Recall last week the market rallied on hopes of a trade war truce only a day after Trump announced he may very well stick a tariff on autos coming in from China. Markets stayed up to the end of the week on the hopes that truce may become reality, writes Jeff Greenblatt.

Is there anyone here who did not believe Trump and Xi would find a way to create a great photo-op at the G20 meeting?

They announced a truce and Dow futures opened up over 400 on Sunday night. Last week I discussed what happens to the stock market in bearish years. The period from Thanksgiving to Christmas is the real Santa rally season due to the usual euphoric feelings the holiday season brings. Those feelings of euphoria usually drip into the market activity. But in bearish years the seasonality still stays bullish even as we’ve seen big time interruptions to the bullish activity.

As it turned out, this year was no different. The Dow (DJIA) was down 800 after Trump called himself “Tariff Man.”

What is really going on here? It’s typical bear market behavior. Markets jump on the hopes something good will happen. Then they slide down that same slope of hope when those feelings are dashed. The truth of the matter is the U.S.-Chinese trade negotiations are very complex and will take months to complete if they ever do. There will be many twists and turns along the way. That’s our reality check.

But in navigating the stock market from one sequence to the next, its imperative to understand the psychology involved.

There is the bullish seasonality factor working right now but as Eliades stated, this is the most bullish part of the presidential cycle. That’s great, except for one problem. This time around there are much larger forces at work. Don’t take my word for it, check out The Fourth Turning by Strauss and Howe for yourself. As far as America is concerned, this cycle has repeated back to the American Revolution about every 80 years.

The question here is whether the larger cycles would override the bullish seasonality factor.

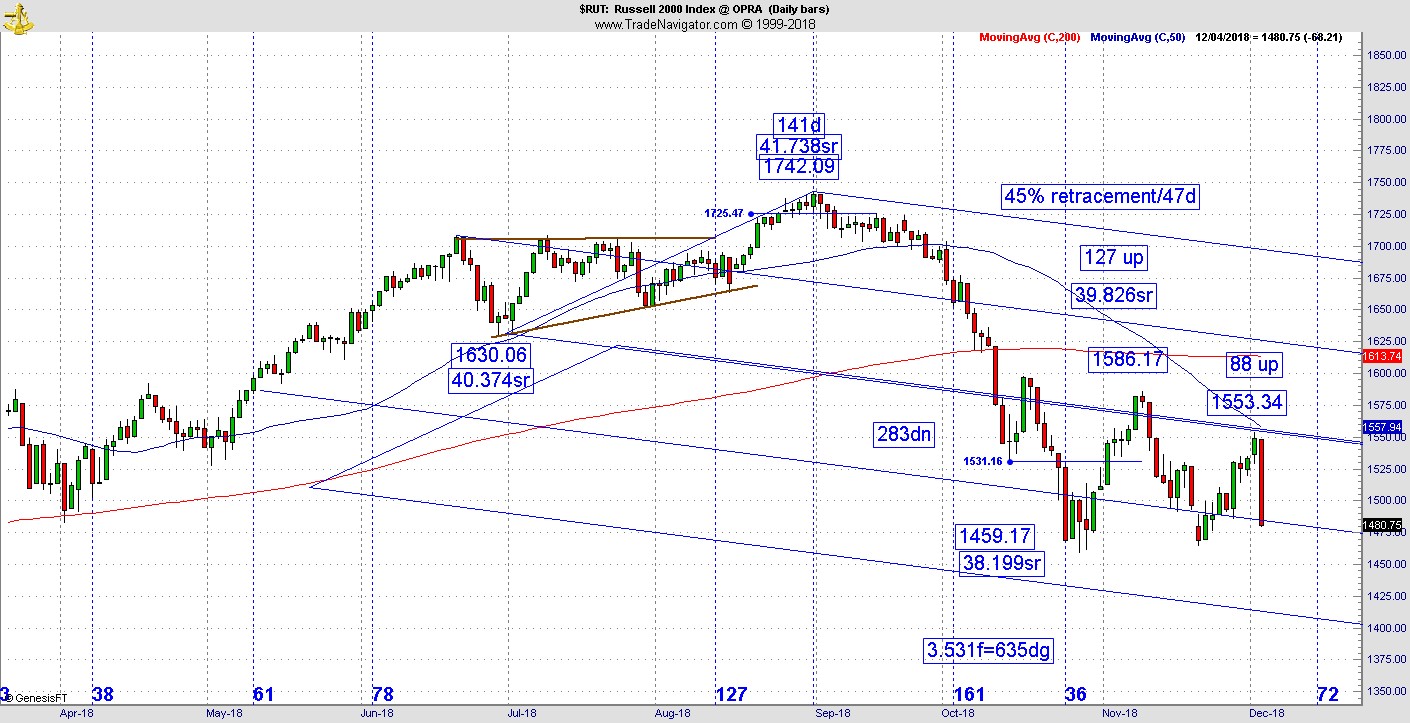

After Tuesday it looks like we have our answer. It almost seems like there is an invisible ceiling blocking upper testing of the charts. The Russell 2000 (RUT) which should be leading in a healthy market has been lagging even in this rally type environment. One major distribution day and they are already retesting the bottom. This rally faded on a 45% retracement to the top as it peaked on the beginning of the 47th day. It has done nothing since then. Think about it, if this was a new bull wave higher, shouldn’t the Russell lead?

Instead it’s lagging which is part of the problem.

On another front, the major charts finally had their death cross. For the Russell this happened a couple of weeks ago. For the NASDAQ (IXIC) it came last week. That means the 50-day moving average crossed below the 200. The last time it happened was during the 2015-16 correction.

What should we expect down the road? Surprises come to the downside in a bear market. I suspect we will get back on the bull horse as we get closer to the holiday. My concern now is what happens after the turn of the year.

If we have to discuss politics, the drama in Washington will heat up as the House of Representatives turns blue. Many investigations are scheduled and the market isn’t going to like it one bit. Trump has threatened to hit back and there is no doubt he will follow through.

So, 2019 promises to be a difficult year and markets will not be immune. But for right now, stay in gear with the psychology and take things one step at a time. But it does appear markets are taking two steps forward and three steps back.