amazing to hear since many of these same people were around in 2000 and 2008. Many have not learned the lesson and those who don’t learn from history are condemned to repeat it.

My overall view was the market would be toast if the lows achieved around October 11 were taken out. That has materialized in the Nasdaq, SPX, DJIA and many other charts.

The Philadelphia Housing Index (HGX) has closed below the 200-week moving average. This is the second week it looks like it will close below that line. Do you know when was the last time housing closed below the 200 week in consecutive weeks? It was the bear phase in 2011. That’s right.

So, I’m always looking for the mitigating factor. If you were on the jury and held a person’s life in your hands, wouldn’t you be looking for that last shred of doubt? I have one for you. If you seriously think about it, these types of affairs only end when it feels like the action is going down forever and not coming back. That’s the other shoe dropping and exactly what we had in 2009 when the late Mark Haines at CNBC called the bottom right on the air.

On Tuesday the Dow (DJI) was down 500 and came back to breakeven as we know. Today it gave back most or all the gains depending where you look.

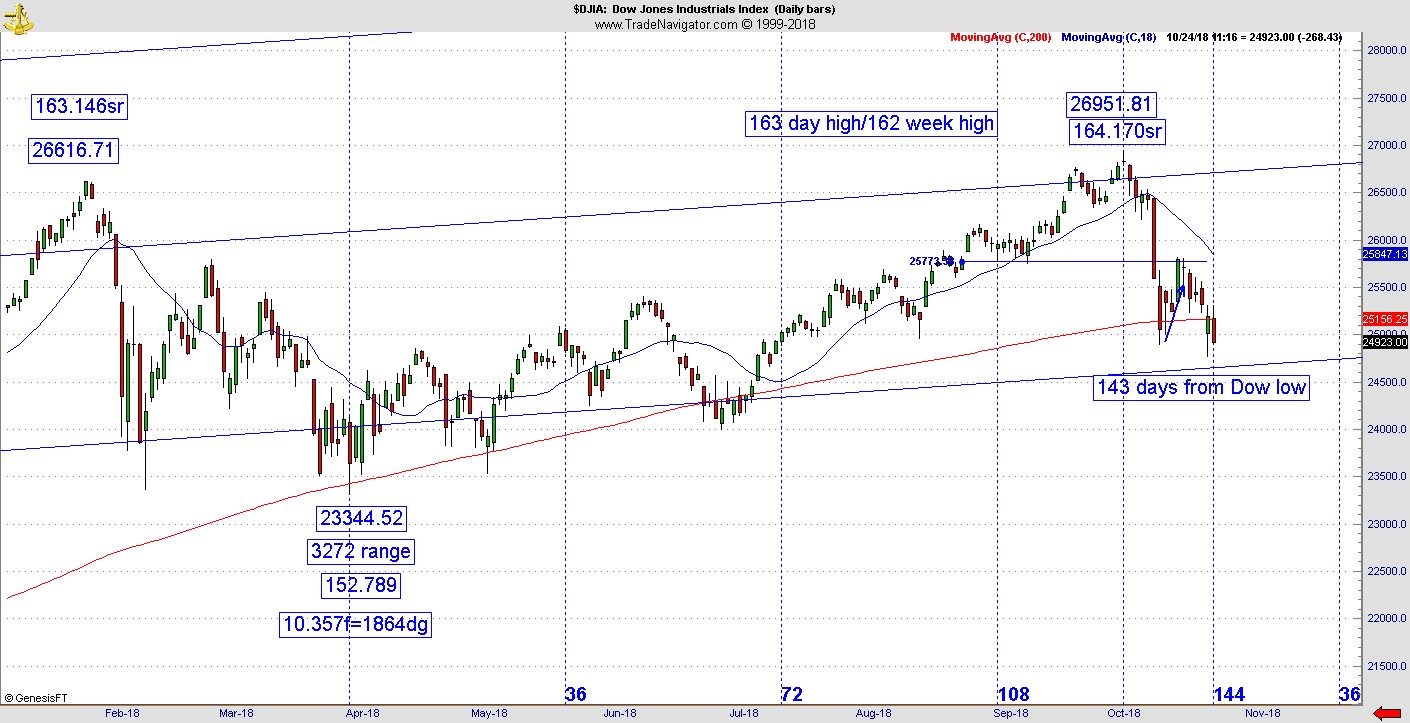

Here’s the kicker. Tuesday and Wednesday are 143-44 trading days back to the Dow bottom on April 2 at 23344.52. The vibration works. It looked like we could get a more significant bounce based on yesterday’s recovery right in the vibration window. But we didn’t and a case could be made Wednesday could be the other shoe. If markets don’t lift coming out of this vibration, this could be Custer’s last stand.

While we are mitigating, let’s see what cold water I can pour on that outlook. Going back to the top it would be hard to fathom there is enough fear in the market only a day after so many recommended stocks are on discount.

With the VIX in the low 20s, that could also be a fly in the ointment. Does it yet feel like it’s going down forever? I didn’t think so. Let’s use the poker analogy. If you ever watch it on television, you know the best players in the world calculate the outs in their head. That means they know how many cards are left in the deck and how many cards are available to pull their hand. Given that bit of intelligence they can calculate the odds to manifesting their hand.

What we are doing here is looking at the potential time windows that could turn the market back up. What I can tell you is the market is starting to run out of outs.