This time is different as we are living in a new world where the stock market is more like Texas weather than a vehicle for price discovery and investing, writes Dr. Joe Duarte. Applied Materials (AMAT) and Micron Technology are moving higher and may gather some steam.

Volatility is certainly here to stay as the Dow Jones Industrial Average traveled over 1300 points on a closing basis in a mere two trading sessions last week. For those who slept through the spectacular events, things started to unravel when Apple (AAPL) delivered a stark warning about its upcoming quarterly results on January 3. The market promptly crashed and burned delivering a 600-point decline putting the bears in “I told you so” heaven.

On January 4, a huge beat on the new jobs section of the monthly Employment report and a cordial sounding Fed Chairman Powell who noted that the central bank was going “to adjust policy quickly and flexibly” combined to kick start what seemed to be a dead cat bounce which turned into a real stock rally, at least for a day.

That was then

No matter what they say, this market now trades one day at a time, sometimes one headline at a time, making it difficult for anyone who has even a few days for a trading time frame.

What does it all mean? Well for one thing, the Fed admitted that it’s willing to pause on its path toward more rate increases for a period of time. So, for a day that was good news. Of course, Powell’s remarks don’t necessarily mean that the Fed will stop raising interest rates altogether, but it does suggest that the Fed may know something about a bank or two that may be in some trouble and they are hoping to keep things from getting worse. And since he’s back on the talk circuit on Thursday, we may have more fireworks, unless someone else beats him to the headline circus.

Furthermore, the currency markets had a flash crash last week, which suggests that the market may now be reaching a significant potential fracture point beyond stock prices. If this dynamic develops, we could see something similar to the 1998 Thai Baht and the 1999 Ruble crises. Anyone who lived through those events should shudder given the fact that a stock market crash is like comparing a lit match to the nuclear explosion that could materialize if a major currency crisis is further inflamed and fueled by algo trading.

Moreover, the Fed may have noticed that we live in a new world where even as they move at the speed of a dormant glacier, information travels, and algos trade at the speed of light. Indeed, this incongruence between the Fed’s clock and that of robot traders leaves the markets at the mercy of the algos leaving while the central bank scrambles.

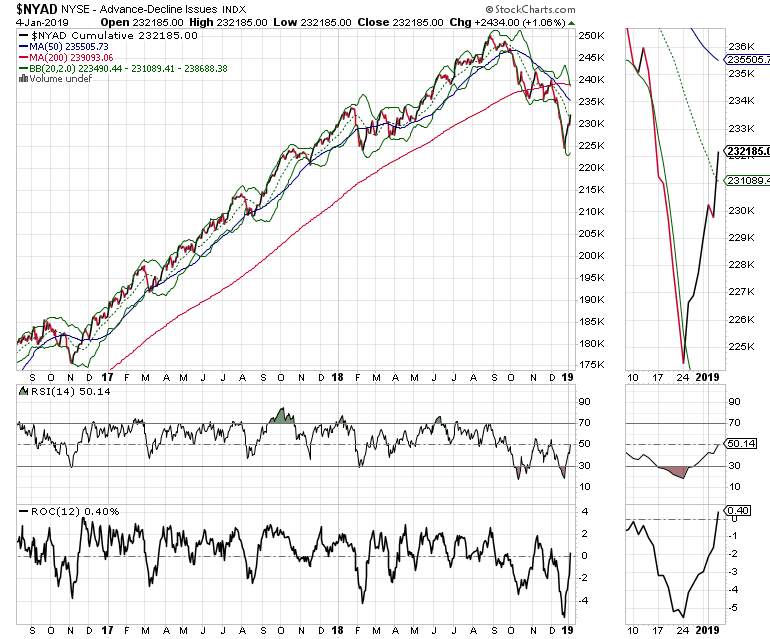

Market breadth tries to recover

The New York Stock Exchange Advance Decline line (NYAD) is trying to recover from the drubbing it took over the last three months. Because this indicator remains the most reliable market trend gauge since the 2016 election, its actions remain paramount to understanding what may come next in the stock market.

Currently NYAD has bounced and has climbed above its 20-day moving average which suggests that the short-term trend in the market has reversed. Also encouraging is the combination of both the RSI and ROC indicators moving above 50 and 0 their midpoints, a sign of a possible reversal of the recent down side momentum. Of course, if this configuration of indicators fails to hold up, all bets are off.

Indexes bounce

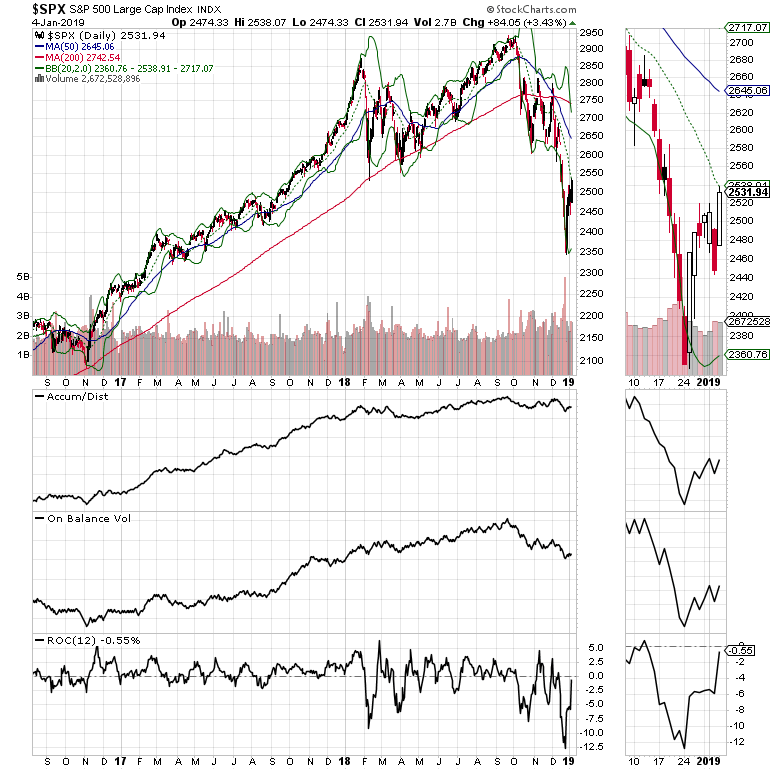

Despite the selling on January 3, the December 24, 2018 selloff in the S&P 500 (SPX) had all the hallmarks of a capitulation selling climax: extraordinary volume, a huge break below the lower Bollinger Band, and a feeling that the world was coming to an end. Thus, the ensuing rally has not been as surprising as it might have been otherwise.

But the rally has yet to be fully convincing as SPX failed to close above its 20-day moving average to end last week, although NYAD did close above its 20-day line.

A similar picture emerges when we look at the Nasdaq 100 Index (NDX) where the 20-day moving average remains an area of key resistance.

It’s a trader’s market

The new market reality is all about increased volatility, rapidly development of new trends, and heavy sector rotation.

From a trading standpoint, the extremely oversold chip stocks such as Applied Materials (AMAT) and Micron Technology (MU) are moving higher and may gather some steam.

This, along with some base formation in commodities and a bit of a move in select emerging markets is what’s working at the moment. But of course, it may not be what works in a few days. It is a trader’s market.

Therefore, it makes sense to look for trading opportunities more broadly than usual, perhaps in unfamiliar territories, in terms of sectors and geography. It also makes sense to shorten trading time frames, to take early profits, use tight stops and reduce position size while always keeping an eye on the exit. Finally, keeping a very close eye on opportunities to hedge is also a useful survival skill these days.

Disclosure: I own MU and AMAT as of this writing

Joe Duarte has been an active trader and widely recognized stock market analyst since 1987. He is author of Trading Options for Dummies, rated a TOP Options Book for 2018 by Benzinga.com - now in its third edition, The Everything Investing in your 20s and 30s and six other trading books.

To receive Joe’s exclusive stock, option, and ETF recommendations, in your mailbox every week visit us here.