Because of speculative market behavior, investing in early-stage biotechnology companies requires great skill and patience (luck is always helpful as well). Here are a dozen and a half stocks that investors and traders should know about, writes Monty Guild Thursday.

The year 2018 has not been kind to many expensive stocks -- that is, to those that trade at elevated price-to-earnings ratios. The technology giants were the last to fall as the rolling correction finally reached them in October, and fall they did, with the Nasdaq 100 index down 16.3% between October 1 and November 20.

Early-stage biotechnology stocks did not evade the carnage, with the equal-weighted SPDR S&P Biotech ETF (XBI) falling 26.4% in about the same period. Many companies represented in this ETF do not yet have commercially available products, and they typically trade at a multiple of very speculatively estimated future earnings.

Even if your assessment of the technology is correct, and even if the company defeats its competitors (which can include deep-pocketed big pharma companies), your investment can languish during periods in which biotech falls out of favor as an investment theme, and during periods of general market malaise -- when institutional buyers are unwilling to ascribe a decent multiple to those elusive and uncertain future earnings.

Still, we believe that many of the best and most rewarding long-term investments will be found among technology stocks, and specifically in biotech stocks. The reason is simple, in the case of biotech: the potential to provide new and effective therapies for unmet medical needs, to enhance quality of life, and to boost longevity. With a global population that is, on average, becoming older and wealthier, there are powerful demographic trends in place to support the demand for new, effective therapies.

This is why it’s worthwhile to keep abreast of significant developments in biotech, even if the current market environment is not one in which owners of most early-stage biotech stocks will be quickly rewarded.

2019 might see new data on some ongoing transformative themes in biotech. One of these themes is gene editing -- particularly a new technique called CRISPR. You may have seen CRISPR pop up in the news this week due to an experiment conducted by a rogue researcher in China, which allegedly resulted in the birth of human twins whose DNA had been modified to make them more resistant to HIV infection. (Of course, that incident highlights some of the ongoing and unresolved ethical issues surrounding the potential use of this technology in human beings.)

There are currently several publicly traded startups directly involved in the development of CRISPR technologies to create new human therapies: Editas Medicine (EDIT), Crispr Therapeutics (CRSP), and Intellia Therapeutics (NTLA). These companies are also working in collaboration with larger pharma companies such as Vertex Pharmaceuticals (VRTX), Allergan (AGN), Regeneron Pharmaceuticals (RGN), and Novartis (NVS).

Investors and traders can monitor ongoing clinical trials either through trade publications or through the National Institutes of Health site, http://www.clinicaltrials.gov. Positive clinical trial results are often near-term catalysts for stock performance, as are announcements of data from ongoing trials at professional conferences, which investors can usually find on companies’ websites.

What is CRISPR technology?

Here’s how we described it last year: Biochemists have uncovered a new technique for genetic modification that promises to be an exponential leap over current technologies in ease and precision. The effects of this discovery will ripple across every field where genetic modification has become a primary driver of innovation, from healthcare to agriculture.

Individual scientists are winning acclaim for their work on the discovery, but it’s not a breakthrough from a single institution or laboratory. The first hints of the new mechanism were uncovered almost 30 years ago by Japanese researchers, and at that time, gene sequencing was still in its infancy and astronomically expensive, so they didn’t realize what they had stumbled upon. As the years passed, many other scientists contributed to the effort -- and with the arrival of cheap sequencing, the promise of the mechanism became clear.

The mechanism is known by the acronym “CRISPR” -- “clustered regularly interspaced short palindromic repeats.” CRISPRs are sequences of DNA that initially baffled the researchers who found them, because they couldn’t determine their function or origin. Adjacent to them, researchers found genes that encoded DNA-cutting enzymes. And as sequencing technology improved, this pattern started to turn up in many microbes -- CRISPRs of unknown purpose, with gene-splicers next to them.

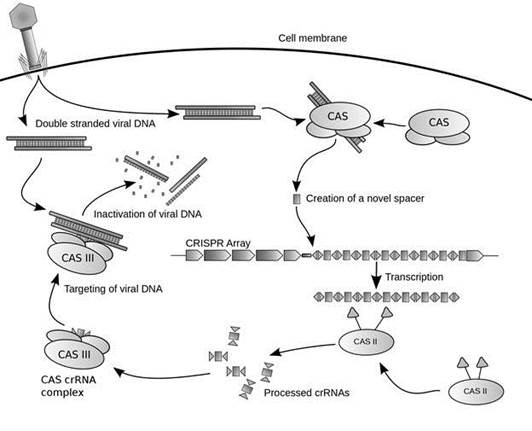

The first clue came when scientists noted that CRISPRs looked like virus DNA. Eventually, they learned that CRISPRs are a bacterial immune system. The bacterium expresses enzymes that cut the DNA of invading viruses, and then take snippets of that DNA and stash it in their own genetic code as a permanent memory of the attacker -- so afterwards it can always be recognized. Some bacteria seemed to have CRISPR sequences that were related to no known virus -- and scientists believe that this is essentially an archaeology of viruses that bacterial species once encountered that are now extinct.

Over several decades, scientists deciphered the CRISPR mechanism

Source: Wikipedia

The “CRISPR-associated genes” (CASs) that run the splicing and insertion, and the enzymes they generate, are the real focus of interest. They are giving scientists what amounts to “programmable DNA-cutting enzymes,” offering the potential for a fundamentally new, easier, and more effective approach for gene therapy.

Gene therapy is the first obvious potential application as scientists turn the CRISPR mechanism to their own ends.

In gene therapy, scientists identify the gene whose malfunction gives rise to a particular disease; applications so far have focused on rare genetic illnesses that can be unequivocally associated with particular genes. Through a variety of techniques, scientists attempt to remove the DNA causing the illness and replace it with functional DNA.

However, the techniques to accomplish this have so far been imprecise and fraught with various problems -- for example, using genetically engineered viruses to deliver the desired DNA, or using enzymes from other families to cut and modify a cell’s DNA.

The enzymes from CAS genes, though, promise to do the same job with qualitatively greater precision and ease. With this technology, and with similar advances in genetic medicine, we see the potential for therapies as dramatic and revolutionary as vaccinations were when they were introduced in the early 18th century.”

CRISPR is the simplest and most effective gene editing technique yet developed -- so simple that “biohackers” have already begun releasing commercial CRISPR kits that adventurous experimenters could use, for example, to create new varieties of yeast for brewing beer.

With CRISPR-based gene therapies entering the clinic, and the technology rapidly advancing, we would not be surprised to see the first commercial applications of CRISPR technology within the next three to four years. In spite of the potential for pricing pressures and new regulations, we believe that new and significantly more efficacious treatments -- especially for diseases where there is a large unmet need -- will reward innovating firms and those who invest in them.

Cancer immunotherapies

Besides gene editing, another area in biotech that may see outstanding data releases and new enthusiasm in 2019 is cancer immunotherapy. A few years ago, we wrote about immunotherapy as it was beginning to get mainstream traction:

“Immunotherapy” is a broad field, which includes the last generation of revolutionary cancer treatments -- monoclonal antibodies. Normally, germs are easy for the body’s immune system to spot and attack, since they’re so different from the body’s own cells. Cancer cells, though, are another story; since they’re more like turncoats than members of an invading army, they look enough like the body’s healthy cells that they easily go unnoticed by the immune system. “Antibodies” are the immune system components that attach themselves to some specific protein called an “antigen.” Monoclonal antibodies (mABs) are engineered antibodies which attach themselves to cancer cells, which then signals the other cohorts of the immune system to come and attack them. Some of the biggest recent cancer blockbusters have been mABs.

Merck (MRK) has been the biggest winner, with its flagship Keytruda enjoying clinical success after clinical success over the past year, leaving other major competitors’ offerings behind (such as Bristol Myers’ Opdivo (BMY). Keytruda belongs to a class of immunotherapies called “checkpoint inhibitors.”

However, analysts note that the clinical application of immunotherapies is still very much in its initial stages. Most are still used conjointly with chemotherapy, and researches hope to obviate the need for combination therapies moving forward. Next-generation immunotherapies are being developed and are showing a lot of promise in clinical trials.

One group is tumor-infiltrating lymphocytes, or TILs. T-cells, a type of white blood cell critical in immune system function, have been found deep inside some solid tumors. They can be removed with a tumor sample, cultured in the lab, and injected back into the patient. Iovance Biotherapeutics (IOVA) focuses on TILs, and has a promising pipeline including a candidate that has shown robust efficacy in metastatic melanoma.

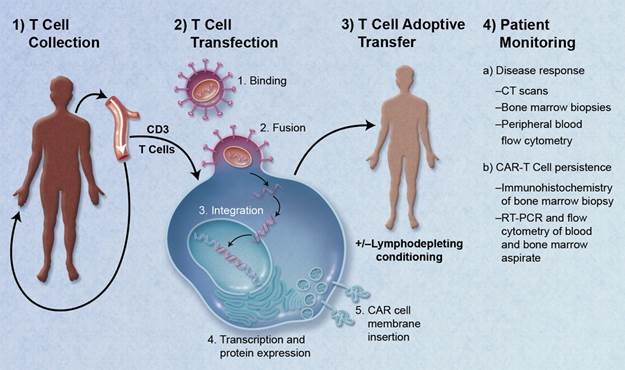

Another technology is chimeric antigen receptor T-cell (CAR-T) therapy. Here, a patient’s T cells are taken via blood sample, genetically engineered in the lab to have specific antigen receptors, and then infused back into the patient. The technology has shown stunning early results in hard-to-treat leukemias and lymphomas, but severe side effects have also been observed. Gilead Sciences (GILD), through its acquisition of Kite Pharma, is developing CAR-T therapies for blood cancers and solid tumors.

Another CAR-T developer, Juno Therapeutics, which developed a technology to deplete CAR-T cells if toxicity occurred, was acquired by Celgene (CELG). CELG is also collaborating on a CAR-T project with bluebird bio (BLUE) and should soon report data at the American Society of Hematology conference on Dec. 1–4.

CAR T technology -- potential breakthrough for leukemia and solid tumors

Source: Wikipedia

Cancer vaccines are another promising area of immunotherapy development. The complexity of the immune system has thwarted efforts to “teach it” how to recognize cancers, but there are some promising developments.

“Autologous” tumor cell vaccines take a sample of a patient’s tumor, engineer the cells in a lab to exaggerate traits that may make them identifiable to the immune system, and then inject them back into the patient -- hopefully, teaching their immune system to identify those cells’ unmodified cousins as well.

“Dendritic” cell vaccines represent another attempt to manipulate parts of the immune system outside the patient’s body and then reintroduce them, so that they can provoke a response against the cancer cells. These technologies are seeing great interest in glioblastomas (brain cancers), some of the most aggressive and hard-to-treat tumors.

Messenger RNA therapies: another potential breakthrough

CRISPR and immunotherapies have both been in the news for several years. CRISPR is about to start producing data from human trials, and immunotherapy has already reaped rewards in commercial products, with further advances to come.

A newer technology is messenger RNA (mRNA) therapeutics. This technology, if successfully applied, would represent essentially an entirely new field of biopharmaceuticals -- different from traditional small-molecule drugs and from the monoclonal antibodies that were the first wave of immunotherapies.

mRNA is a component of cells which shuttles between DNA, where protein-creation instructions are stored, and ribosomes, where those instructions are used to create actual proteins -- the chemicals that then go on to have various effects in the human body. mRNA therapeutics were first imagined in the 1990s, but have only become practical possibilities in the last few years.

Essentially, rather than permanently changing the DNA (as CRISPR does), an mRNA therapy introduces a synthetic piece of mRNA into the cell, designed so that it will be taken up by ribosomes and create specific proteins. In essence, the technology causes individual cells to become drug factories -- manufacturing therapeutic proteins within the body. And it does this without the potential risk and complications of permanently editing the genetic code. In theory, an mRNA platform could treat an infinite range of diseases.

mRNA therapies are being developed by Moderna Therapeutics, a company which recently filed for an IPO and has received capital from many prominent investors, hedge funds, and sovereign wealth funds. So far, this will be the only publicly traded company specifically focused on this technology, but other private companies are at work, and big pharma is pursuing it as well, including Eli Lilly (LLY), Sanofi (SNY), Roche (RHHBY) and Pfizer (PFE).

Investment implications: Investors should monitor the biotech and pharma landscape to spot important new technologies early, even if the current market environment is hostile to speculative investments. It can take many years, or even decades, for new technologies to reach commercialization. Would-be speculators should monitor the overall market environment, as well as the market psychology surrounding biotechnology, and should look for catalytic events by monitoring company-specific news, presentations at the meetings of major physicians’ specialty associations, and ongoing clinical trials.

Disclosure: Please note that principals of Guild Investment Management, Inc. and/or Guild’s clients may at any time own any of the stocks mentioned in this article, and may sell them at any time. Currently, Guild’s principals and clients own PFE.

Guild recently taught a Master Class on cryptos and digital assets at the Dallas MoneyShow; if you are interested in seeing the slide deck from this class, please send us an email.

View Monty Guild’s presentation, Global Stock Market Outlook 2018-2019 here.

Recorded: MoneyShow Dallas, Oct. 5, 2018.

Duration: 10:17.

Subscribe to Guild Management here.